|

Here are some links I believe are worth your time...

More Evidence Gold Stocks Have Bottomed Relative to Gold

Our latest editorial. The gold stocks are showing increasing relative strength.

My Interview with Kitco

In this video with Kitco we comment on GDX, provide a few companies we like and also comment on the one area in mining that we are avoiding.

Potential for Correction Exists

The latest post from Tiho Brkan. Great information in this post.

New Highs = Last Hurrah?

Cam Hui's blog. Excellent post with numerous charts.

Jim Rogers Kitco Interview

No one has been dead on during this bear like Jim Rogers. He thinks the opportunity to buy Gold has not come yet.

Premium Snippets

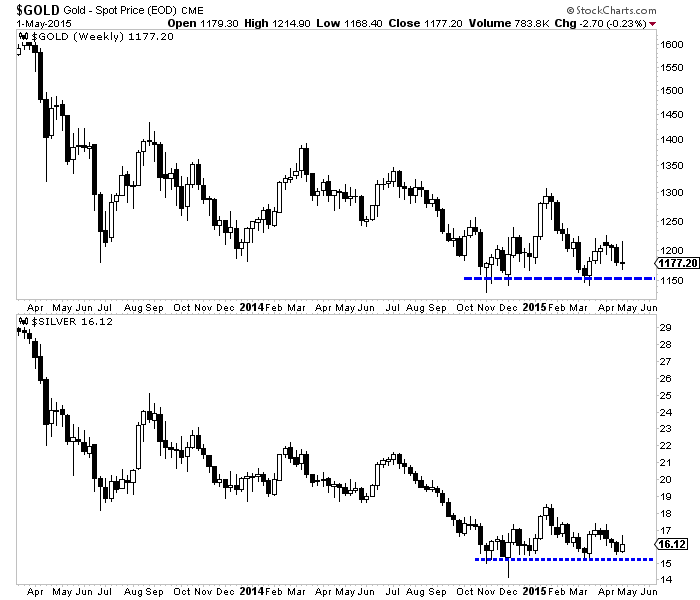

Gold rebounded above $1200 at the start of the week but ultimately reversed and again closed below $1180. Silver was higher but closed well off the highs of the week. Will the metals rebound from support or will they break to new lows?

Even though metals seem to be on the cusp of that final breakdown, the miners have held up. Last week was particularly encouraging as Gold fell back below $1200 and closed Friday below $1180. Despite that, miners finished the week up 4-5% and were up Friday when Gold fell below $1180.

The weekly candle chart of the top 40 index is below. The index closed at 313. A weekly close above 335 could be a signal that a new bull market is underway. A break lower to multi-year support around 260 could mark a final low (especially if it occurs with Gold trading below $1100).

As I wrote last week the miners could be waiting on the metals to bottom. They appear to be leading the metals so it is possible that they could begin to rebound even before Gold makes a final bottom.

I put some cash to work this week and also hope to put more cash to work after Gold breaks below $1150....if it does that.

This week's update TDG #411 was 29 pages and included a company report as well as comments on a few other companies. We are starting to see a lot more value in the market. We covered a junior producer that has a stronger cash position and should grow its production in 2016. It should perform really well after Gold bottoms. The company has an enterprise value below $200M and is the type of company that you would think could

be a +$1 Billion company in the future.

We covered another company that we were stopped out on a few months ago. Its now trading very close to major long-term support and is probably at its best value given what it has now compared to previous years.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports and our book, "The Coming Renewal of Gold's Secular Bull Market". You pay money up front but you get everything up front, plus everything we send over the next six months.

(Side note- our book should be available next week on Amazon Kindle and we are going to send out a free sample chapter for you).

With the book done, we will focus on updating the company reports of our 15 favorite stocks. The weeks ahead figure to be a great time to do that as we could be seeing epic buying opportunities in the months ahead!

Subscribers in recent weeks commented on our work:

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|