|

Here are quite a few links from the past week. I think you will glean at least one point/insight from each….

Are Miners Leading Gold?

We posit this and explain why miners could be leading Gold and why it should be expected eventually following a very long bear market.

Podcast: Erik Townsend Thoughts on Gold

Erik Townsend chats with us about what he sees for Gold in the short-term and medium term. He discusses the technicals and some possible driving forces.

Podcast: Mickey Fulp's Views on Oil & Currency Impact on Gold Miners

Mickey discusses his views on the currency correlations and the impact on miners as well as Oil's decline. He also discusses this new industry metric of "all-in sustaining cash costs." Below the audio file I share links to a 3-part series in which Mickey discusses the real cost of Gold mining (video).

Precious Metals Video Market Update

This video recorded Monday examines the potential medium to intermediate term technical outlook for gold stocks.

Market Anthropology: Looking Towards the Ides of March

Erik Swarts is anticipating a positive reversal in the Euro, Gold, Oil, etc.

Tiho's Latest: Fund Managers Very Bullish & Breadth, Volatility & Volume

Gary Tanashian's Take on Gold's COT

Premium Snippets

Gold stocks were able to hold support and rebound. Both the top 40 index and GDX were up +4% on the week. Not bad. The miners remain in a tight range. If they can continue to hold support then they may gradually push higher and start a new leg higher. Otherwise they may fall back into that major double bottom scenario we've been discussing. I'm not sure either way but the worst for the miners appears to be

over. Its definitely over for the strongest companies. With a crash in Oil and major weakness in foreign currencies, there are fundamental reasons why gold stocks should outperform Gold or at least perform better. That wasn't the case until the very end of 2014.

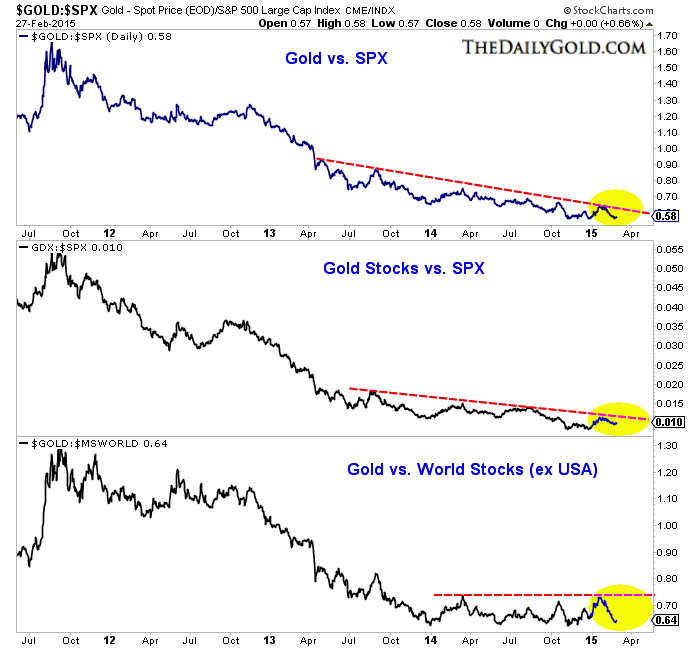

One thing to keep a keen eye on is precious metals against the stock market. In the chart below we plot the various relationships.

Can Gold & gold stocks break the downtrends? Can Gold breakout against global equities? I think these breaks (in favor of Gold) are coming sometime this year but who knows when? I don't think it happens this spring but you never know.

There have been some positive developments for Gold and gold stocks. Fundamentals for the companies are legitimately improving. On a very sharp US$ rally, Gold rallied to $1300 instead of falling to $1000. However, I keep coming back to the precious metals versus stock market relationship. The negative correlation has been obvious. This has happened a handful of times in history dating back to the mid

1930s. The negative correlation has remained in place but the performance has flipped. Once this turns in favor of precious metals look out!

We update our company reports a few times per year and with quarterly reports coming out we've started our updates. In TDG #401 we included two reports. One is a company that is performing really well. Its a producer that has valuation upside and some growth potential. It's getting a double benefit. Our second company is a development company that has underperformed and we speculated as to why it has

underperformed. However, we remain very optimistic on it long-term. I think it is primed for a huge 2016 and I love its management team. They know how to build, grow and sell.

Right now we are managing two portfolios and subscribers get all the details of our holdings, buys/sells etc. Now is a great time to consider a subscription as we will have new and updated reports coming over the next two months. We also are working on E-Book for subscribers. Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts who is the editor of a service. Secondly, we are one of only a few people who run a real money

portfolio. That means our goals are 100% aligned with our subscribers.

Subscribers in recent weeks commented:

Mr. J Roy-Byrne,

I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|