|

Here are some links to check out....

Potential Upside Target for GDXJ

A brief article in which we touch on the oversold condition and make the case for an upside target in GDXJ.

Precious Metals Video Market Update

We recorded this video earlier in the week. Covers several topics.

Global Macro Charts

Tiho's post contains many great charts.

It Could not Look Better for PMs in 2015

Do you agree with Clive Maund?

Premium Snippets

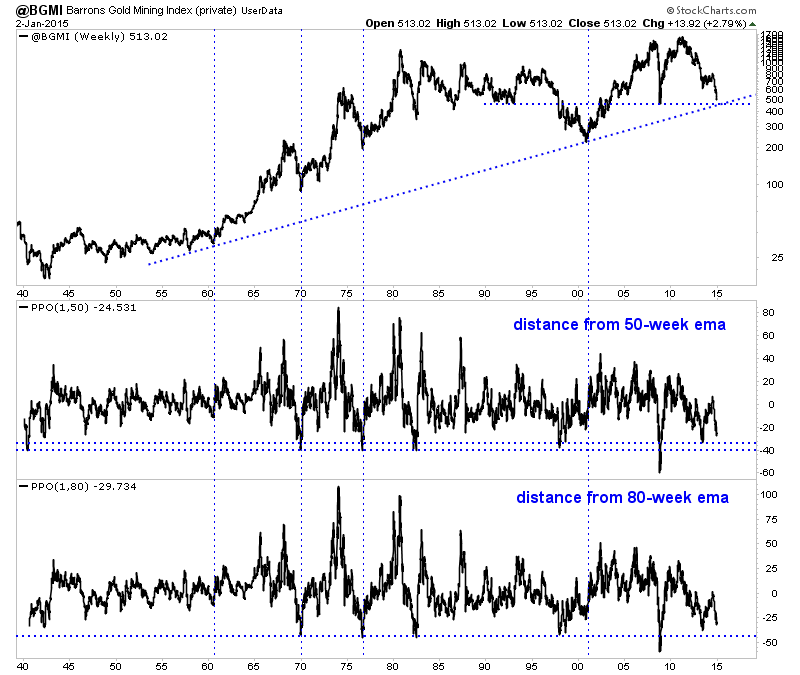

This chart was not included in the update but it allows me to pontificate as to the greatest buying opportunities of all time in the gold stocks. Two criteria could be how oversold the market is and then its potential upside. The latter is also determined by where the market is in its long-term cycle and its valuations at that point.

Anyway, below is the Barron's Gold Mining Index back to 1938. We also plot the index's distance from its 50 and 80-week exponential moving averages. It can serve as an oversold/overbought indicator. Gold stocks are enduring their second worst bear market ever. Thus it's not a surprise that in recent weeks they reached their 3rd most oversold point 16 years or their 4th most oversold point since the early

1980s.

In my opinion, the greatest buying opportunity of all time was in 2000. Gold stocks hit a 24-year low and valuations were potentially near all-time lows. Going further back we can also consider 1976, 1970 and the early 1960s. Obviously 2008 was a great buying opportunity and perhaps similar to 1970. The best buying opportunities are always at the start of secular bull markets. It's quite clear that

1960 and 2000 were the two best buying opportunities.

In terms of the potential for immediate gains, 2008, 2000 and also 1960 were great opportunities. I expect that the immediate gains from the coming bull market will rate very close to what we saw in 2000 and 2008.

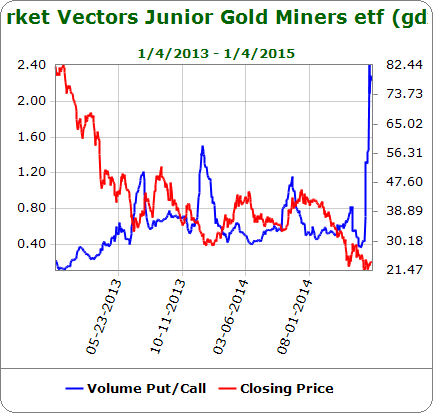

Moving on, we included this chart last week. I checked it today and noticed that the put-call ratio for GDXJ continued to spike. This is now at a multiyear high. Considering the spike and the little rally in GDXJ, it's a very bullish sign.

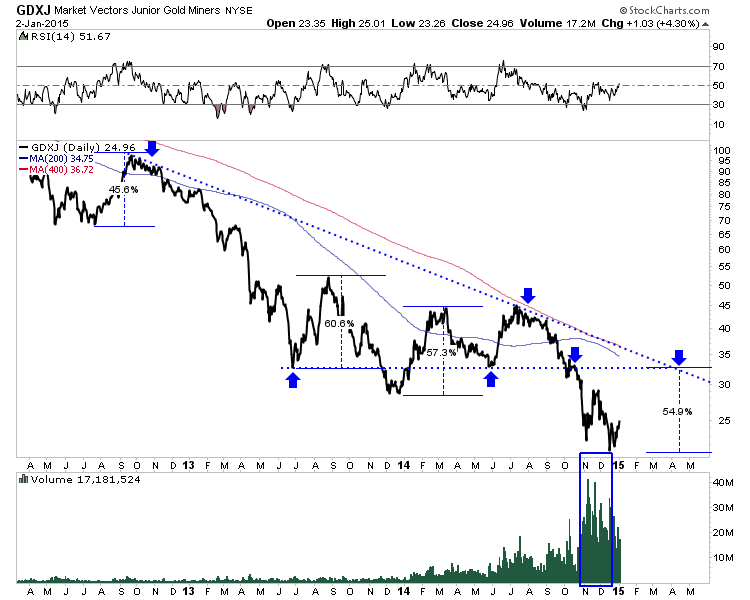

Here is a daily line chart of GDXJ. We plot the rally percentages (of its four rebounds) since 2012. If GDXJ rallies to $33 it would be a 55% rally from its recent low. Over the past 10 months GDXJ has only had that 45% rally in late spring and a little pop in November.

Is this the start of another bear market rally or will it morph into a real bull market? I don't know but I try to provide a few insights with respect to our portfolio and how we are trading it.

Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts

who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

Upon signup you will immediately receive all recent updates and important reports. Recently, we've published a Top 10 Stocks report and a Long-Term Precious Metals Outlook Report. You won't

be disappointed with this material.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|