|

Here are some links well worth your time....

Huge Reversal for Gold & Silver. Now What?

This is a video we shot Thursday evening. We cover the near-term outlook for Gold, Silver and GDX.

Could Gold Surprise us All?

Interesting conclusion from Tiho.

Gold Miners Find Support

Another good post from Tiho who concludes: So finally, let me be crystal clear here without mincing my words: whether you

buy this sector right now or at a lower price (if it goes there), you are buying only of the most undervalued and unloved asset classes. Returns could be spectacular going forward!

My Interview with the AuReport

I discuss my outlook for 2015 as well as the things investors should look for in choosing producers and exploration/development companies.

Criteria Report for Production & Exploration/Development Companies

This report is now updated. This is the free version of the report. Subscribers get the premium version which gives more details and examples on the criteria points.

Premium Snippets

So much for that bearish running correction! Metals looked like they were starting that "final selloff" on Monday morning as Silver was trading in the low $14s and Gold at $1140. Then a massive reversal began. Only time will tell how significant the reversal is. The action in the coming weeks could give us a strong hint if we've seen the end of the bear market or if more pain is ahead.

Here are a few charts from our latest premium update that I will share….

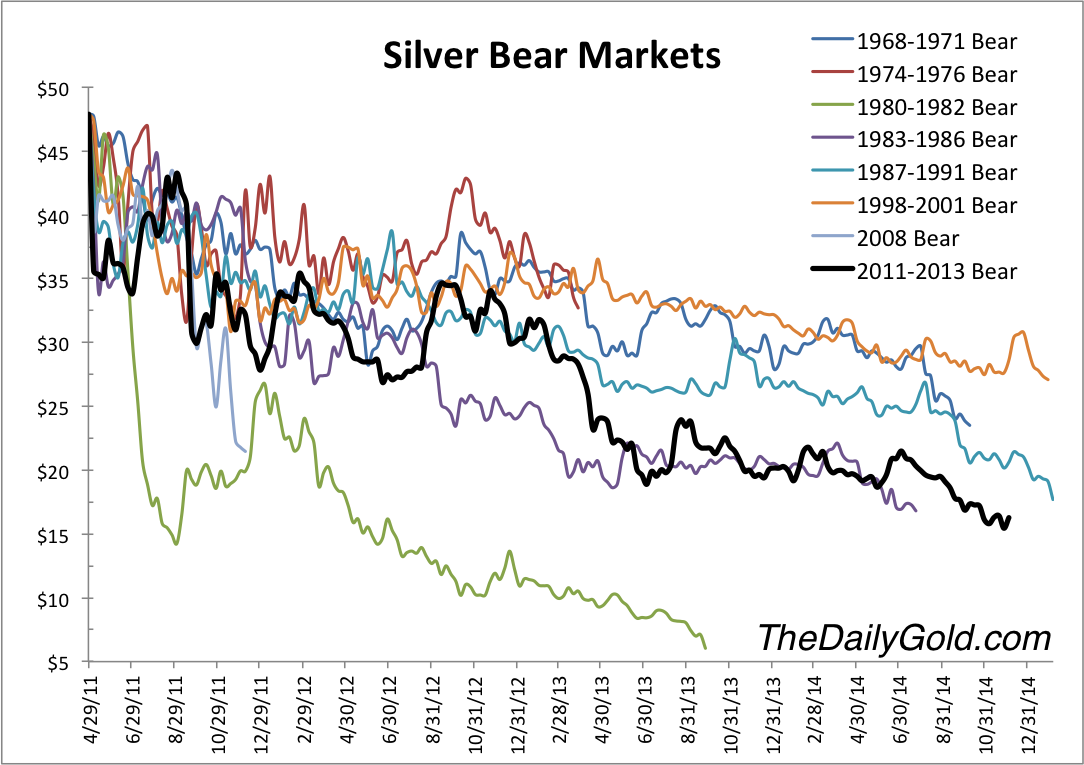

Here is the Silver Bears analog chart. The current bear is in black. How much lower can this go?

