|

The bears took back control! Here are the links of the week....

Strong Reversal Augurs for Rough September

Our latest editorial. It includes 5 charts.

Corvus Gold Reports More High Grade Results

Listen to Jeff Pontius discuss the significance of the latest results. I expect Corvus to continue to grow Yellow Jacket.

Emerging Markets Soon to Breakout?

Good post from Tiho.

Gold vs. Big Bad Bears

Could Gold be in for a 5-year bear? I disagree. In one of those bears the price decline was only 35%, thus it lasted very long in time. In another bear, Gold had a huge snapback rally.

Premium Charts- Precious Metals

We were leaning strongly towards a breakout but that appears to be out the window with last weeks decline. Markets are humbling and its just one of many times we've been humbled. Huge credit to those who saw this coming. The key charts for me are the bear analogs that we posted in our weekly editorial. They provide some context as to when, where and

how this bear market in metals could end.

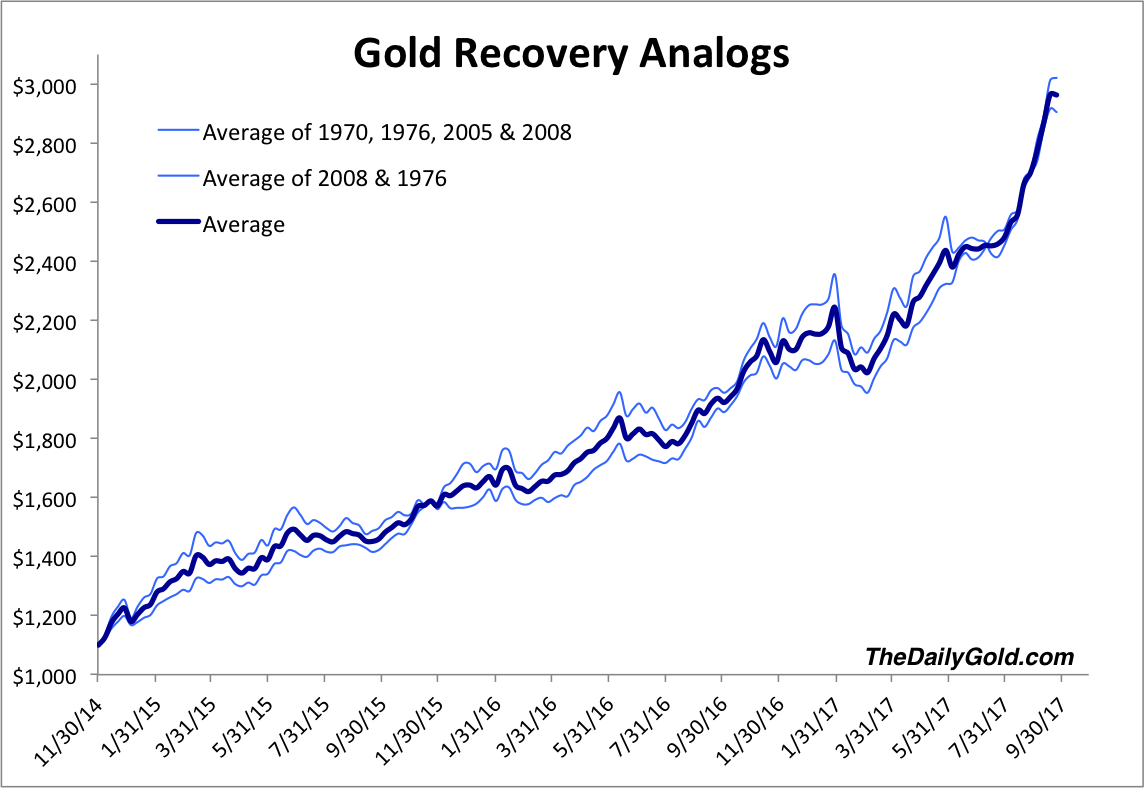

On the bright side, we can project the potential recovery using history. We've started our projection at the very end of November at a weekly bottom of $1100. To that ending point we applied the average of Gold's strongest four runs and the average of Gold's two strongest recoveries (1976, 2008). The thick blue line is the average of those two averages.

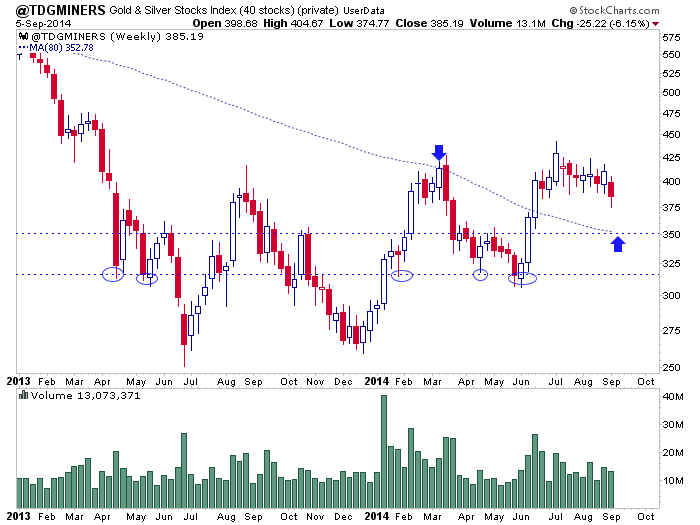

Nonetheless, the near-term risk looks to be to the downside. The top 40 index was down 6% last week and broke through consolidation support. It closed at 385 and the next strong confluence of support is around 350. After that it has support around 320. That is the downside potential bulls have to contend with as Gold has strong potential to make that elusive final low.

In the coming weeks we will be watching sentiment indicators such as COTs, public opinion and ISE put-call ratios. Combine those with the bear analogs as well as technical analysis and we have many tools we can use to monitor the potential end of this bear market. The other scenario would be Gold holding $1240 and rebounding hard above $1300. In that case, the shares would have to show some sudden and immediate strength in reversing recent losses and

challenging resistance.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our

subscribers.

We have three goals: to help subscribers make money, to provide some education and to produce the highest quality research and analysis we can. After TDG #373 one subscriber called our service exceptional while another said that a specific chart was worth the price of a subscription. We work really hard to deliver a top notch service.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|