|

Here are the links of the week....

Rick Rule: Absolutely Manic Bull Market in Gold Coming Soon

Palisade Radio interviews Rick Rule.

Why the Gold price is so high?

A post from Steve Saville. He's referring to the real price of Gold and specifically Gold's strength against commodities.

November Fund Managers Survey Charts

Great sentiment charts from the Fat-Pitch Blog. So much value in this information.

Could Emerging Markets Rebound?

Post from Tiho Brkan, ShortSideofLong.

Looking at Copper's Bear Market

Another informative post from Tiho Brkan.

Credit Market Update and Bank Lending Booming

From Macronomy Blog and Calafia Beach Pundit.

Premium Snippets

Gold is oversold but it has more downside!

The sentiment indicators I track are not at extremes nor is Gold anywhere near major support. The good news is its getting close though.

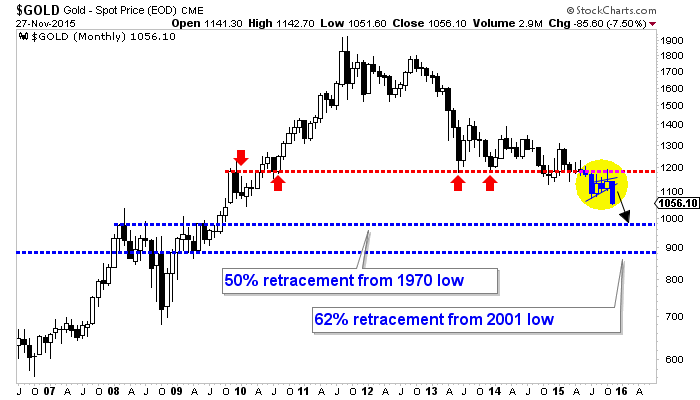

The monthly chart below continues to depict the situation best. Gold has broken down from a bear flag pattern that projects down to $1035-$1040, which is the next support. The next strong support is not until $970-$1000. Gold has more immediate downside but if it declines to $970 over the next few weeks then it could setup a rebound.

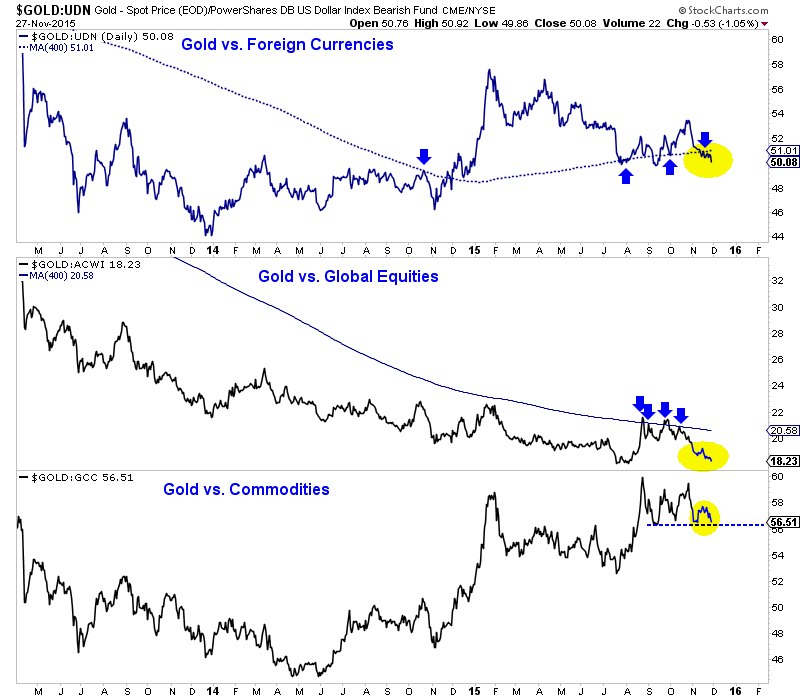

Sticking with Gold, it is also growing weaker against the other asset classes. Gold/foreign currencies was stable or strong for much of 2014 and 2015. However, it lost its 400-dma a few weeks ago and declined another 1.5% last week. (It also failed in October at the 200-dma). So it failed at resistance then lost the important support of the 400-dma. Gold/global equities has declined to its summer low and Gold/commodities is on

the cusp of a mini breakdown.

