|

Here are some links well worth your time....

Gold's Volatility & Other Things to Watch

My latest article. With respect to Gold, I'm watching volatility and a few other things.

The Commodity Supercycle Aint Over Yet

Great piece from Erik Swarts from Market Anthropology. He was bearish Gold and commodities at the top in 2011. He's been bullish on precious metals in recent months. Find out why.

Brent Cook: Peak Gold in 2015?

Good interview with Brent Cook.

Dan Norcini on the Tips Spread

Gold usually follows the Tips Spread.

Premium Snippets

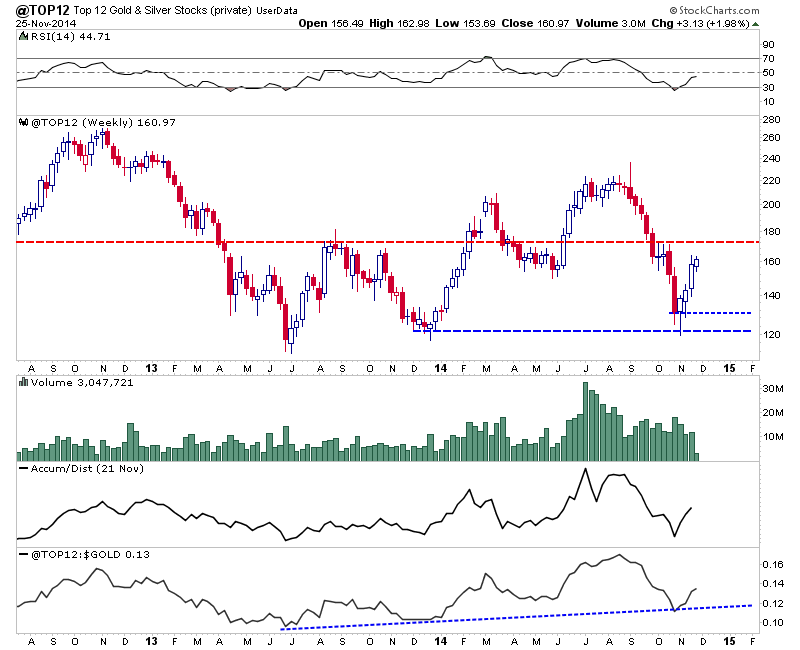

Below is a weekly candle chart of our top 12 index which has rallied over the past three weeks. It has an important confluence of resistance around 170. It closed at 161 today, Tuesday.

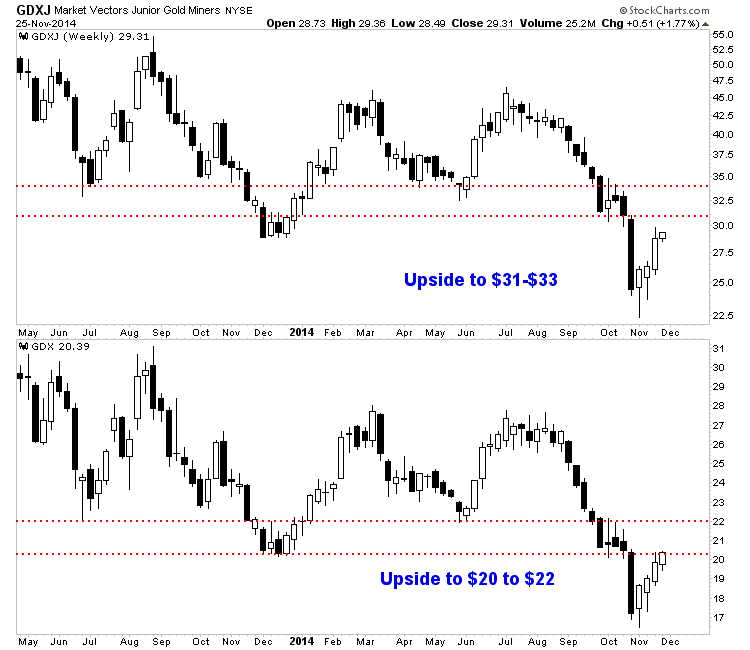

Next is an updated look at GDXJ and GDX. This is also a weekly chart. We note the resistance targets on the image.

