|

Good Sunday to you. Here are the links for this past week.....

Leading Indicators for Gold's Turnaround

This was recorded on Tuesday. Thoughts on precious metals, September, what I'm looking for as far as price action and thoughts on the manipulation meme.

Balmoral Resources to Raise $10M

This will take the company's working capital close to $20M. The end of the bear market could see this stock trading at a much better price (from a buyers standpoint) than a few months ago.

S&P 500 to Test Important Support

The 400-day moving average is the key for the S&P 500. It is great at distinguishing bull and bear markets.

Global Macro Update

A look at global markets from Tiho Brkan.

Premium Snippets- Precious Metals

Gold is building some relative strength beneath the surface as was the case before its bottoms in early 2001 and late 2008. It is showing strength against foreign currencies, commodities and global equities. Even if Gold falls below $1100, it has a good shot to hold the recent lows against those other assets. The biggest key to follow is Gold vs. the S&P 500. Gold has more work to do there.

Overall, Gold's relative strength (performance against other asset classes) will help determine when and where it may bottom. If Gold is showing very good relative strength at $1100 then its obviously much closer to a bottom then if its showing poor relative strength.

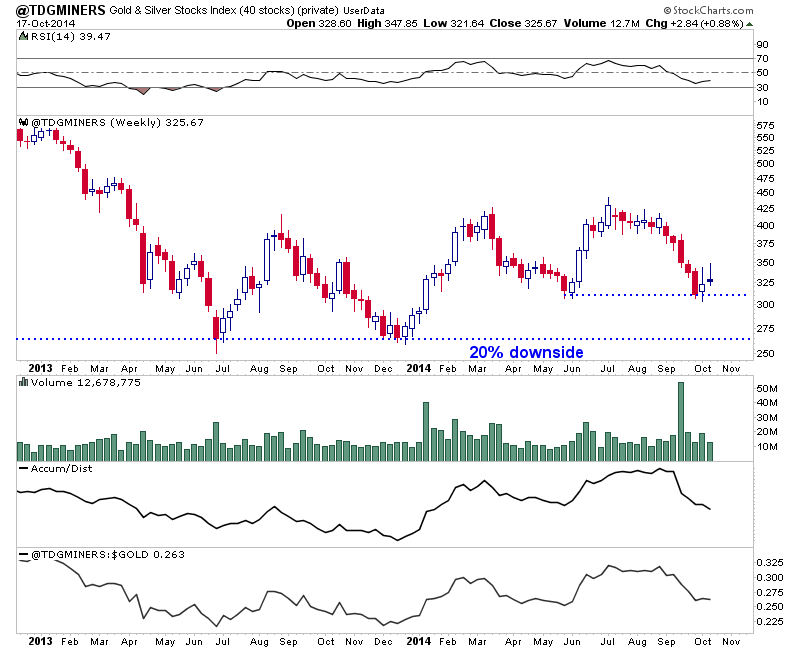

That being said, the picture in nominal terms remains bearish. Gold has rallied $50 yet the stocks have barely done anything. That is not a good sign. Also, as my indices below show, even the quality stocks look vulnerable. If they lose support they could fall more than just 5-10%.

Here is a weekly chart of our top 40 index. The index plunged five weeks in a row to its May support. The bounce over the past two weeks has been weak as the index has failed to hold gains. The index has closed nowhere near the highs in each of the past two weeks. The index is looking quite vulnerable to a break below that support. If that happens it could fall to the 2013 double bottom. From Friday's close that is 20% downside. A break below that support

could coincide with Gold breaking below $1180.

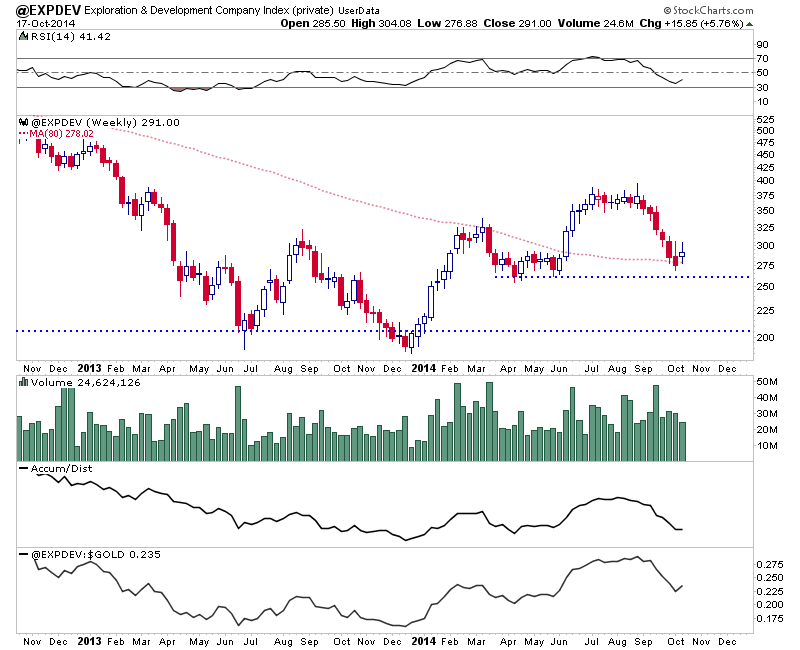

Here is a weekly chart of our 15 stock exploration & development index. These are some of the strongest exploration and development companies with projects that are or appear likely to be economic at $1200-$1300 Gold. These stocks performed quite well from December to July. The index is holding above its 80-week moving average and is sitting above

spring support levels. However, where do you think this index is going in a sub $1200 or sub $1100 Gold environment?

We've positioned ourselves to take advantage of this final decline. Huge gains are made after severe market declines. I believe that the risk of a severe decline remains in play. Perhaps not immediately but its still there.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people

who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Upon signup you will immediately receive all recent updates and important reports. In the past few weeks we've published a Top 5 Stocks report, a Long-Term Precious Metals Outlook Report as well as a Global market update. This is in addition to our weekly updates. Our top 5 report covers our top 5 stocks to buy at the coming bottom. The Long-Term Outlook report is a 36-page report which contains a bevy of actionable charts

and information. You won't be disappointed with this material.

We have three goals: to help subscribers make money, to provide some education and to produce the highest quality research and analysis we can. We work really hard to deliver a top notch service.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|