|

Here are some links worth your time….

Gold Sentiment Not Bearish Enough

Here is my latest article. I penned this before the COT came out showing Gold's net position at 13%. Still, the three best bear market rebounds occurred at levels of 10% and twice below 10%. If you believe Gold is still in a bear market and going to $1000 then sentiment has room to get worse.

Commodity Crash Points to a Bottom

A post from Tiho Brkan.

FOMC Decision

Tiho's latest post which covers the US$ and inflation expectations.

Ignore Per Ounce Valuation of Gold Companies

Post from Steve Saville, one of the best gold bug analysts in my opinion.

Debunking the London Gold Bias Manipulation Story

Another great post from Steve Saville.

Premium Snippets

Precious Metals are rebounding, as we predicted last week and we predicted the night before the Fed meeting. Miners and metals were trading slightly above important support and were oversold. Gold was down 11 of the past 12 days. A bounce was likely.

Is this only a bounce or something more? I don't know but here are a few charts I will be following..

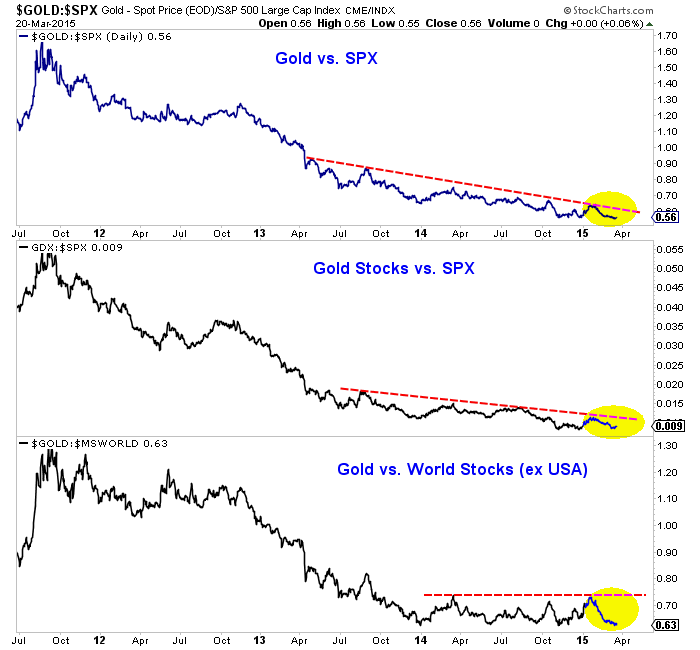

First, we have precious metals against stocks. Gold/S&P 500, Gold Stocks/S&P 500 and Gold/Global Stocks...

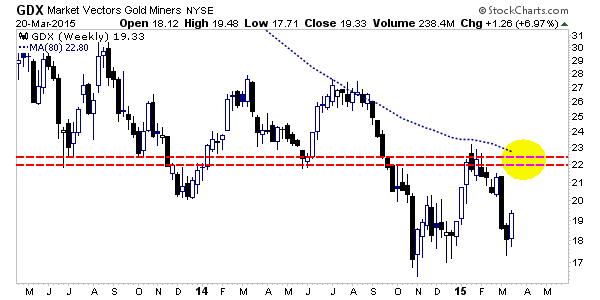

Next, and we could do this for the HUI, GDXJ, etc. This is a weekly candle chart of GDX with its 80-week moving average (the weekly equivalent to my favorite, 400-day MA). GDX could face a confluence of support around $22. Will it make it past $21?

Simply put, the action in these charts will give us additional information as to the trend in the weeks and months ahead. It will help us determine if this rally peters out quickly or if Gold and gold stocks might have some staying power.

For me, the Gold vs. Stock Market remains paramount. We've seen a lot of positive developments that signal we are near the end of the bear market. Gold has bottomed against foreign currencies. Its showing strength there. Its also showing strength against Oil. These are huge positives for miners in certain jurisdictions. The US$ is strong and could continue to go higher. That's a problem. But the lack of strength against stocks

is a bigger issue for Gold. It needs to overcome that before it gets back into a bull market.

Additional thing to watch, if the Euro rebounds, watch how Gold/Euro performs.

Subscribers in recent weeks commented on our work:

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

In the next two months we will be coming out with a new Top 10 Companies report as well as our first book (free for subscribers) which will publish all of our research and analysis on precious metals.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|