|

Here are some links worth your time...

Podcast: TheDailyGold Podcast #3

This week we have only one guest. David Morgan, publisher of The Morgan Report discusses the current situation in the precious metals complex and some big picture and historical thoughts on precious metals and Silver especially.

Intriguing Dynamics b/w Euro:USD, Bunds & Oil

The latest from Erik Swarts. Take note of the chart that shows how the US$ has performed before and after its first rate hike.

The Problematic Comparison w/ the 1970s

Steve Saville, one of my favorite commentators looks at the problem with comparing Gold's secular bull market today with that of the 1970s.

Chart of the Day: PM Bear Market

Chart & Thoughts from Tiho Brkan

Balmoral Resource Extends Grasset Discovery by 20%

Drill results expand Balmoral's Nickel-Copper-PGM discovery

Marc Faber Interview with Kitco

Premium Snippets

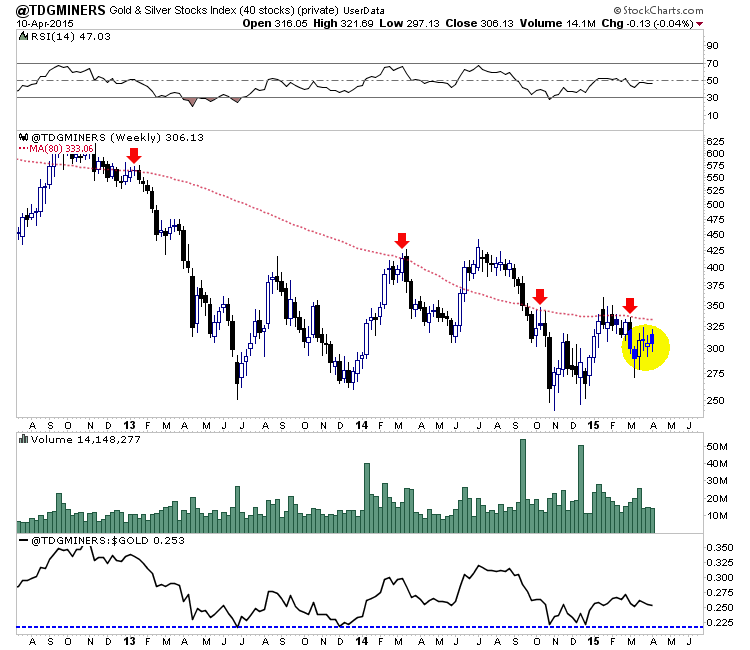

Below is a weekly candle chart of our Top 40 Index. It did not have as strong as a week as GDX, GDXJ, HUI, etc and that could be a signal of short covering in the main indices and larger stocks. The top 40 index closed at 306. Its 80-wma is at 333. Again, the index needs to make a weekly close above the 330-335 level to start to turn bullish. A down week this upcoming week would be bearish as it would render the recent weeks a bearish

flag.