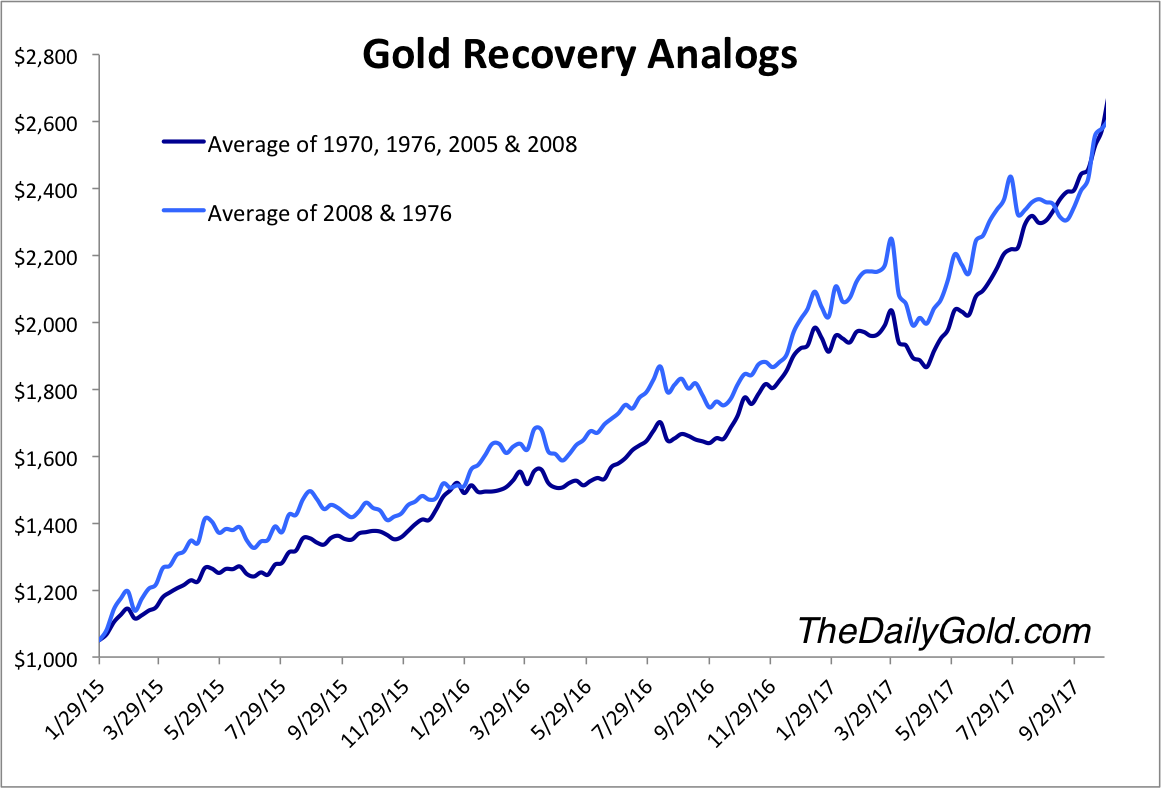

Another point I'd like to share is the historical precedent of very strong recoveries in Gold within secular bull markets. Gold is in its 4th week of this rebound and has only advanced about 5% in daily terms. The 1976 recovery gained 15.5% in less than a month while the 2008 recovery gained 23% in about a month. I think Gold has more upside in this rebound but in any case it currently pales in comparison

to what should happen after a severe cyclical bear market.

Gold bugs and gold bulls might think its the end of the world if Gold falls below $1100 but my work shows that will catalyze a very strong and sustainable recovery. Volatility would spike and so too would short interest. That would facilitate a strong short squeeze at a time when

support below $1100 would kick in. The recovery analogs above show that if Gold follows its history it will rebound strongly and be back above $1200-$1300 within months. We have to be patient because Gold is in rebound mode and its not going to suddenly fall below $1100.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only

credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers. In September we liquidated all long positions and urged subscribers to protect themselves.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription.

I am very confident in the future success of these companies. They meet a set of strict criteria.

Upon signup you will immediately receive all recent updates and important reports. Recently, we've published a Top 10 Stocks report, a Long-Term Precious Metals Outlook Report as well as a Global

market update (with a new one coming). You won't be disappointed with this material.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|