|

Here is some important information and analysis from the past week....

Gold Shows Increasing Relative Strength Amid US$ Strength

Our latest article. Gold is really showing some impressive relative strength considering the strength in the US$. Since the end of 2013 the buck is up 15% while the US$ is up a tiny bit. Over the past few months the US$ and Gold are both up ~6%.

Precious Metals Video Market Update

This was recorded on Wednesday. We discuss our short-term outlook, targets and more.

Podcast: Tiho Brkan Comments on Precious Metals

In this interview we ask Tiho several questions on precious metals. He talks Gold, Silver and the juniors. He also covers why he is very bullish on China.

Why Gold May Finally Be Turning Higher

Erik Swarts at Market Anthropology was correctly bearish on precious metals in 2011. He uses history and analogs quite a bit in his work. He's not a gold bug but is now bullish on Gold and commodities.

Portfolio Update: Buying More Precious Metals

A post from Tiho that preceded our interview.

Argonaut Gold Produces Quarterly Record 44.3K oz Au in Q3

Argonaut Gold shares are up more than 100% since being given away a month ago.

Premium Snippets

Gold stocks recently were at their there most oversold point since the bull market began. The other two were in spring 2013 and the financial crisis of 2008. Not surprisingly, sentiment also reached major extremes. We noted the extreme put-call ratio in GDXJ last week and also GDX's sentiment (as per sentimentrader.com's Optix indicator) recently hit an all time low (since it began trading in

2006).

Furthermore, the gold stocks (Barron's Gold Mining Index) were more than 3.5 years into a bear market and down 75%. It was literally the most oversold gold stocks had ever been, EXCEPT for the weeks leading to the 2000 bottom. That was arguably the greatest buying opportunity of all time (in gold stocks). The point is, at worst the gold

stocks have started a huge bear market rally. Otherwise they started a new bull market.

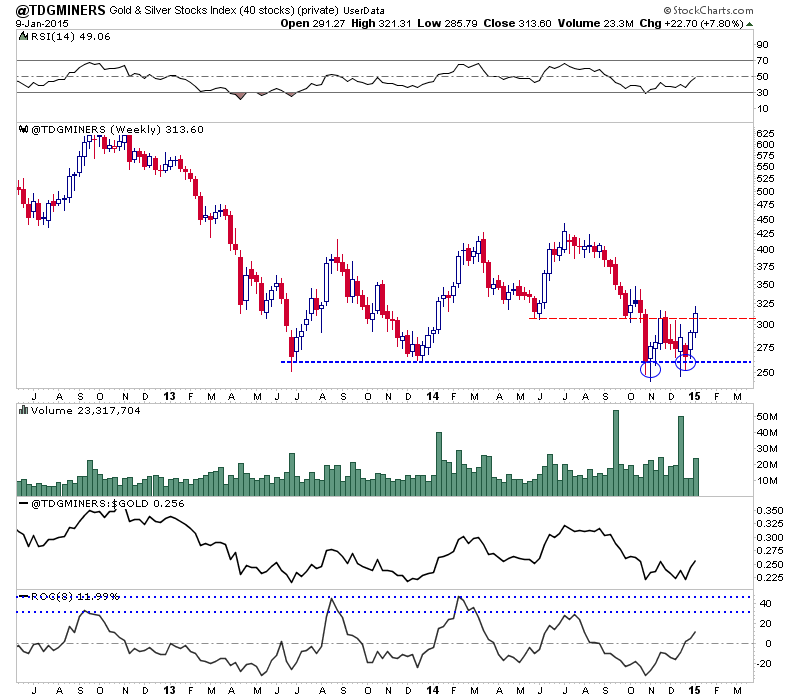

The top 40 index is charted below. This is a really bullish looking chart. I could see it rising another 20% in the weeks ahead. In charting our holdings as I do in every premium update, I noticed that more than a few had very strong charts. Not only do we see a bottom but we see a strong retest. The November low emerged after

three weeks and the index successfully tested that support around the holidays.

Last week we asked is this the start of another bear market rally or will it morph into a real bull market?

We positioned ourselves (in recent weeks) for a big rally. Making money is not about opinions but buying and selling at the right times and having the discipline to execute that strategy and cut your losses. Its also about knowing yourself, your own goals and risk tolerance, etc. But to answer the question, we will have a better idea in the coming weeks. If Gold makes a weekly close above $1240 and breaks

to the upside against various equity markets then that may put the nail in the coffin for the bears.

Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts

who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Subscribers in the past week commented:

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16

months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

We are also working on a Gold E-Book and 2015 Macro Market Outlook Report for subscribers. Each will be published in the coming weeks.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|