|

Here are some links which I think you will find actionable...

Gold- Rebound or Breakdown?

This article was penned Thursday so it was before Friday's reversal in the gold miners. Nevertheless, still quite relevant.

Video: Gold Struggling to Rebound

Video analysis of Gold from Wednesday.

How Cheap will Gold Miners Become?

Post from Tiho at ShortSideofLong

The Wizard of Odds for US$

The latest from Erik Swarts at Market Anthropology.

Credit- Mack the Knife

This is a high-level blog and this post is excellent with numerous actionable charts.

Premium Snippets

Starting on the macro side...

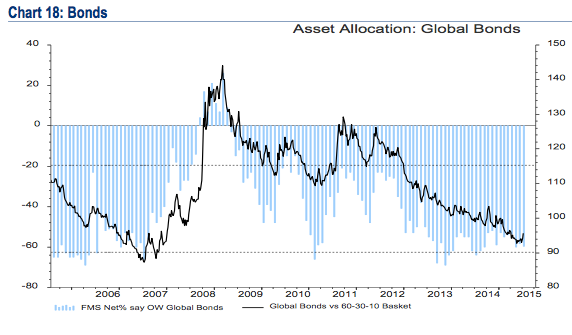

Below is a chart of Bonds which we featured a week ago and data from the Merrill Lynch fund managers survey. Urban Carmel at the Fat-Pitch Blog writes: Fund managers are -60% underweight bonds, almost 1 standard deviation below the long term mean. Bonds continue to be the most underweighted asset

class.

The other thing to note about Bonds is they recently held their 400-day moving average which is sloping higher.

As we wrote about in our book and often mention, Gold is driven by negative real yields or falling real yields and little else. For Gold to get back into a bull market then either inflation has to rise faster than yields or yields need to decline faster than inflation.

The chart below highlights the three bad bear bear markets in Gold along with the real fed funds rate and the real 5-year yield. Note how real yields increased in every instance. Also consider how ridiculous the comparisons are with the early 1980s. In the first four years after Gold peaked real rates increased almost 14%! Over the past 4 years the fed funds rate has only increased about 4% while the real yield on the 5-year increased

by about 5%. That is not how a secular bull market ends.

The next chart will be in the updated version of my book. This shows the Barron's Gold Mining Index against the S&P 500. It is just about the cheapest ever. Gold stocks are the cheapest ever against Gold, S&P 500 and likely so against cash flow and other metrics.

As I see things, and this is only a guess (and it goes back to my video and article) precious metals could rebound and then decline to a final low or they could breakdown in the days ahead and crash to a final low. In that scenario we could see an end to the bear market sooner than most expect. Even non gold bugs have been thinking Gold would bounce. A failed bounce could lean to a final selloff which would produce an even greater

rebound. Say, something like a rebound from $1000 to $1150-$1180.

In TDG #425 (30 page update) we charted most of our favorite top-tier juniors and also provided comments on a handful of companies outside of the top tier. Those types could be very volatile in the weeks and months ahead. We also provided comments on a junior producer that looks incredibly cheap, operates in a good jurisdiction and has some big names on its board.

Whether the bottom comes soon or in a few months, now is the time to ready your list. That is what we are doing.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +50 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get everything up front, plus everything we send over the next six months.

This is an important point as it appears that the bear market could end with a really loud bang in the months ahead. We will be using various technical indicators and sentiment indicators to assess developments and position our portfolio appropriately. Find out the stocks we are watching and planning to buy in the months ahead.

Here is some unsolicited feedback from readers and subscribers:

I consider you the best analyst out there

I read your book while on vacation I must confess I thought it was fantastic I especially enjoy the sections where you use previous actions in the precious metals to gauge where you think it may go to in the future I think it may be the best book ever written on the subject and I don't say that lightly as I am a brutally honest

individual.

What's best about your service from my perspective and what you continue to deliver in EXCELLENT FORM is your recommendation of individual stocks within the junior sector along with your detailed and fairly comprehensive explanations for each of them. I think you do this as well as any of your peers

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|