|

Here are some links well worth your time....

Black Friday for Precious Metals

I wrote this article on Friday. It was truly a Black Friday for Precious Metals.

Precious Metals Bear Market Update

The latest from Tiho including Gold & Silver bear analogs using daily data. (I use weekly data).

Emerging Markets are Cheap

Another good post from Tiho.

Balmoral Resources with More Great Nickel Results

CEO.ca covers the company's latest results and its overall tremendous performance in 2014. This is another example of backing management teams with a strong track record. Darin Wagner had a strong track record and therefore its less of a surprise that Balmoral has made two excellent discoveries.

Premium Snippets

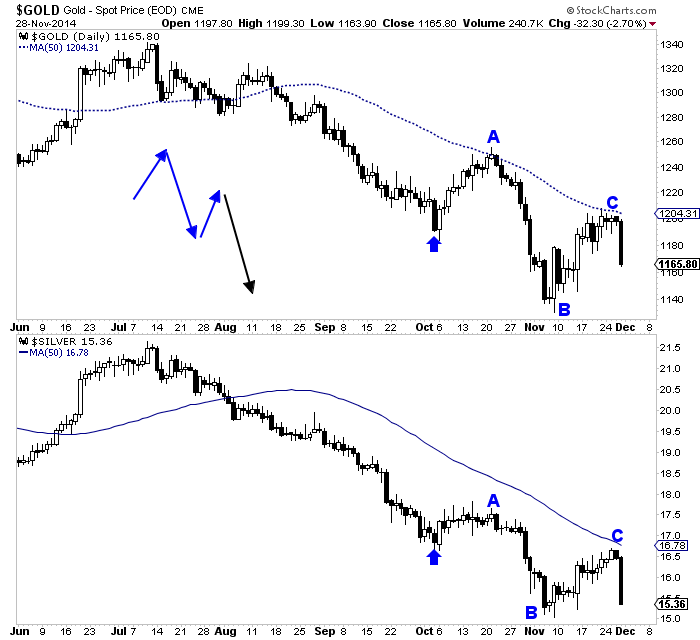

After Friday its clear that Gold & Silver may have completed a bearish running correction pattern. Corrections feature three legs and typically the A and C legs are stronger than the B leg (which is the counter-trend move during the correction). Also, the C leg tends to end where the correction starts. A running correction is essentially a very weak correction that bodes very well for the prevailing

trend. In this case, it's very bearish for precious metals in the coming days and weeks.

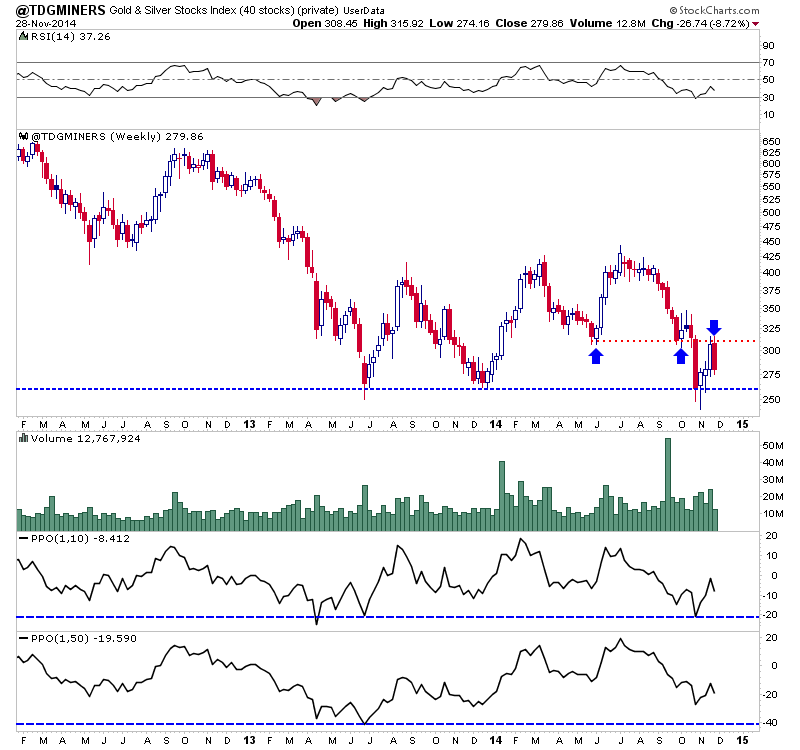

Here is an updated chart of our Top 40 Index. We replaced a few weak components. This index also formed a bearish running correction but we did not label it. Note how the index rallied back to previous resistance around 310-315 but failed to break above it. I'm expecting the index to break below 250 before it bottoms.

Staying with the top 40 chart, focus on the bottom portion. We plot the index's distance from its 10 and 50 week moving averages. This can be used as an oversold indicator. The entire sector was extremely oversold in summer 2013. The top 40 index was 40% below its 50-wma and 20% below its 10-wma. Currently those figures are 9% and 20% (rounding up). There's no reason it has to go lower but if it does we can

use those figures as a guide for letting us know when the index becomes extremely oversold rather than just oversold.

The key to not "picking the bottom" but buying at the best spot is to look for a combination of 1) strong support, 2) extremely oversold conditions and 3) extreme bearish sentiment. We already discussed #2. Regarding sentiment some indicators have reached extreme. CEF is trading at the largest discount to NAV in 13.9 years! assets in the Rydex PM fund are

at a 12-year low. The COTs were at an extreme in summer 2013 and that explains why its taken Gold almost 18 months to sustain a break below $1200. I think when Gold breaks $1100 we will see the COTs at 13-14 year extremes. Finally, the strong support for Gold is around $1000. We could see a bounce around $1080 as that is the 50% retracement of the entire bull market.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is

the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers. In September we liquidated all long positions and urged subscribers to protect themselves. We didn't chase the recent rally and after Friday subscribers were quite thankful.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription.

I am very confident in the future success of these companies. They meet a set of strict criteria.

Upon signup you will immediately receive all recent updates and important reports. Recently, we've published a Top 10 Stocks report and a Long-Term Precious Metals Outlook Report. You won't

be disappointed with this material.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|