|

Here are some links which I think you will find actionable...

Video: What's Next for Gold, Miners and US Equities?

Recorded after Monday. Still very relevant. We hold the same views today.

Emerging Markets Underperforming but not yet Oversold

Good, brief post from Tiho.

Rick Rule Interview w/ Palisade Radio

There is some actionable information in this interview. The link takes you to the interview and some questions that Rick answers. He believes a "rate hike failure" will trigger a big rally in Gold.

Fat Pitch Blog- Current Setup in Gold

Urban Carmel is a great analyst of markets & economic data. Definitely worth following.

Credit Spread Update

This is a good economic blog with good charts. Also worth following. We can see that the energy crash is spreading a tiny bit so far, to the high yield market.

Premium Snippets

We were on vacation last week so our weekly premium update (TDG #424) was shorter. Nevertheless, we have a few things to share.

First, recall the chart that we included last week which showed Gold and its net speculative position going back 15 years. Last week, Gold's spec position (as a percentage of open interest) was at its second lowest mark in 14 years. Well Friday's data showed that the position was down to 3.5% which is the lowest in 14 years. That is the kind of extreme bearish sentiment that was lacking in recent weeks and months. Silver's

net position was ~6%. That needs to go below 3% to reach its 14 year low.

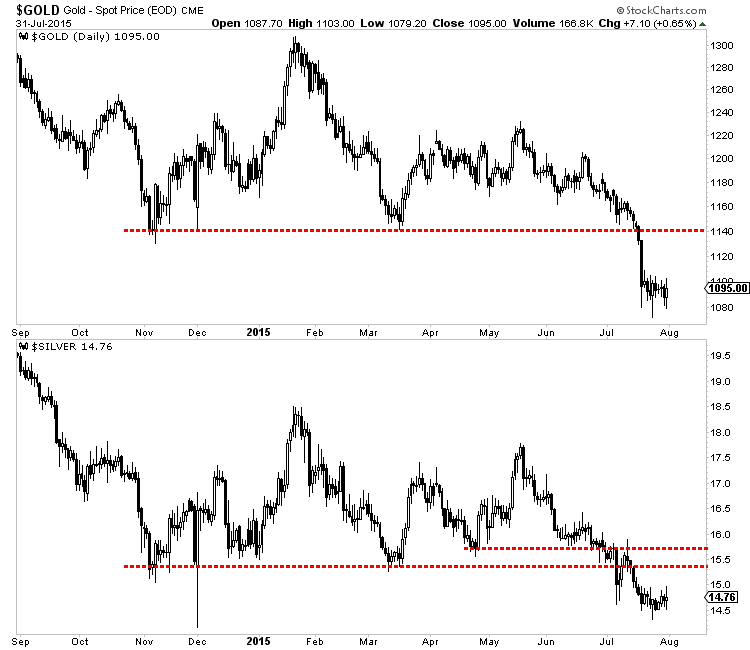

A daily chart of the metals is shown below. Gold is on top, Silver is below. The metals became extremely oversold the previous week and are trying to form a low. If Gold closes above $1100/oz then it will be in position to rally back to the breakdown point at $1140/oz. Silver's resistance is around $15.50.

The miners are more oversold than the metals and therefore have a bit more room to "snap-back" to former resistance. That doesn't mean it will happen though. At worst, miners will fill the gaps. At best, they could reach the higher line. GDXJ is at the top with GDX below.

GDXJ continues to outperform GDX. In other words the GDXJ/GDX ratio is at an 8-month high. The reason could be because the large producers and majors have debt while most companies in GDXJ do not. One thing someone I respect told me is look for a major bankruptcy or two and that could mark the bottom. The point I want to make is be very careful with the majors and bloated companies with huge debt. They appear cheap for a reason and

thats because there is a risk they go bust.

I think the macro-market picture will be quite interesting in the months ahead. We discussed it in the conclusion to our premium update and hope to expand upon that in future updates. Keep your eyes on trends in currencies, bonds, equities and emerging markets as they figure to influence precious metals and possibly create a positive inflection point for precious metals in the months ahead.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +50 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get everything up front, plus everything we send over the next six months.

This is an important point as it appears that the bear market could end with a really loud bang in the months ahead. We will be using various technical indicators and sentiment indicators to assess developments and position our portfolio appropriately. Find out the stocks we are watching and planning to buy in the months ahead.

Here is some unsolicited feedback from readers and subscribers:

I consider you the best analyst out there

I read your book while on vacation I must confess I thought it was fantastic I especially enjoy the sections where you use previous actions in the precious metals to gauge where you think it may go to in the future I think it may be the best book ever written on the subject and I don't say that lightly as I am a brutally honest

individual.

What's best about your service from my perspective and what you continue to deliver in EXCELLENT FORM is your recommendation of individual stocks within the junior sector along with your detailed and fairly comprehensive explanations for each of them. I think you do this as well as any of your peers

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|