|

Here are some links with important information & analysis….

Short-Term Bounce but Danger Looming

The PM sector is oversold and may have begun a bounce. However, there is potential danger following that bounce.

Video: Precious Metals Market Update

Video update, recorded Tuesday night.

Tiho Brkan: Precious Metals Update

Tiho's latest on PMs. Its a long post containing several charts.

Palisade Radio: A Look at How Mining Titans Play the Downturn

Collin Kettell interviews Tommy Humphries who discusses how mining titans such as Lundin, Beatty, Guistra are playing the downturn.

Global Finance Faces $9T Stress Test as US$ Soars

There is $9Trillion of US$ Denominated Debt Worldwide. The burden of the debt is increasing as the US$ soars.

Premium Snippets

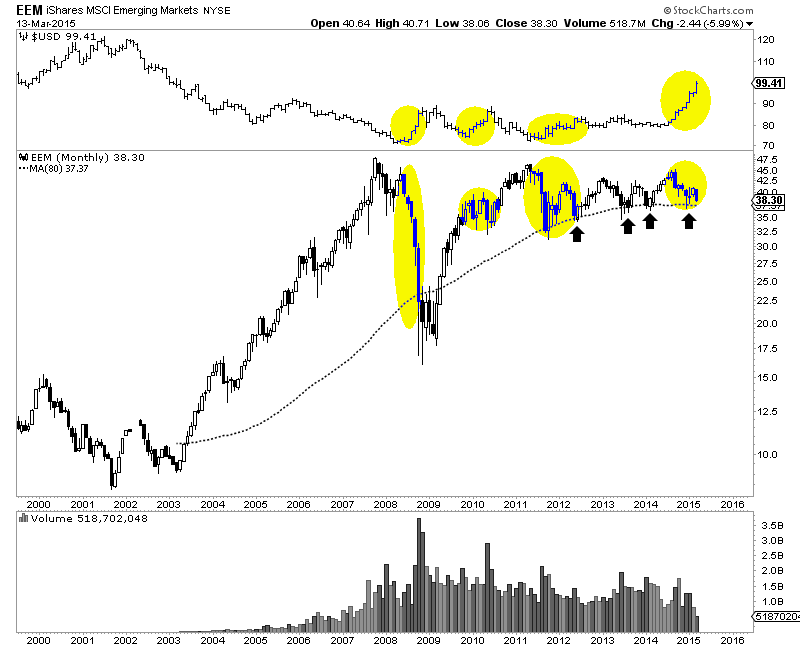

The surging US$ could be considered a black swan, though I'm not a fan of the concept. With so much US$ denominated debt in the emerging world, there could be major fallout. A rising US$ is generally not good for emerging markets. This large and fast of a rise should create some problems in the capital markets of various emerging markets. Below is a monthly chart of EEM. It appears quite close to breaking

its 80-month MA which has provided important support in the past few years.

Keep an eye on EEM as well as Emerging Market bond ETFs such as EMB which also looks bearish.

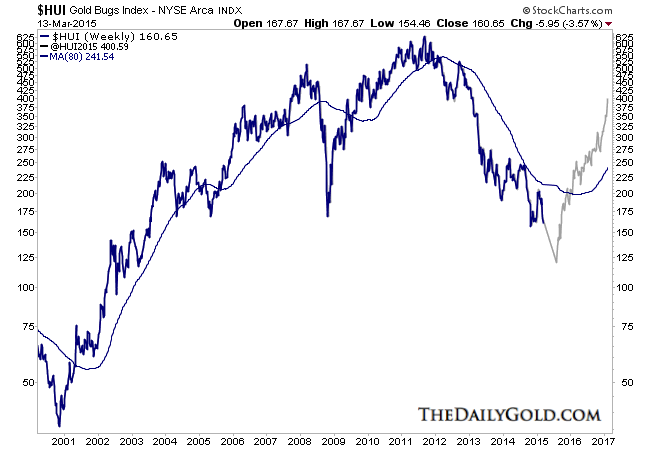

Moving back to precious metals, here is a chart we constructed for a recent premium update. This shows the average recovery of the HUI from its 2000 and 2008 bottoms applied to a weekly closing low of 120 in August. That would a be a 25% decline from here. But the HUI's daily low in that case would materially lower than 120.

In TDG #404 we included a list of 14 of our favorite companies and included their current market capitalizations and cash positions. Its clear to me who the best junior producers are and which companies have the best deposits and therefore are the best takeover targets. This final phase of the bear could create substantial value in a number of companies. We are going to produce/update reports on these

companies in the weeks ahead.

Subscribers in recent weeks commented on our work:

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|