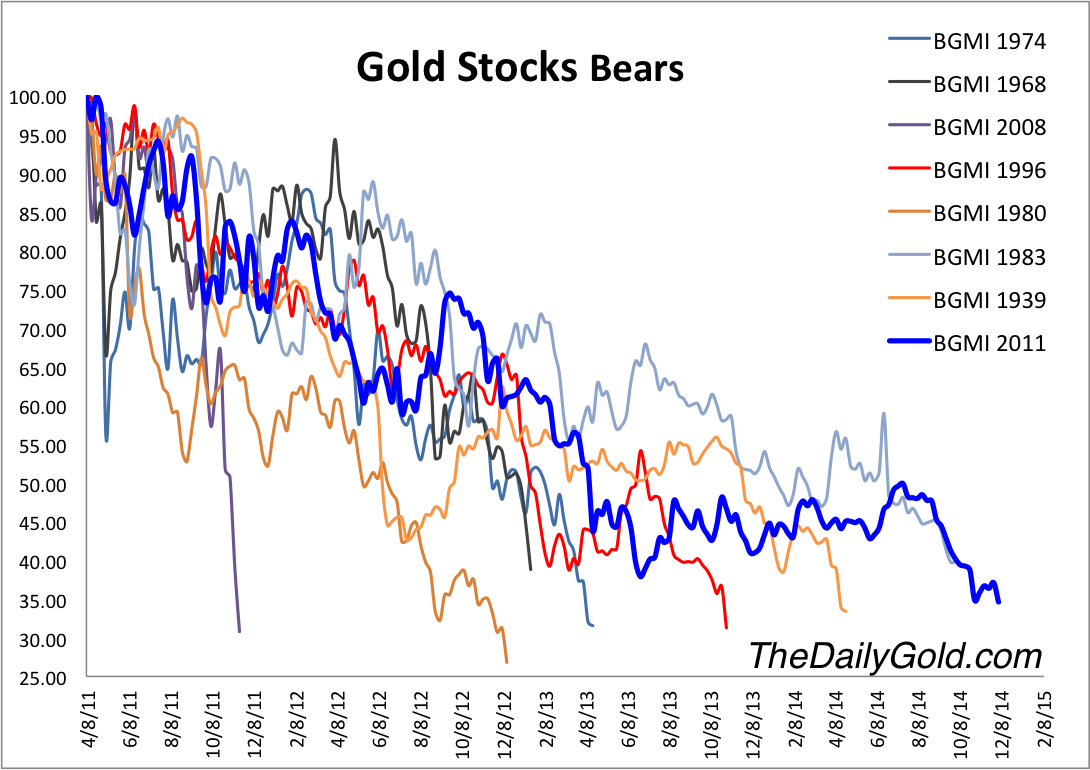

Here is the updated bears analog chart for gold stock bears. The 1996-2000 bear was the longest and we cut that one to give the chart a cleaner look. At this point in time, the 1996-2000 bear was 40% above the current bear. How much lower can gold stocks go?

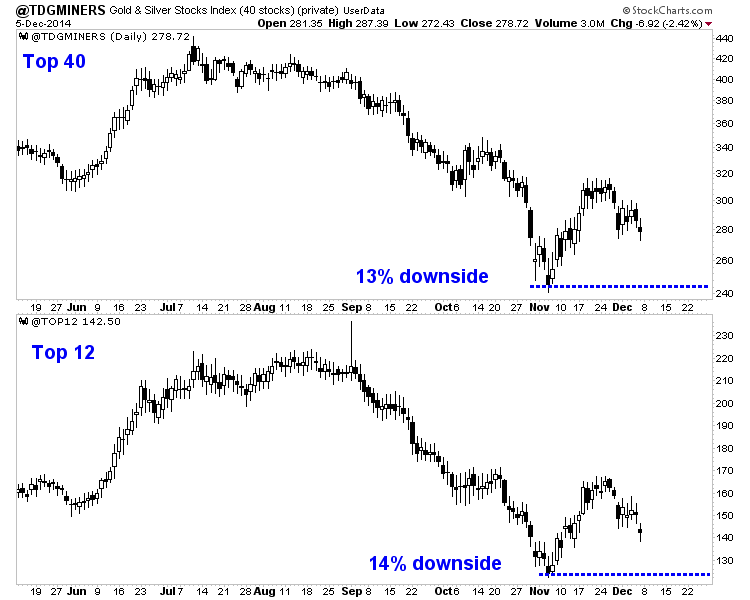

Last is a daily candle chart of our top 40 and top 12 indices. They have 13% and 14% downside to their early November low. The miners actually put in a fairly strong rebound in November which puts a double bottom setup in play.

Is now the time to start buying or should we remain defensive? It depends on each person and their situation and only time will tell as far as the market. We have some ideas and share what we are doing, not doing or plan to do in our premium service.

Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts

who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers. In September we liquidated all long positions and urged subscribers to protect themselves.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

Upon signup you will immediately receive all recent updates and important reports. Recently, we've published a Top 10 Stocks report and a Long-Term Precious Metals Outlook Report. You won't

be disappointed with this material.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|