|

Here are some links worth your time….

Support & Resistance Levels for Precious Metals

In this article I focus on the key support/resistance levels in Gold, Silver and gold miners.

Interview with WallStreetWindow

Recorded on Tuesday, I provide my latest thoughts on precious metals to friend Mike Swanson and his audience. One of my best interviews, in my opinion.

Podcast: TheDailyGold Podcast Weekend Edition

Our goal is to produce a weekend podcast with 2-3 interviews covering Precious Metals as well as global capital markets. Click the link above to listen to the 1 hour show. We have 3 interviews in this file, (Erik Townsend, John Kaiser, Dave Skarica) that start at roughly 3, 26 and 50 minutes. The interviews ran a bit longer than I intended. I'd like to keep future shows under 60

minutes.

Podcast: Balmoral Resources Update

Check out our interview with Balmoral CEO Darin Wagner. He updates us on the company's progress and also mentions his criteria for investing his own money in juniors.

Old School Currency Parables

The latest from Market Anthropology. Erik Swarts is a very sharp analyst. I don't always agree with him but he's definitely worth following.

Premium Snippets

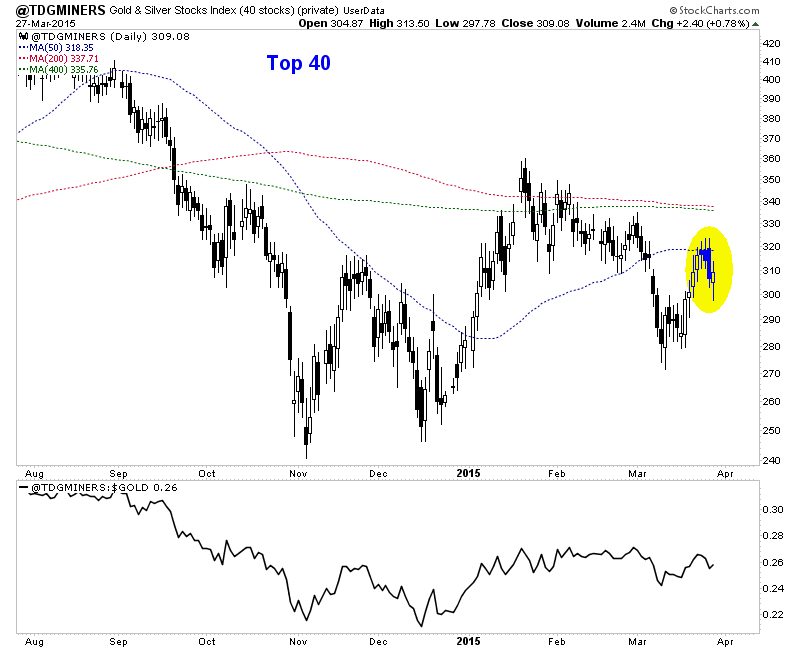

Below is a chart of our Top 40 index. It shows the daily candle plot along with the 50,200 and 400-day moving averages. A ratio of the Top 40 index vs. Gold is at the bottom.

For this market to breakout and become very bullish it first needs to reclaim the 50-dma and then close above 335-340 where the 200 & 400-dma's are. Note how the Top 40 index rallied up to the 50-dma and failed to push above it! This is a bearish looking chart unless the index can move above 320.

Over the past 2 years the Top40/Gold ratio has reliably bottomed around 0.225. There is some support there. A Gold price of $1050/oz with that ratio equates to a 24% decline in the index.

If Gold's double bottom fails to hold then the bear will have one last, but big growl.

Subscribers in recent weeks commented on our work:

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

In the next two months we will be coming out with a new Top 10 Companies report as well as our first book (free for subscribers) which will publish all of our research and analysis on precious metals.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|