|

Here is some important information and analysis for your consideration:

Gold Maintains Strength While Large Miners Reach Resistance

Our latest article. Brief but concise.

Precious Metals Video Market Update

This was recorded on Tuesday evening.

Podcast: Erik Townsend on Precious Metals & Oil

This was recorded a week ago. Fund manager Erik Townsend shares his thoughts on precious metals as well as Oil.

Market Anthropology: Going Up?

The latest from Erik Swarts at Market Anthropology.

Balmoral Resources' 2015 Winter Drill Program

Balmoral had a terrific 2014. The stock has digested those gains and may be forming a base here. The company has two strong projects.

Premium Snippets

Quick note on GDXJ. Should bulls be worried that GDXJ is lagging?

In 2009 Bob Hoye used GDXJ's data to create a history of the index. We circled the 2008 bottom and points 1 and 2. Recall how GDX bottomed in October then made a double bottom or higher low in November. According to this chart, GDXJ bottomed in November, not October. Two weeks later GDXJ retested its November low even as GDX was trading well above its low.

So I'm personally not concerned about GDXJ's relative weakness as a bearish big picture indicator.

After all, a person much smarter than me said that Gold is the key. Honestly, he was right. Gold was right in the summer. It was right at the bottom in 2008 as it moved back above $900 quickly yet the stocks were trading as if Gold was at $700. Gold made a marginal high in 2004 as the stocks corrected. Gold was right as the sector surged into the end of 2005.

Gold looks really good as long as it holds above $1250 in US$ terms. Gold is surging against foreign currencies. Its nearing a 2-year high against the foreign currency basket. Its not just strength against the Euro and the Yen. Its showing strength against almost every major currency.

Meanwhile, the US$ index is surging but showing extreme bullish sentiment. Looking at the past 15 years we see that sentimentrader.com's public opinion is 91% bulls and at an all time high. The daily sentiment index recently touched 98% bulls.

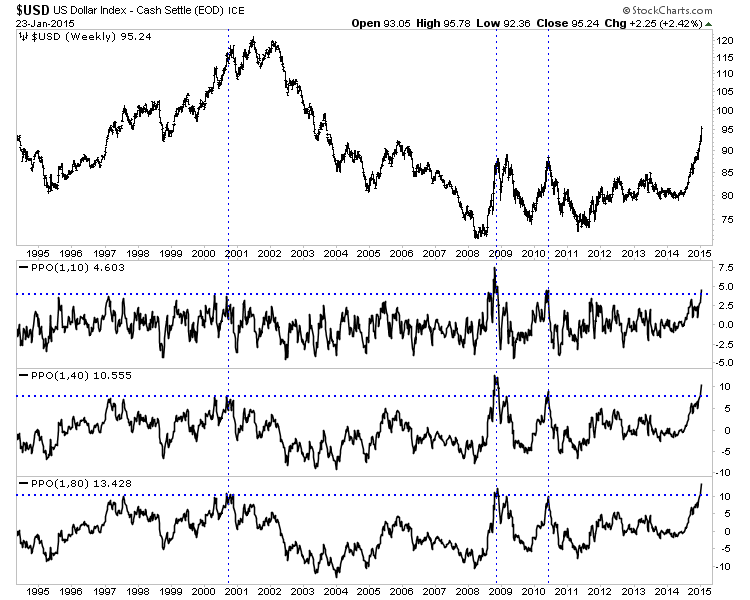

Take a look at the chart below (which I created a few minutes ago and will put in the next premium update). We plot the US$ index and show three oscillators which mark the index's distance from its 10-week, 40-week and 80-week exponential moving averages. The greenback is extremely overbought on all time frames. In the past 20 years the greenback was this overbought only three other times. Those

times were late 2000, late 2008 and early 2010. Looking at the three oscillators together, the only times the greenback was more overbought was in 1984 (its all time high) and 2008 (height of the financial crisis).

The US$ is not only due for a correction but a pretty big one. What will happen to Gold and precious metals when the greenback corrects? If the greenback corrects for several months then it might be enough to push Gold above key resistance at $1350.

In TDG #397 we provided near-term downside targets for the various indices (HUI, GDX, GDXJ) as well as technical updates on our favorite stocks. We also wrote a brief intro report on a very tiny exploration company (sub $10M market cap) that has a high grade resource (with good expansion potential) in a good jurisdiction.

Now is a great time to consider a subscription as we will have new and updated reports coming over the next two months. Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Subscribers in the past few weeks commented:

Mr. J Roy-Byrne,

I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|