|

Here are some links well worth your time....

Precious Metals Starting to Show Bullish Signs

Our latest editorial and probably the most bullish one since the summer. We note some bullish signs we are seeing and we also note (at the end) what we want to see from the sector to close out the year.

Kitco Video: 2015 Outlook with Brent Cook

Brent Cook discusses which companies might move first and the types of companies he wants to invest in.

Scotia Bank Mining Conference Info

Follow this link to find links to numerous company presentations.

Is Inflation Oversold?

Good post from Gary Tanashian. He's one of the top precious metals / macro market analysts in my opinion.

Global Stocks Still Correcting

US equities have performed well but global equities are in still in corrective mode. Read Tiho's latest thoughts.

Premium Snippets

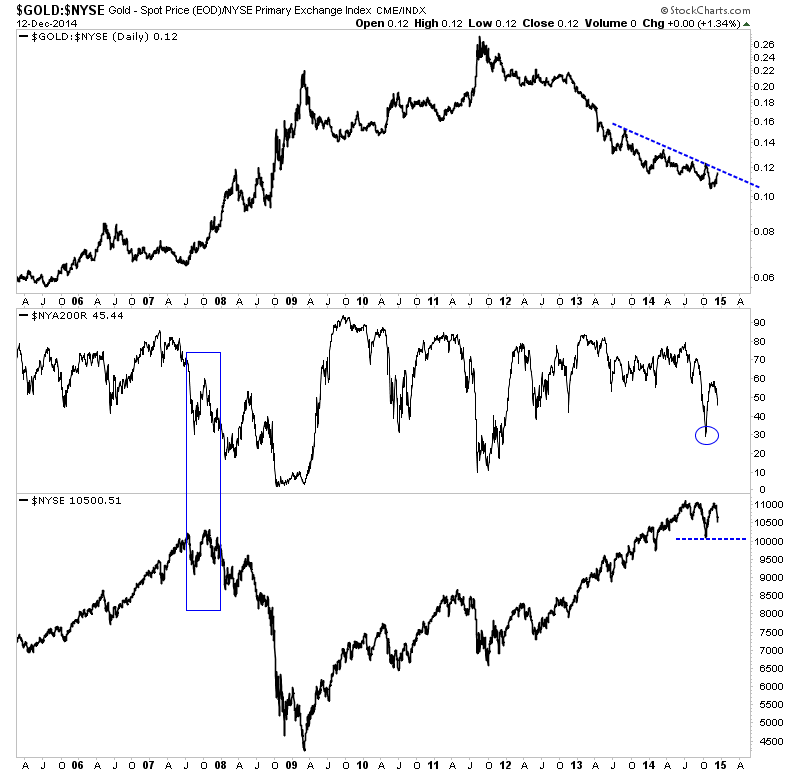

We included a chart of the NYSE in our premium update but we've expanded upon it below. We plot the Gold/NYSE ratio and then the % of NYSE stocks trading above the 200-dma and then the NYSE. Other than the S&P 500 and Nasdaq, most indices may have peaked.

The NYSE peaked in July and has failed twice to break higher. Meanwhile, breadth has really slipped. The % of stocks trading above the 200-dma recently hit 30% a multi-year low. Back in 2007-2008, that figure slipped below 30% and that is when half of the market realized a bear market had begun. (The other half realizes a bear is going usually a few months before it ends).

Meanwhile, note the Gold/NYSE ratio. As we noted in our editorial Gold is starting to show good relative strength. It remains weak against US equities. Could that start to change in the coming weeks?

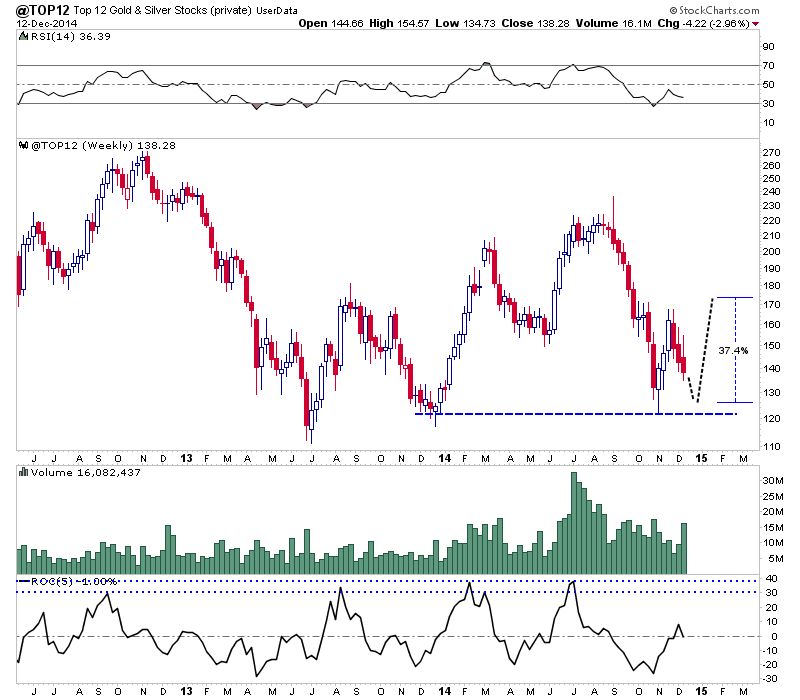

Here is the weekly chart of our Top 12 Index. The index closed at 138. It has 10% downside to its daily closing low and about 5% downside to its weekly closing low. There is the setup for a potential double bottom given the strong rebound in January and the slow decline of the past few weeks.

At the bottom we plot the rate of change over 5 weeks. Four times in the past two years the index has gained 30% to 40% in a five week period. That uses weekly closing prices. The daily figures would be greater. We sketch in the chart what a 37% move in five weeks could look like.

I was planning to include a sentiment chart but it is too large to include in this space. Using StockCharts.com I can include multiple pieces of data in the same chart. I showed the premium/discounts for CEF and GTU as well as holdings in the GLD and assets in the Rydex Precious Metals Fund. Within the past few weeks each of these indicators hit major extremes. The lowest was +6 years (low in GLD

holdings) while the high was the 14 year discount to NAV in CEF.

Also here is more sentiment food for thought….

The short interest in GDXJ has exploded in the past three months from 3.6M shares to 11.6M shares. Data is two weeks old but GDXJ is down in those two weeks so I doubt there was much short covering.

Also, In a Dec 4 report Merrill Lynch noted that selling of inflation hedges reached an extreme and in particular TIPS and Emerging Markets Equities. They mentioned precious metals but that group as we know has already seen extreme selling.

Is now the time to start buying or should we remain defensive? It depends on each person and their situation and only time will tell as far as the market. We have some ideas and share what we are doing, not doing or plan to do in our premium service.

Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts

who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

Upon signup you will immediately receive all recent updates and important reports. Recently, we've published a Top 10 Stocks report and a Long-Term Precious Metals Outlook Report. You won't

be disappointed with this material.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|