|

Here are some links from this past week….

Gold & Gold Stocks Near Term Prognosis

Our latest article, penned Thursday evening. After last week's action, the near term prognosis is more clear.

Interview with Wall Street Window

I discussed my thoughts on precious metals with Mike Swanson of Wall Street Window.

Precious Metals Shakeout

Tiho Brkan's latest thoughts on precious metals.

Mickey Fulp: Real Cost of Mining Gold

My friend Mickey Fulp takes a detailed look at this. FYI, its a PDF download.

Valuations are in the 99th percentile, smart money is selling

Premium Snippets

Here is a weekly candle chart of the top 40 index. The index lost 3.5% on the week as it failed to sustain Wednesday's recovery. During each of the previous five weeks the index wrestled with the 40-dma. Last weeks action shows failure and the near-term trend is definitely bearish.

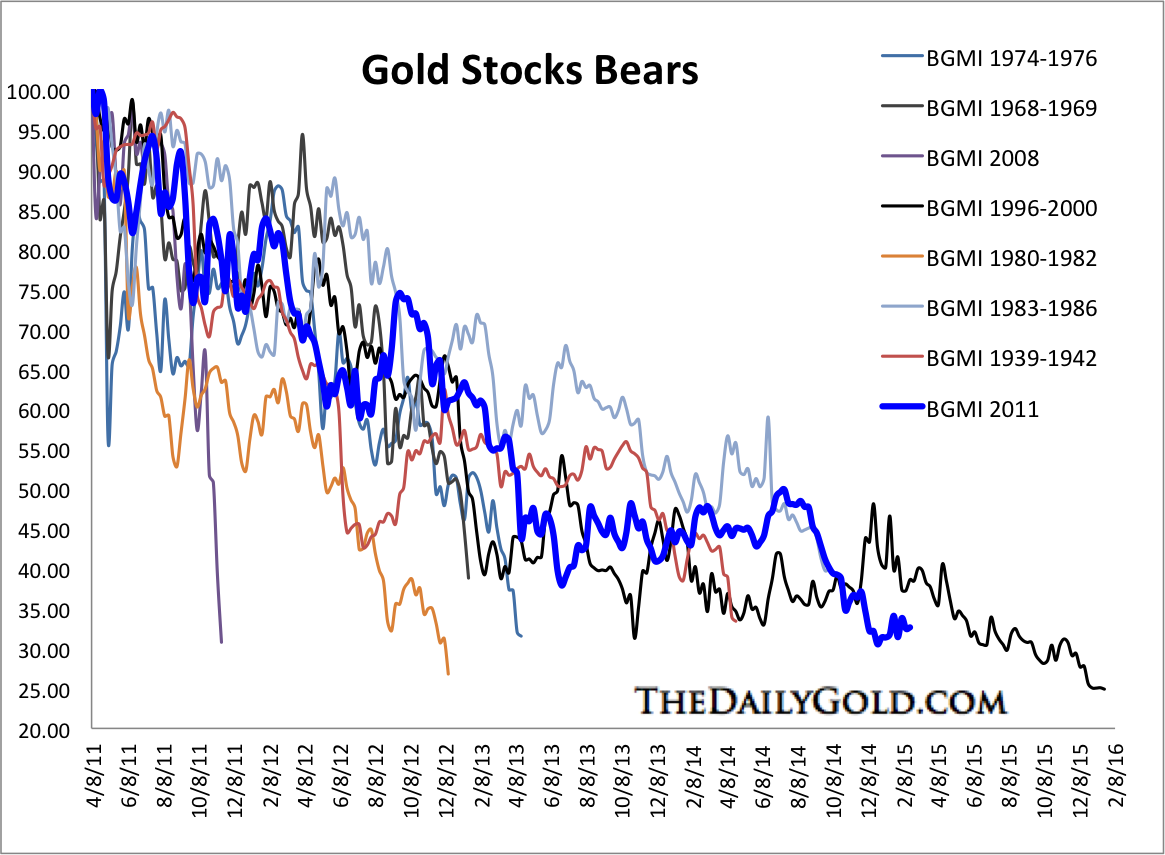

The bear analog chart makes an extremely compelling case if someone has a 1-3 year time horizon. We are likely coming up on the end of the bear market.

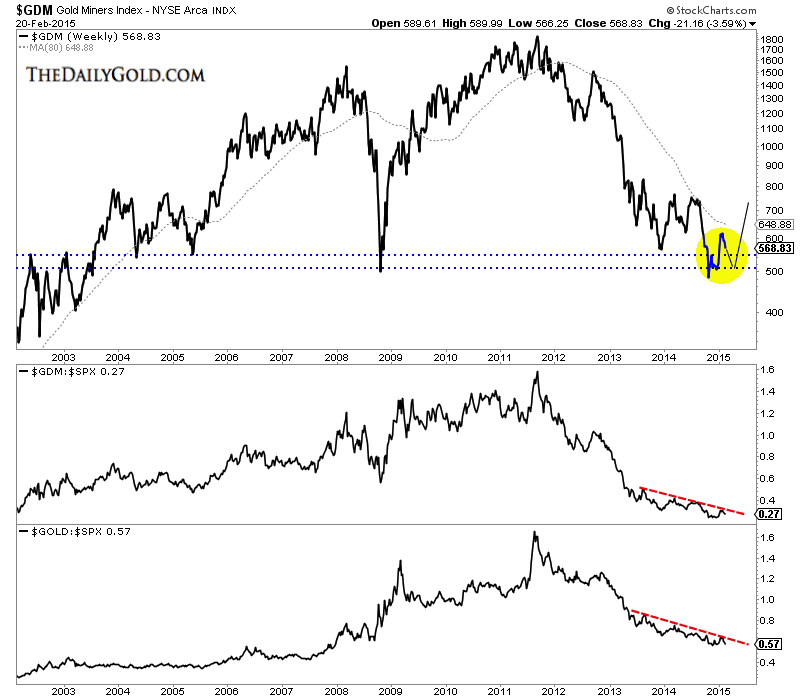

The gold stocks put in a strong bottom at the end of last year as we noted. On the daily charts and weekly candle charts it shows a strong double bottom. However, we see potential for a larger double bottom on a weekly line chart. The chart below is GDM, the forerunner to the GDX ETF. I see the miners having some near term downside potential but the next low could setup a major double bottom.

GDM's weekly low was at 471. It closed at 569 and also has weekly support at 500. We also plot GDM vs. S&P 500 and Gold vs. S&P 500. Those ratios are very important to a turnaround in the precious metals sector.

In TDG #401, we spent several pages covering developments in six of our holdings. Most of our stocks are in healthy uptrends and pullbacks to certain spots would be buying opportunities. The stocks not in uptrends, we own because they have a catalyst coming or are deep value type plays. Its important to periodically review your holdings in terms of technicals and fundamentals. One of our favorites has

disappointed recently and we realized it was due to a macro development that was unforeseen.

Right now we are managing two portfolios and subscribers get all the details of our holdings, buys/sells etc. Now is a great time to consider a subscription as we will have new and updated reports coming over the next two months. Consider a

subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts who is the editor of a service. Secondly, we are one of only a few people who runa a real money portfolio. That means our goals are 100% aligned with

our subscribers.

Subscribers in the past few weeks commented:

Mr. J Roy-Byrne,

I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates which includes a recent Top 10 Company Report. This Top 10 Report is a full 35 pages and 15,000 words long and is available with a subscription. I am very confident in the future success of these companies. They meet a set of strict criteria.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|