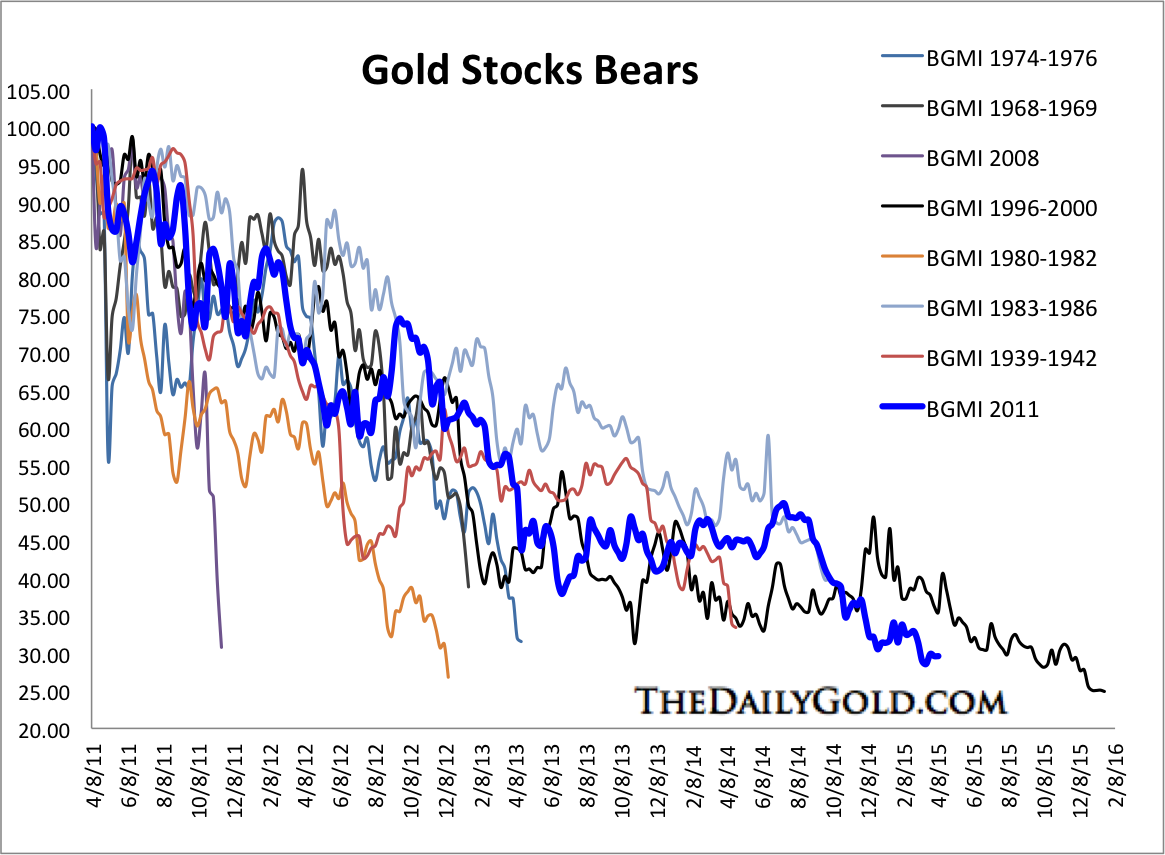

Sticking with the stocks, here is the updated bear analog chart. If I apply the "final decline" of the 1996-2000 bear to the current bear, then the current bear would end at the very end of July.

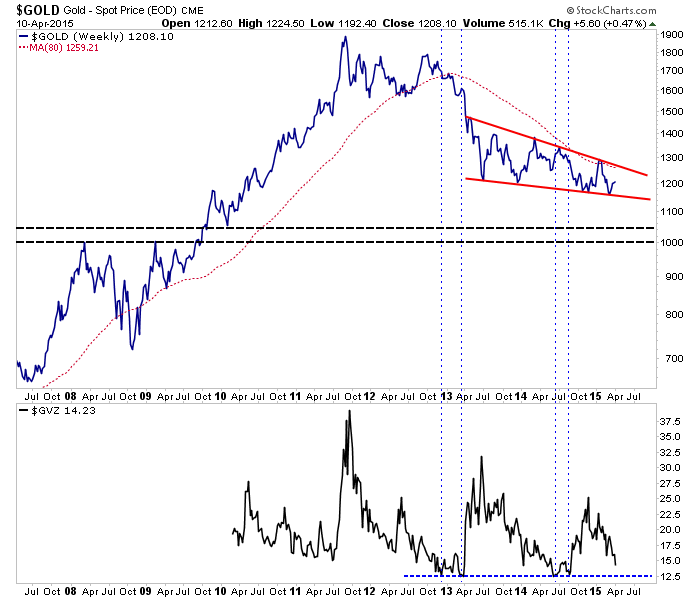

Here is a look at Gold with its volatility index at the bottom of the chart. That has declined from 25 to 14. Very low volatility often leads to sudden, large moves. It appears that Gold could reach very low volatility within the next few weeks.

Also of note is the COT remains elevated for Gold and Silver. The net speculative positions are too high at this stage. It would be one thing if the COTs were high and Gold was trading above $1300 or even above $1250. Gold has barely been able to remain at $1220 and yet a decent amount of speculative longs remain. The net position is at 29% of open interest. Over the past two years important lows occurred at 6% twice and

10%.

Given the declining and low volatility, traders and investors should be on alert for a big move…not so much immediately but beyond the next few weeks. Think May or June. That move could be a breakdown below $1150 or it could be an advance above $1250 and that key resistance we discussed last week.

I wish I could share some new and great insight with you but that is the situation. We are seeing declining volatility in the miners and the metals. Bulls and bears are getting frustrated but perhaps it leads to a resolution as far as the end of the bear market. Will we see that final breakdown that would likely lead to a V type bottom (after a bad break) or will we see precious metals continue to hold support and slowly grind

higher?

Subscribers in recent weeks commented on our work:

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

In the next two months we will be coming out with a new Top 10 Companies report as well as our first book (free for subscribers) which will publish all of our research and analysis on precious metals.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|