|

Here are the links for this past week.....

More Downside for Precious Metals

In my latest editorial I argue why even after the severe downside moves, that precious metals have more downside before the bear market ends.

Tiho Brkan: Precious Metals Update

Tiho says miners offer amazing value but Gold itself needs to bottom first.

Hui/Gold Ratio Hits Lowest Level Ever

Dan Norcini is a great trader and is one of the top follows in the precious metals world. I don't always agree with him but he has excellent info on his blog.

Premium Snippets

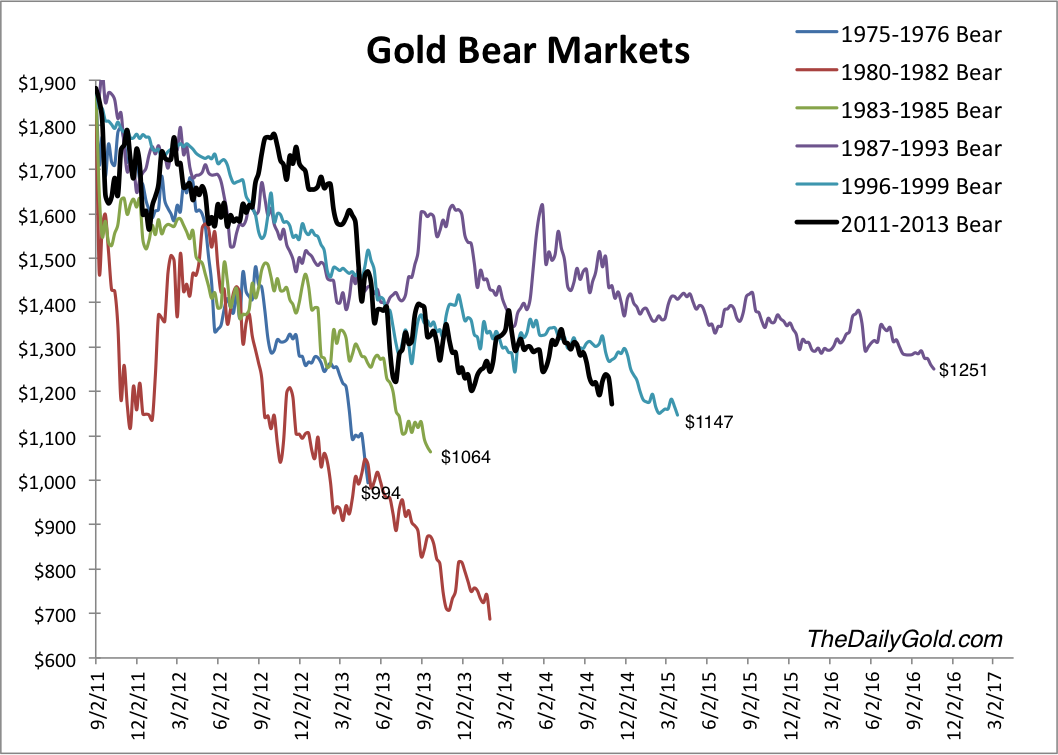

Below is an updated chart of the bear markets in Gold. We included the price low for each. The price scale is the current bear market. Throw out the 1980 collapse and there are four bear markets. The two long ones bottomed near $1150 and $1250 while the two short ones (less than two years), bottomed at $1064 and $994. The chart uses weekly data. Something around $1050 seems reasonable (as a weekly

low).

There are obviously other things we can look at. Technical analysis tells us that there is a strong base of support at $1000. Sentiment indicators like the COT can help us determine when Gold is not just oversold but extremely oversold as in on a historic basis. The combination of extremely oversold and extreme sentiment while trading down to major support is what puts the odds in the bulls favor.

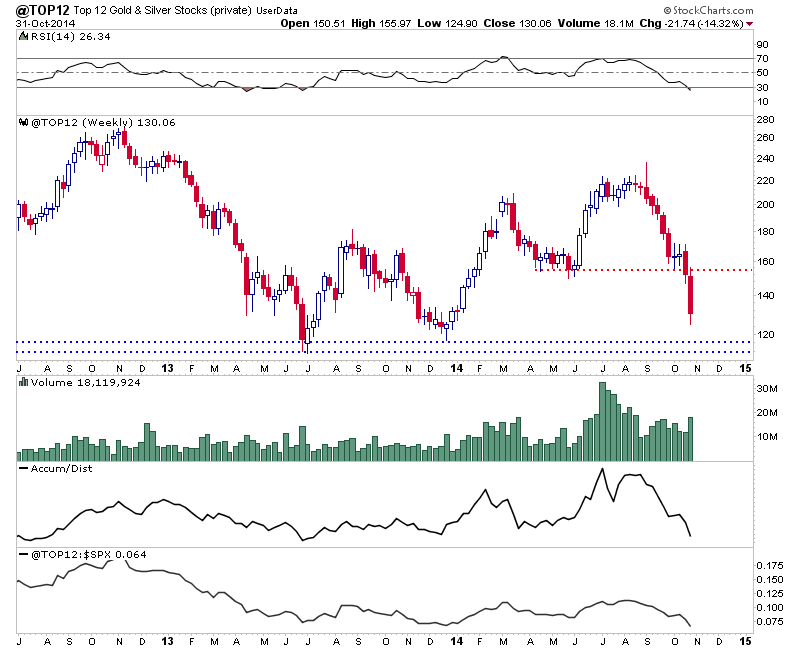

We have looked at the HUI and other indices to get a better idea of downside potential in the stocks. Yet those indices aren't much help right now. Hence, we pulled out the Barron's Gold Mining Index and that gives us some clarity (see the editorial). We also took our 12 favorite companies at the moment and put them in one index. Before Friday the index had about 20% downside to its 2013 low. Now it has 12% downside to its daily low. In April 2013 the index

was down in 10/12 weeks. At present it is down 9/11 weeks.

A historic buying opportunity is coming. In fact, it could end up being the best of all time. That opinion comes after analyzing history, valuations, sentiment, etc. However, Gold has yet to break below $1080 and the bottoming process could take a few months to play out. The bottom

could come soon but then you are likely to get a retest or slight higher low at somepoint. Patience are discipline is key if we want to take advantage of the opportunities to come.

In TDG #385 sent yesterday we included among other things, a new report on one of top 12 (a company with two strong projects) and a page with potential buy targets on our favorite stocks.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only

credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers. Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report.

This Top 10 Report is a full 35 pages and 15,000 words long and is available with asubscription. Upon signup you will immediately receive all recent updates and important reports. Recently, we've published a Top 10 Stocks report, a Long-Term Precious Metals Outlook Report as well as a Global market update (with a new one coming). You won't be disappointed with this material.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|