|

Here are some links which I think you will find actionable...

Gold Bullish in Real Terms, Bearish in Nominal Terms

We discuss Gold's performance against stocks, the potential outlook for stocks and more in this editorial.

Stock Market is Due for a Bounce

We explained (with a chart that includes various indicators) why the stock market was due for a bounce.

Emerging Markets Bottom

Great post by Tiho Brkan. He explains why emerging markets could be approaching an important bottom. Also take a look at this post and the Vix analog chart in particular.

Fat-Pitch Blog Weekly Market Summary

Detailed weekly missive from Urban Carmel that covers mostly the equity market.

Premium Snippets

For those who missed it, you can download our entire book at the links below. We will publish a paperback version soon.

Book PDF File

Book Epub File

I truly believe that this book will help your understanding of Gold and gold stocks as an investment and help you make money in the quarters and years ahead.

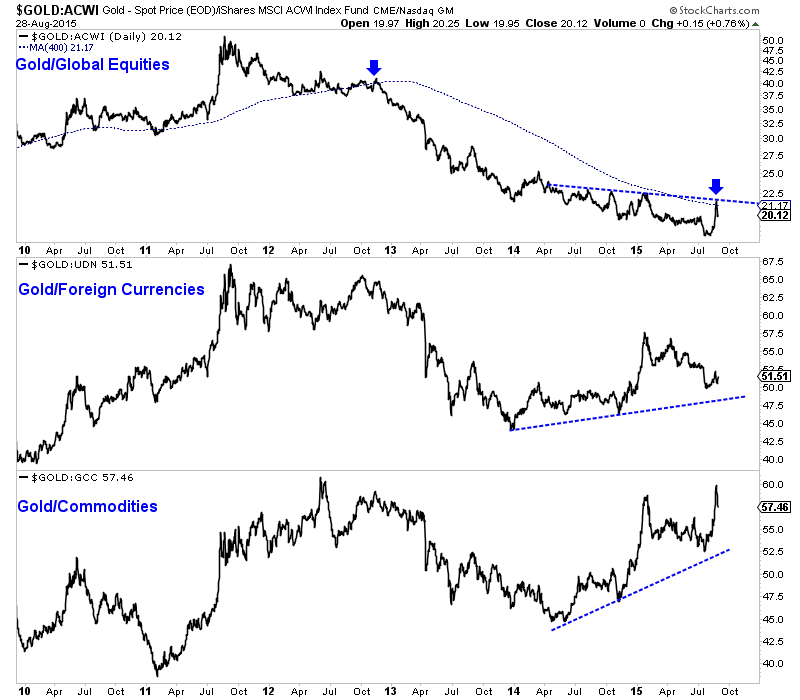

First, let us take a look at Gold in real terms. The chart below plots Gold against ACWI (all country global index), foreign currencies and commodities. Gold has been very strong against commodities as it recently neared an all time high. Gold against foreign currencies has been weak recently and could remain weak. However, that ratio appears to have bottomed at the tail end of 2013.

Gold vs. Stocks is the key for me in the weeks ahead. We can look at Gold/SPX, Gold/NYSE or Gold/ACWI as we see below, which gives us a global look. If this ratio busts out to the upside it will have very bullish implications for precious metals.

Let's turn to the miners...

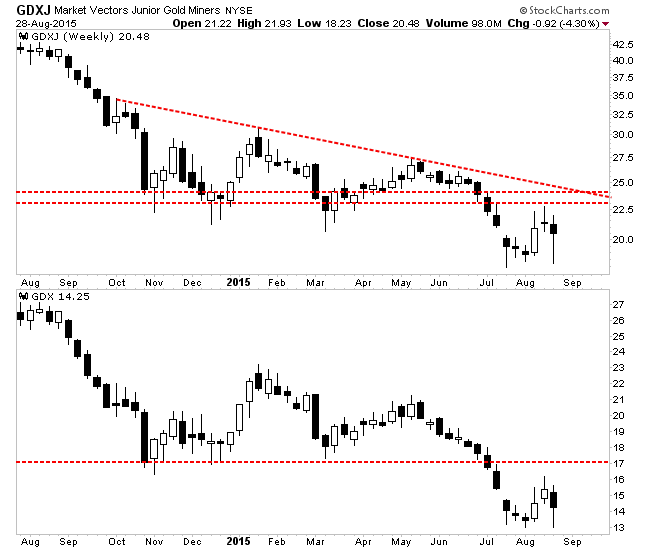

There is talk of the miners forming a double bottom. Considering my research I see that as a very low probability. If I'm wrong and it is a true double bottom then miners will explode higher over the next few weeks.

The weekly charts for GDXJ and GDX do not look so bullish to me. We saw signs of distribution a few weeks ago even as the miners rallied. Last week they formed a hammer but hammers are bullish when they follow a downtrend. Look at the hammers in October 2014, December 2014 and March 2015. They followed weakness and the market rallied. The hammers in July followed weakness and the market rallied, even though it has been tepid at

best.

In TDG #428 we provided a new report on a company we own a small position in. It has a great deposit in a strong jurisdiction and is a strong takeover candidate in 2016-2017 (assuming Gold's bear ends in the next few months).

We also charted 10 of our favorite juniors and noted technical support for each as well as a potential low target for each, in the scenario of a test of $1000 Gold.

Whether you are accumulating Gold and Silver or want to speculate on promising juniors, our service can help you. We provide objective and actionable research on Gold, Silver and the companies. And we provide fundamental analysis reports of the companies. We also keep our eye on other markets. We are one of the only newsletters in the space that trades a real

portfolio. That means our goals are aligned with yours. And we are one of the only editors who is a professionally credentialed analyst.

Unlike many of our competitors we don't make ridiculous promises, we don't employ copy writers to give you the hard sell, we don't try to sell you additional products nor do we charge obscene prices. Also, we admit our mistakes and learn from them because thats how we grow and provide greater value in the future. Learning from mistakes we made in 2014 has helped us to be up this year and over the past six months

in which GDXJ is down over 20%.

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +50 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Here is some unsolicited feedback from readers and subscribers:

I consider you the best analyst out there

I read your book while on vacation I must confess I thought it was fantastic I especially enjoy the sections where you use previous actions in the precious metals to gauge where you think it may go to in the future I think it may be the best book ever written on the subject and I don't say that lightly as I am a brutally honest

individual.

What's best about your service from my perspective and what you continue to deliver in EXCELLENT FORM is your recommendation of individual stocks within the junior sector along with your detailed and fairly comprehensive explanations for each of them. I think you do this as well as any of your peers

I just wanted to say thanks for all the great work you do..I consider you truly one of the best in your field.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Jordan, your honesty and humility is always appreciated. And rare in this sector.

Jordan, Just so you know, in my opinion you are the best newsletter writer in PM space.

I like that you combine TA with fundamentals and you even include…(deleted).

And I like that you don't have 50+ picks!

Mr. J Roy-Byrne, I really enjoy your newsletter, extremely informative as you have been great in calling Gold's turns. I happen to

listen to several views, (yours being most accurate)..

Personally, I think your $149 subscription for half a year is probably the best deal I know of anywhere! Thanks again for your work and insights.

I think you have one of the 2 best paid web site's on the market right now, the other being …….. Of course he charges $1,600 for 16 months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Click Here to Learn More

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|