|

Here are some links worth your time...

Podcast: TheDailyGold Weekend Podcast #2

Greg Weldon & new guest Jesse Felder cover quite a bit in these two interviews. Greg focuses on Fed policy, precious metals and currencies while Jesse opines on US equities, bonds and Gold.

Precious Metals Video Market Outlook

This video was recored on Tuesday.

Tiho Brkan: Junior Miners to Rally?

Tiho opines on GDXJ.

Tiho Brkan: A closer look at Emerging Markets

Great post from Tiho that includes quite a few charts. Really good stuff!

Market Anthropology on China

The latest from Erik Swarts. He has been a bull on China and he's been right on.

Premium Snippets

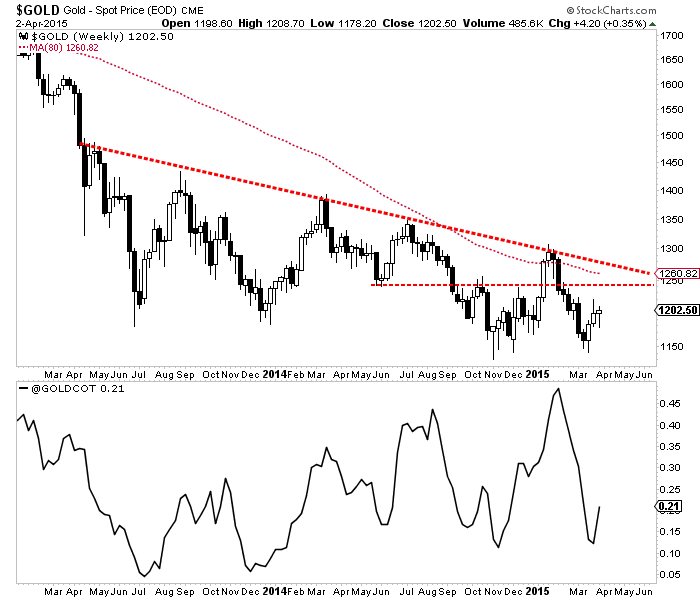

Gold closed at $1202 and figures to test $1220 on the back of the poor jobs report. Note the significant confluence of resistance that is approaching $1250. Gold would need to takeout the January high for full confirmation of a new bull trend but $1250 will be the most important stop along the way. Two trendlines are converging there as will the 80-week moving average in the weeks ahead. If Gold is trading above $1250 after June then I

have to think the bottom could be in. Another scenario is Gold could rally up to $1240-$1250 and turn down again.

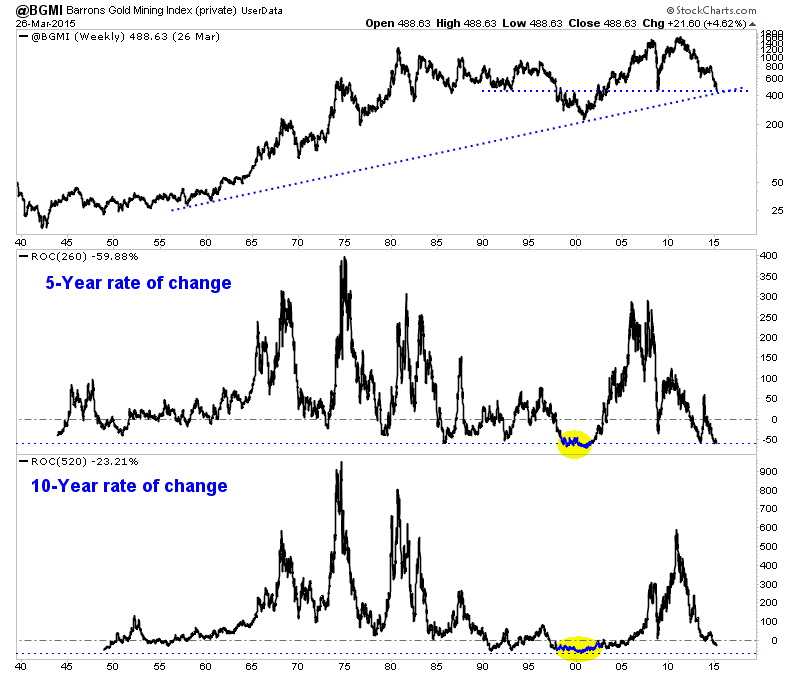

The Barron's Gold Mining Index, chart below is trading around essentially 55-year trendline support. The trendline connects what were probably the two greatest buying opportunities for gold stocks in history. I believe the 2015 low may become the 3rd most significant bottom, behind those two.

Greg Weldon said it in our interview. (He's been at this for 31 years and is very highly regarded). He is unsure of the near-term future. Will this disinflation turn into higher inflation or will it turn into deflation that forces something new from central banks. And even in that scenario we are unsure of how precious metals perform. All the recent talk has been about deflation and a strong US$ yet precious metals have not

made new lows.

Of course, the future is always uncertain. We can use probabilities based on facts to decipher the likelihood of potential outcomes. The precious metals bear market is likely nearing its end but we do not know how it will end. Maybe the metals will grind out a bottom. That could mean they have already bottomed. In that case we will not know it until Gold takes out its

January highs and the miners take out their 80-week moving average. And until that happens, the scenario of a break below $1100 remains possible. Every time I've been convinced of a big break lower to $1080, Gold has failed to come close to that.

In any likely scenario it seems that miners are unlikely to run away immediately and therefore would give us a buying opportunity in the summer. Will it come from below $1100 or at a higher price as the sector grinds out a bottom? If you have a crystal ball, please send it my way!

Right now, there is a clear top 10 or 12 that fits my criteria that I'm very confident will perform quite well in the quarters and years ahead. There are also other companies with fundamentals that are not quite as good but those could really outperform once the market believes Gold is in a new bull market.

In Saturday's update I wrote an intro report on a company that I reintroduced to subscribers. I noted the risk in this company but because the stock price is near a low, the risk is low. A few years ago it was much higher. If I gave more hints you could figure it out. Its a top notch company that is discounted quite a bit and has significant long-term potential.

One of our other favorite companies corrected 30% and held important support. There certainly is downside if Gold breaks support but I hope to buy it this week, off its high, instead of waiting and hoping. There is another company we recently started following which has corrected 20%. I noted that if it corrects some more than that is one we'd like to start a small position in.

Subscribers in recent weeks commented on our work:

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

In the next two months we will be coming out with a new Top 10 Companies report as well as our first book (free for subscribers) which will publish all of our research and analysis on precious metals.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|