|

Here are my favorite links for this past week....

Gold: Still Waiting…

We are still waiting on Gold to make a final breakdown. That would give us visibility to the end of the bear market, which means an imminent big recovery.

Precious Metals Video Update

Very similar to the above editorial. We focus on Gold only.

Dumb Money Piles Into Silver

The COTs are a problem for metals bulls & especially for Silver. During the recent push higher, speculators loaded up.

Currencies at Crossroads

Market Anthropology looks at the US$ and Yen and what it could mean for Japanese stocks and miners.

A Very Tired Bull

Great, long post by Cam Hui. He looks at where the economy is and where the stock market is.

Premium Snippets

Saturday's update (TDG #415) featured an updated report on a junior development company that has made a series of moves that has put it in position to be a +200K oz Au/yr producer in the years ahead.

We are including a company report with each weekly update and will continue to do this until we have 15-20 companies updated. I think Gold is going to begin its final breakdown in June or July which could setup the final opportunity to buy most of these companies on the cheap. Perhaps that opportunity comes in July or August.

The sector is bifurcated as some companies are strong and a few have broken out recently while others are flat or weak. Gold going below $1100-$1150 will create an opportunity and also the currency market could for US investors. If US$/CAD$ makes a new high then US prices of Canadian juniors will weaken.

Here are some charts I wanted to share.....

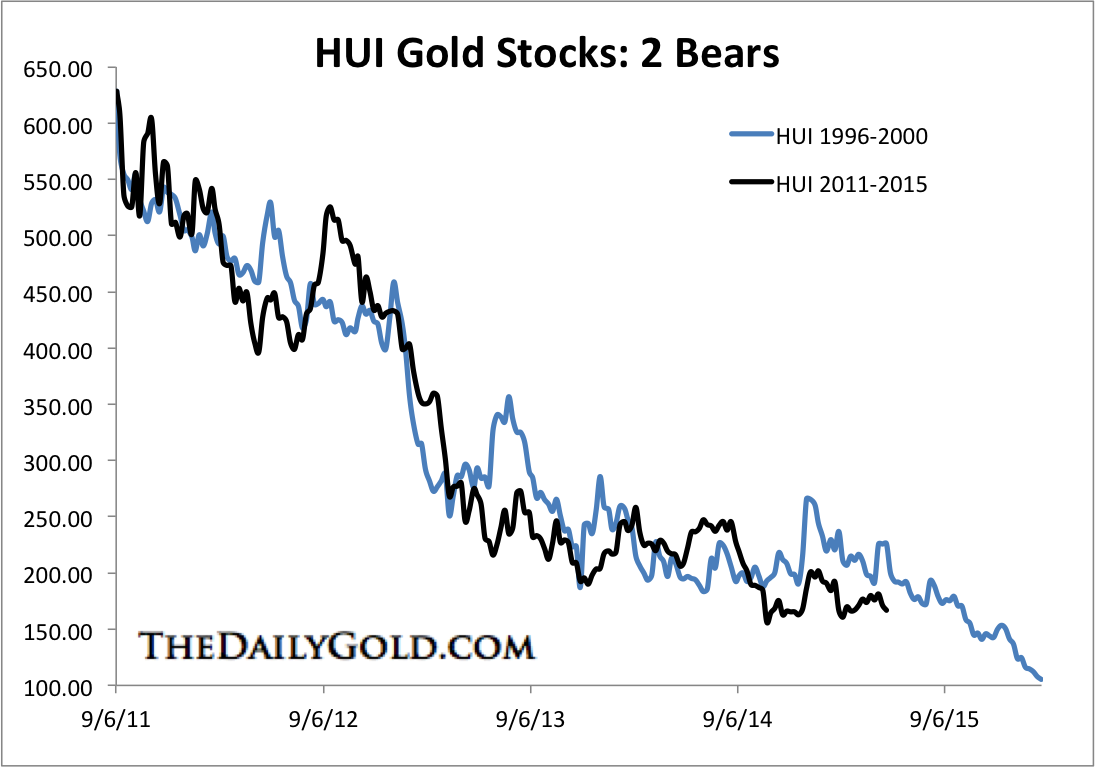

The first is an analog comparing the two bad bears in gold stocks via the HUI.

We will have a global macro update coming soon and the next two charts will be featured.

The next chart shows the intervals between 10% corrections in the S&P 500.

The next chart examines the occurrences of a decline in corporate profits with the S&P 500 trading at 2-year highs.

A 10%-20% decline in the stock market would definitely be bullish for the precious metals sector. Perhaps that coincides with a recovery in precious metals.

By the way, that HUI bears chart is scary but the bulls analog chart would make you feel better. Following the 2000 and 2008 bottoms the HUI gained 200% within 18 months. According to my research, juniors tend to return 200% in 12 months following major bottoms.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports and our book, "The Coming Renewal of Gold's Secular Bull Market". You pay money up front but you get everything up front, plus everything we send over the next six months.

Here is some unsolicited feedback from subscribers:

What's best about your service from my perspective and what you continue to deliver in EXCELLENT FORM is your recommendation of individual stocks within the junior sector along with your detailed and fairly comprehensive explanations for each of them. I think you do this as well as any of your peers

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|