|

Here are the links of the week for you....

Are Precious Metals Breaking out?

My editorial penned Friday. I take a look at Gold, Silver as well as GDX and GDXJ.

The Gold Sector: Close but No Cigar Yet

Comments on the PM sector from Steve Saville, one of my favorites.

Gold Miners Test the 200-dma

Tiho Brkan's latest thoughts on the gold miners.

Can Europe Save China & Vice Versa?

The latest from Market Anthropology. Great thoughts as usual.

Worry About the Divergence between Transports & Industrials?

A few very interesting charts. It is a strong warning signal for the stock market but that isn't necessarily an imminent warning.

Premium Snippets

For those who missed it, click the link below to download a free sample of my book. Subscribers get the book for free and get an excellent, clean PDF file.

Moving on, to answer the question, I conclude no or at least not yet. GDX has about 8% upside to that strong confluence of resistance while GDXJ has a bit more upside. Gold has a confluence of resistance around $1250. For a real breakout in the sector, GDX needs to surpass its 80-week moving average and Gold needs to takeout $1250 convincingly.

In other words, whether its nominal or ratio charts, precious metals need to take out their January highs.

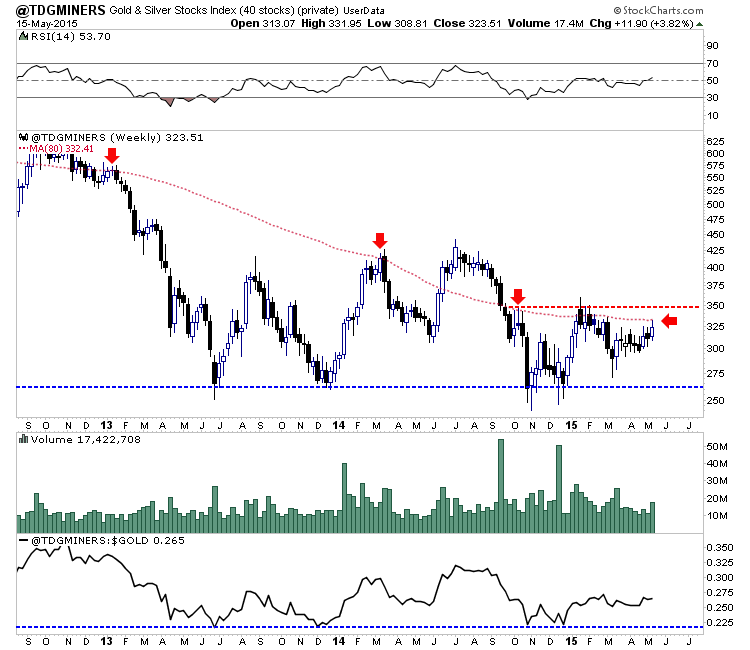

Below is a weekly chart of our top 40 index which was up 3.8% last week. It tested its 80-wma and backed off a bit. I could see it rising to 350, which is an 8% gain. If the sector is going to make a real breakout then this index would make a strong weekly close above 350. A weekly close above 330-335 would certainly be bullish but perhaps not beyond the short-term. 350 looks like the key.

Currencies are playing an important role. While Gold/FC put in a strong week, this move is being driven by US$ weakness. We plot the US$ and the Euro. The US$ closed at 93 and has a confluence of support around 90. The Euro closed at 114.6 and has a confluence of resistance around 120.

The US$ has more downside ahead and that would support more near term gains. Yet the US$ will run into strong support (~90) and the Euro will run into major resistance (~120) at somepoint soon. Be wary of that before you get bulled up.

Things are aligned for more short-term gains in the sector but the sector will have to prove itself before we think the gains are immediately sustainable.

In TDG #413, a 27 page update, we provided an updated company report on a junior producer which contained potential price targets for 12-18 months and beyond. We also covered recent developments in two of other holdings. In addition, we mused over the short-term outlook and potential summer outlook for the sector.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports and our book, "The Coming Renewal of Gold's Secular Bull Market". You pay money up front but you get everything up front, plus everything we send over the next six months.

With the book done, we will focus on updating the company reports of our 15 favorite stocks. The weeks ahead figure to be a great time to do that as we believe the months ahead could be the last chance to buy many stocks cheaply.

Subscribers in recent weeks commented on our work:

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. You also can ask us questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity in 2015!

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|