|

Here are some links worth your time...

Which Way will PMs Break?

This is our latest editorial, the first one we've written since early April. We discuss potential scenarios.

This Chart Suggests a Bear Market May be Lurking

This is from Jesse Felder, who we interviewed a few weeks ago.

Chart of the Day: Commodity Crash

Brief but succinct thoughts on commodities from Tiho Brkan.

Poor Gold Stock Performance is mostly due to….

Steve Saville opines on poor gold stock performance in the shares and poor business performance by the companies.

Palisade Radio: Rick Rule Interview

This interview was just published. I've listened to the first 10 minutes and I'd say it is worth your time to listen.

Premium Snippets

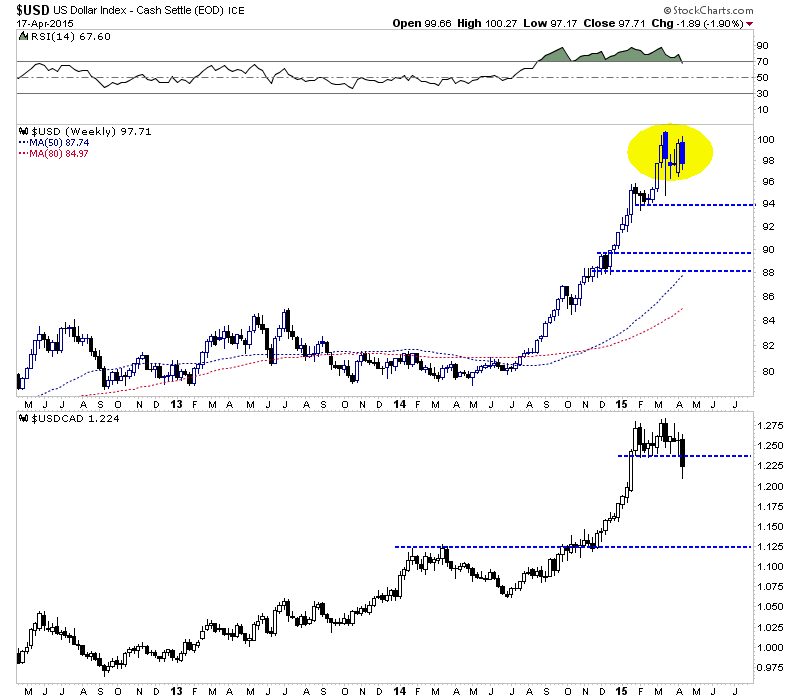

One change to keep an eye on is the currency market. The US$ index has put in two strong bearish candlesticks in recent weeks near 100. The bearish candles and failure to take 100 (especially after a near parabolic move) augurs badly for the near term. The US$ closed below 98 and should test 94 in the not too distant future.

The US$/CAD$ pair has broken below support and closed at 1.22. I could see it falling to 1.12 in the months ahead.

The implications are obviously favorable for US accounts which should see some relief in their miner positions. But, it is negative for Canadian accounts.

Gold has been very strong against foreign currencies. It will get a boost from a correcting US$ but if it is not strong in real terms then the US$ Gold price will not rise as much as one would expect. Miners were up last week but only in US$ terms. The Canadian miner ETFs were down. That tells us movement was 100% currency related.

Last week we included an updated bear analog for the gold stocks. It obviously makes a strong case that the bear market in gold stocks may not have much left…even if it is still going.

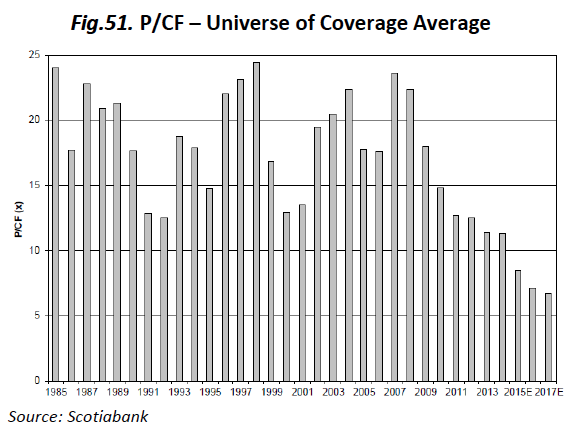

Below is a chart from Scotiabank that shows the price to cash flow ratio of the gold stocks they cover and have covered since 1985. The 2014 data point was the lowest since at least 1985. That is a 30-year low!

The last chart on this page shows the (senior) gold miners recently trading at ~5x cash flow. I have collected various charts and believe this is the lowest since at least 1990. In 1975 and 1980 the gold stocks traded at 22x and 21x cash flow. In 2007 they appeared to hit 23x cash

flow.

Regardless of if the gold stocks can extend this base and trend higher or bottom after a major break below $1150 in Gold, the odds are strong that a new bull market could take hold in the months ahead. Whether that is imminent, a few months away or in October…no one knows.

I am just about done with my book and I gave subscribers some of the details in this weekend's premium update. I hope to send it to subscribers by the end of next week and after that it will be published and available for sale. Simply put, the book is a culmination of my research and analysis over the last few years. It contains many charts and should be a fast read. I try to keep things as simple as possible yet impart as much

knowledge as I can.

With the book just about completed, I plan on writing/updating as much as 15 company reports in the weeks ahead.

This is a great time to subscribe as you will get the book next week and get updated company reports after that.

Subscribers in recent weeks commented on our work:

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports (including our book when completed) and updates. You also can ask us questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|