|

Good Sunday to you. Here are the links for this past week.....

Podcast: An

Update on Corvus Gold with CEO Jeff Pontius

Full update on Corvus from Jeff.

Gold Miners Consolidate & Hold Support

This was recorded on Tuesday. Thoughts on precious metals, September, what I'm looking for as far as price action and thoughts on the manipulation meme.

Podcast: Dr. Jeff Kern's Ski Gold Stocks System

Great post from Tiho.

Mark Faber Interview with Palisade Radio

Mark believes the only asset class worldwide that is relatively and absolutely depressed is Gold & Silver Stocks.

Premium Charts- Precious Metals

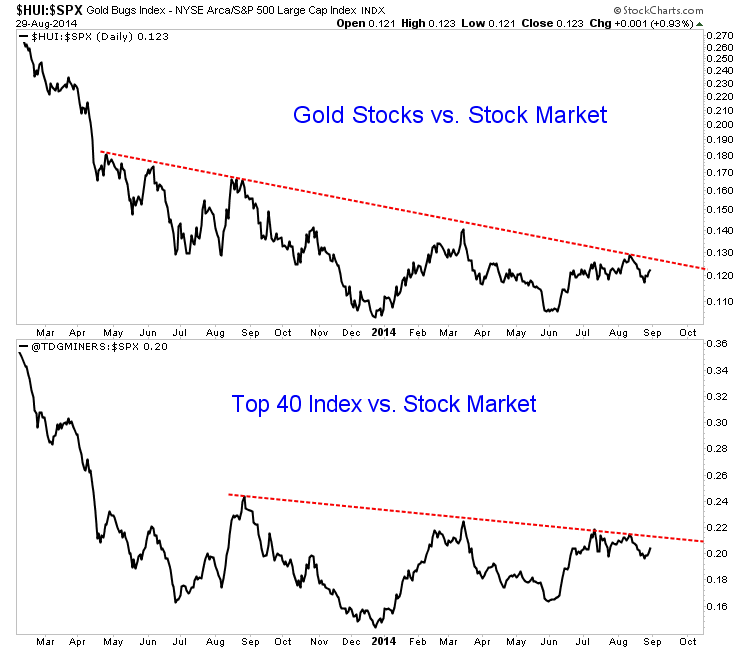

In the chart below we plot the HUI index against the S&P as well as our top 40 index against the S&P 500. Will the mining stocks breakout in relative terms in September? Let me know what you think.

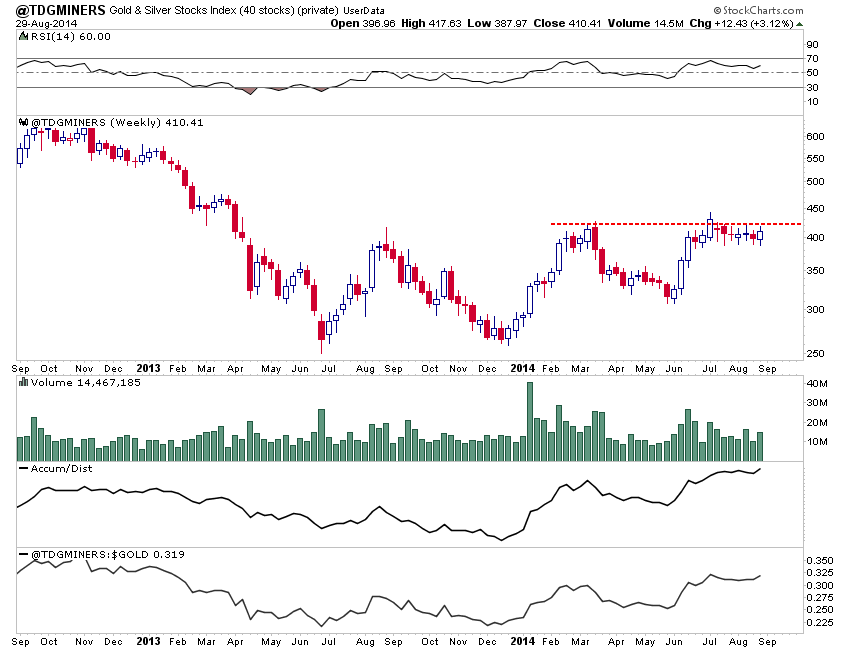

The top 40 index was up 3.1% last week and on the second strongest volume in the past six weeks. GDXJ was up 2.8%. In terms of closing prices the top 40 index never even tested the 38% retracement of the recent advance. It closed at 410. A daily close above 420 would kickstart the breakout.

Last week we wrote:

The evidence in my opinion is bullish until the market tells us otherwise. Commodities have corrected big, the US$ has rebounded strongly, the COTs are a concern yet gold and silver stocks have held in well. The mining indices haven't even tested their 50% retracement and remain above their 200-day moving averages. Furthermore, 78% of the stocks in the HUI

are trading above their 200-day moving averages. That figure was a bit higher a week ago but other than that its at the highest level since late 2009. These reasons among others why I am positioned for a breakout. Sit tight and be right until the evidence changes.

In TDG #375 (last week) we said we expected a rebound to begin and that is what happened. Still, I get the sense that there are plenty of bears or skeptics out there. Last week a major newsletter publisher urged their subscribers to hedge their positions. Their "technical team" warned that the charts were looking bearish. When perma-bulls hedge, it can be a contrary indicator.

On Saturday we sent TDG #374, a 34-page update. It included a report on a company with a market cap below $75 Million that we think has long-term potential to reach $1 Billion. A major company owns shares as well as another significant party. We also spent a full page discussing the portfolio and a full page answering subscriber questions. Its a new section we have added to our weekly updates. Right now our favorite positions are clear. We have six that

makeup nearly half of the portfolio.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our

subscribers.

We have three goals: to help subscribers make money, to provide some education and to produce the highest quality research and analysis we can. After TDG #373 one subscriber called our service exceptional while another said that a specific chart was worth the price of a subscription. We work really hard to deliver a top notch service.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|