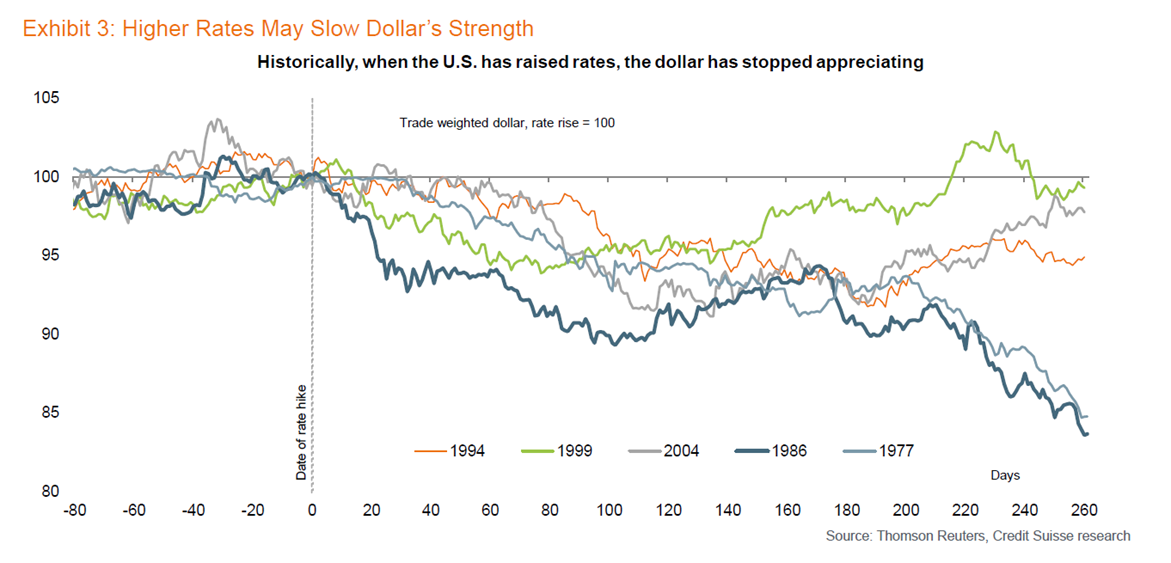

While I am very bullish on the US$ and think it could surge higher in 2016, the following chart makes a counter argument. The US$ tends to decline after the Fed begins hiking rates. The chart below looks at the US$'s performance before and after the Fed begins a new rate hike cycle. This time could be different but this data should certainly be kept in mind.

Over the holiday week Gold broke to a new low while the US$ index appeared to inch to a new bull market high. Meanwhile, the gold miners remained above key support while Silver also failed to make a new low.

To repeat myself, it is a tricky situation. Will Gold continue to plunge and take the miners and Silver with it? Or are the miners and Silver telling us Gold will bounce at $1040, or even $1000?

In the past three premium updates we've spent some time analyzing our favorite junior companies and some on our watch list. The companies with the best fundamentals (strongest deposits or lowest cost production) have held up the best. Everything and everyone else is falling by the wayside. A few companies on our watch list with decent deposits (uneconomic right now) and cash are trading around 2x cash. With the potential for Gold to drop another $100-$200/oz ($890 on a spike low?)

these types of companies could end up trading very close to cash value. That typified the major bottom of the early 2000s.

The good news is if Gold drops another $75-$150/oz then even the absolute best companies will get hit. Those are the ones I'm interested in because they will survive and they will lead the recovery in 2016. Companies with C-grade fundamentals could ultimately rise 10-fold or more but they may not begin to rip higher until 2017.

In yesterdays update TDG #441, I noted a junior producer that could become a great value if it declines more than 10%. There are also some quality juniors that would become great values if they decline another 15%-20%.

We are big long-term bulls on the precious metals sector but we do not want to be buyers until the sector becomes extremely oversold and trades near major support (think Gold $970 or Gold $900) amid extremely bearish sentiment (think CoT's, put-call ratios, surveys, discounts to NAV all showing extreme sentiment). The odds are not yet in the bulls favor but if the sector breaks lower and Gold loses $1040/oz then the odds will come into our favor.

Whether you are accumulating Gold and Silver or want to speculate on promising juniors, our service can help you. We provide objective and actionable research on Gold, Silver and the companies. And we provide fundamental analysis reports of the companies. We also keep our eye on other markets. We are one of the only newsletters in the space that trades a real portfolio. That means our goals are aligned with yours. And we are one

of the only editors who is a professionally credentialed analyst.

Unlike many of our competitors we don't make ridiculous promises, we don't employ copy writers to give you the hard sell, we don't try to sell you additional products nor do we charge obscene prices. Also, we admit our mistakes and learn from them because thats how we grow and provide greater value in the future.

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +50 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|