|

Here are 6 very good links for you to check out:

A Few Positive Fundamental Developments for Gold Miners

What has changed since the end of last year?

Interview with Palisade Radio

We cover a number of topics related to precious metals in this interview. Those include Gold, Gold vs. foreign currencies, Gold vs. Stocks, Silver, the gold miners.

Precious Metals Video Market Update

Recorded a few days ago, our look at the gold stocks.

2015 Forecast for Gold & Gold Stocks

The latest from Steve Saville, one of the best analysts in the Gold camp.

Gold's Bear Market

Post from Tiho Brkan.

Sizing Up the Next Moves in the Market

The latest from Erik Swarts at Market Anthropology.

Premium Snippets

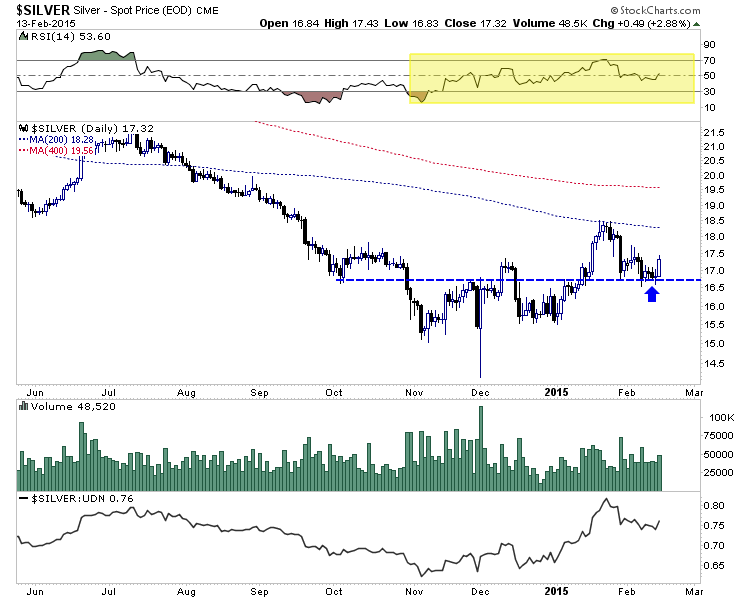

Silver has been an even better indicator than Gold or the miners. It peaked first nearly 4 years ago and throughout 2014 lagged the sector. Its underperformance was a signal that the bear would continue. Silver is suddenly looking bullish. It held support and rebounded almost 3% on Friday. If Silver makes a move above its January high then its a very bullish sign for a number of reasons. Another point to

note is if Silver/foreign currencies exceeds its January high then it will reach a 15-month high.

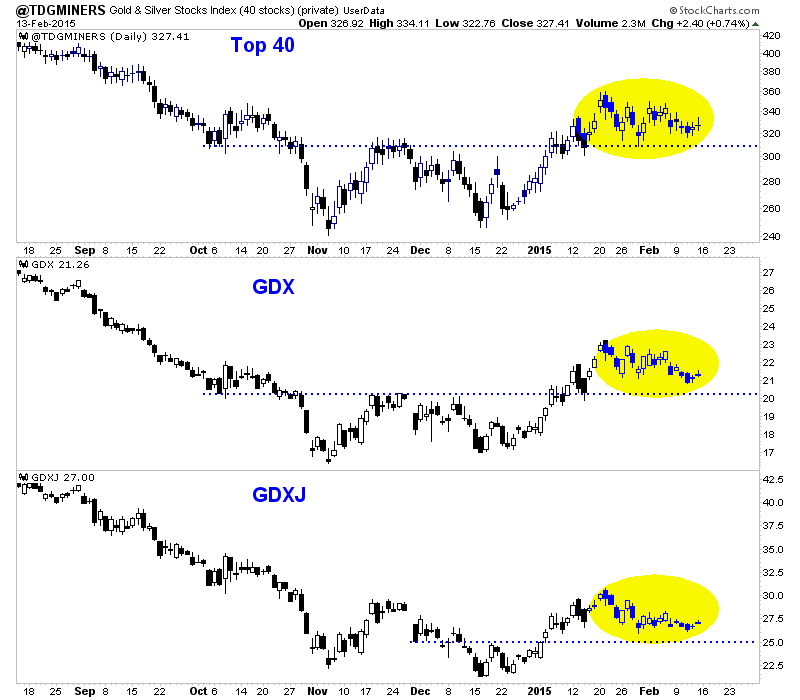

Like Silver, the miners are holding above support. They haven't had a strong rebound like Silver had on Friday but they've managed to hold above support for almost a month. Given the strong double bottom in recent months and the holding above support, the bias is bullish. That does not mean it can't change though. If the miners can hold support for another week or two then they may be in position to start

trending higher again.

In TDG #400 we commented on, among other things one jurisdiction that could see increased M&A activity in the months ahead.

At the moment I am quite confident in the future performance of many of our holdings. Three of our companies are on the cusp of major breakouts which could happen in the next few months. These breakouts would take their stocks to 2-year highs and more. Another two stocks are trading in uptrends and figure to test major resistance in the months ahead. Those two could see major breakouts later in the

year.

We always try to match fundamentals with technicals. The companies with the strongest charts or the companies showing leadership usually have the strongest fundamentals. Also, its important to try to identify future leaders before their stocks make big gains.

Now is a great time to consider a subscription as we will have new and updated reports coming over the next two months. Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our subscribers.

Subscribers in the past few weeks commented:

Mr. J Roy-Byrne,

I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|