|

Here are some links with important information & analysis….

Gold now Waiting on US$ Top

Gold/FC is correcting its latest surge as Euro & Japanese capital flows into their equities and not Gold. Precious metals are being driven lower by the surging US$. We covered this in our premium service in more detail. Note the similarities in currencies, Gold, & Gold/FC between 2014-2015 and 1999-2001.

Podcast: Dan Norcini Comments on PM's & Currencies

Dan Norcini is a professional trader, a real trader. He's more focused on near-term events but he gives great insight on a number of topics in this interview. This is 30 minutes but great information whether you are an investor or trader.

Precious Metals Video Market Update

We take a look at equities, currencies and gold stocks and why the asset classes could be nearing turning points in the months ahead.

Gold COT: Specs in a World of Hurt

Dan Norcini's Take on the COT.

Dave Skarica Interview on Palisade Radio

Dave discusses how to make money shorting the market and Japanese bonds and his outlook for the gold stocks.

Tiho Brkan: March Economic Update

Premium Snippets

The market is seriously challenging my statement that the worst may be over for miners. Every time I get that inclination, the bear growls. For the best companies the worst is over. I'm confident of that. Fundamentals for miners have improved but we can't ignore the price action. The bears have reasserted control again and extreme caution is warranted. I think the gold stocks and Silver have a chance to

bottom before Gold. But they nor even the strongest miners would be immune to Gold plunging to a final bottom.

Below is a chart of the top 40 index which would have to decline 18% to test its daily low. That figure is 11% for GDX & HUI. The top 40 index had wrestled with its 80-week moving average (yellow) every week for nearly two months. Last week's decisive break and 8.7% decline augurs badly for the miners in the weeks ahead.

Below is a weekly line chart of Gold and we also plot its 12-week rate of change indicator. The price action is negative as Gold is threatening a break below the red line. If that happens, an accelerated breakdown could take place to the next strong support at $1080 and down to $1000. The two lows (yellow) on the ROC indicator compare favorably with the worst lows in Gold's history (ex 1980). If Gold

declined below $1080 within the next 6-7 weeks then its ROC would reach 20%.

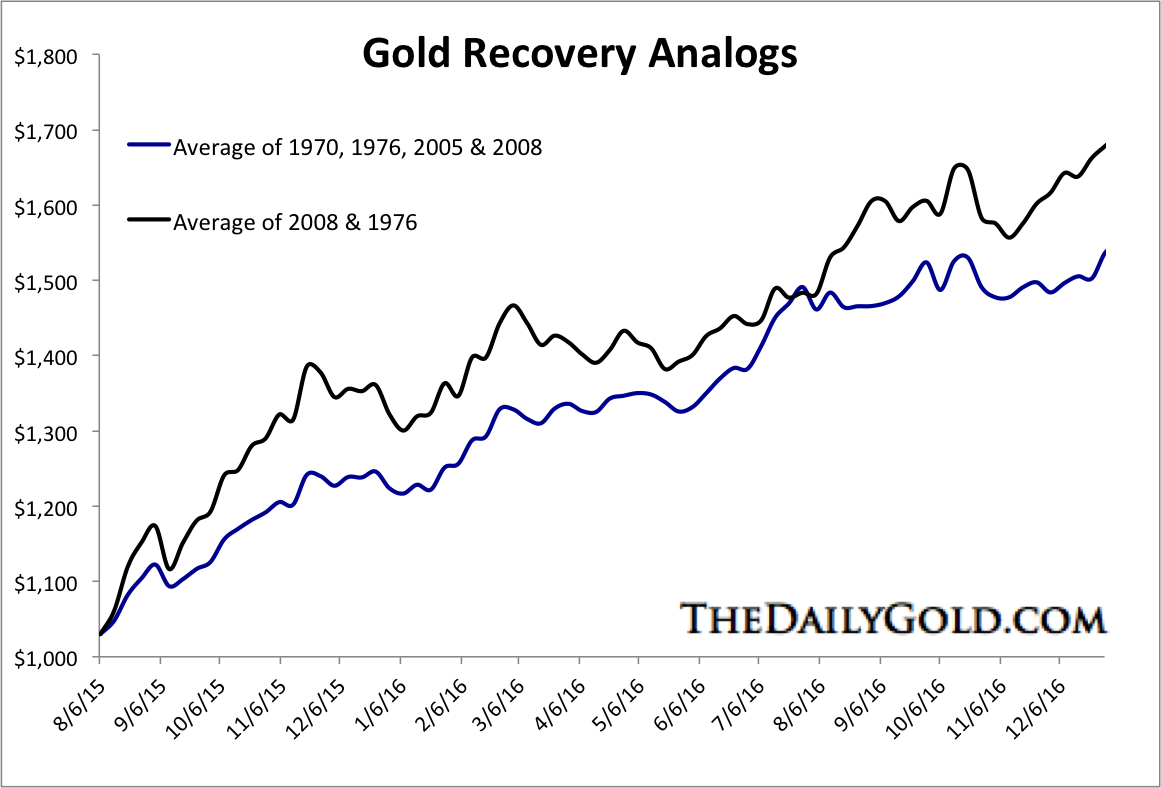

This isn't a prediction. Consider it a projection based on history. We consider a weekly low of $1030 Gold in August. If Gold had an average bull market recovery, how would it play out? If Gold does break below $1100 then I think it would be more likely to have a recovery like 2008 & 1976 (black).

Right now we are managing two portfolios and subscribers get all the details of our holdings, buys/sells etc. Now is a great time to consider a subscription as we will have new and updated reports coming over the next two months. We also are working on E-Book for subscribers. Consider a subscription to our premium service as I believe we have one of the best services available. We are one of the only credentialed technical analysts who is the editor of a service. Secondly, we are one of only a few people who run a real money

portfolio. That means our goals are 100% aligned with our subscribers.

Subscribers in recent weeks commented:

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice.

Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|