|

Here are some links which I think you will find actionable...

Gold Miners Nearing Rebound

We penned this article Thursday night. We make the case for a rebound in the miners and the metals.

Interview: Mike Swanson Interviews us on Precious Metals

This interview was conducted on Tuesday. We share our thoughts on the metals, miners and stock market.

US Equities Could Reach Generational Buy After Next Bear Market

Great chart from Tiho Brkan which shows 17-year rolling return in S&P 500 back to the late 1800s.

Emerging Markets are Breaking Down & Global Breadth is Weak

Tiho Brkan shares two charts. Emerging Markets have broken down while few global indices are trading above their 200-dma.

Gold is Dead, Long Live Gold

This article is from Erik Swartz at Market Anthropology.

Premium Snippets

There are many charts we could share but here are four.

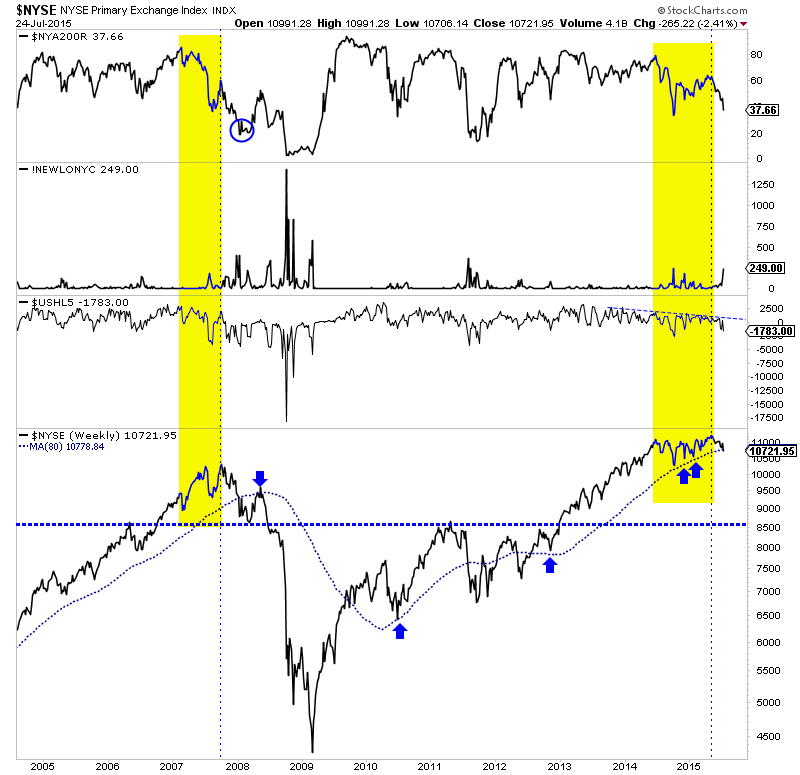

Below is the NYSE Composite which contains over 2000 stocks. The overall market has weak breadth so the NYSE is not as strong as the S&P 500. It gives us a wider look though. We plot a weekly chart with the 80-week moving average. From the top we include: % of stocks trading above the 200-dma, new 52-week lows and 5-dma of new highs less new lows.

Note how the bear began in late 2007 to early 2008. The percentage of stocks above the 200-dma (blue) fell to 20% a multi-year low. Then the next rebound failed at the 80-wma. The market actually closed below its 80-wma. Breadth has been diverging for many months but there is a chance the first real crack could come in the next few months. If the market cracks it definitely would be good for precious metals.

Here is an updated look at the Gold bears analog chart. Most of the other bears ended with steep declines. Now that Gold lost support at $1150, this bear market figures to end in a similar manner.

Here is a weekly look at Gold back to 2001. The lower plot is the net speculative position as a percentage of open interest. That is how we analyze the COT. The latest reading came in at 4.7%, which was slightly above the 2013 low of 4.4%. Nevertheless, the net speculative position is at its second lowest point in 14 years.

Gold held $1080/oz last week (after testing it for a few days) and Friday's powerful reversal suggests a rebound has begun. We are looking for the rebound to go back to $1140. After it runs its course Gold could begin its final leg down towards $1000/oz.

Meanwhile, the gold stocks are even more oversold than Gold. The updated bear analog chart included in our premium update shows this bear is now the worst bear ever. That is the case for every index (BGMI, GDX, XAU) except for the HUI which needs to touch 100 for that to happen.

Below we plot the BGMI going back to 1938. We also plot those oversold indicators on a 10 and 50 week basis. We highlight the points that are as, or more oversold than right now. There are only 6 in the past 75 years! Four of those six produced major cyclical advances. Given that the gold stocks have put in the worst bear market ever, they figure to be ready for a new bull market.

It appears the sector will rebound in the weeks ahead. Friday was likely the start. In TDG #423, our 29-page update sent Saturday, we noted potential rebound targets for Gold, Silver GDX and GDXJ. The only thing that concerns me about the miners is I still see strong potential for Gold to test $1000/oz. That could create another buying opportunity. Gold could rebound back to $1140-$1150/oz but the rebound could be a retest of the breakdown. Then we could get the final move down and bottom over the next few months.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +50 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get everything up front, plus everything we send over the next six months.

This is an important point as it appears that the bear market could end with a really loud bang in the months ahead. We will be using various technical indicators and sentiment indicators to assess developments and position our portfolio appropriately. Find out the stocks we are watching and planning to buy in the months ahead.

Here is some unsolicited feedback from readers and subscribers:

I consider you the best analyst out there

I read your book while on vacation I must confess I thought it was fantastic I especially enjoy the sections where you use previous actions in the precious metals to gauge where you think it may go to in the future I think it may be the best book ever written on the subject and I don't say that lightly as I am a brutally honest

individual.

What's best about your service from my perspective and what you continue to deliver in EXCELLENT FORM is your recommendation of individual stocks within the junior sector along with your detailed and fairly comprehensive explanations for each of them. I think you do this as well as any of your peers

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|