|

Hello and good Tuesday to you. Here are the few links of the week....

Gold Could Lose Safe-Heaven Bid as Equities Rebound

Gold has picked up quite a bit of relative strength as the equity market has decline. With the equity market rebounding what happens to Gold?

Precious Metals Video Update

Video update published Wednesday evening. Our latest thoughts on precious metals.

Interview with Mike Swanson

This was Wednesday afternoon.

Some Gold Bulls Need a Dose of Realism

Great piece from Steve Saville debunking the "Gold Shortage" meme.

January Fund Manager Survey

Great sentiment charts from the Fat-Pitch Blog

Selling Pressure & EM Valuations Attractive

Long update from Tiho Brkan at ShortSideofLong.

Premium Snippets

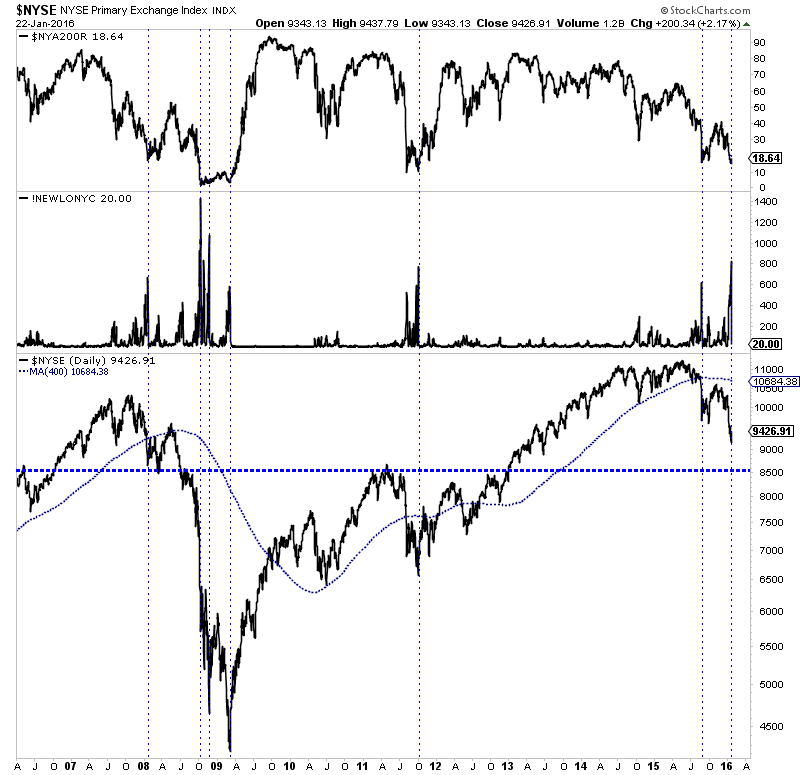

Chart 1 shows the NYSE along with two indicators: the percent of stocks trading above their 200-dma and the new 52-week lows.

The stock market reached a selling climax a few days ago. We marked the other recent periods that were similar in terms of those two indicators. The number of new 52-week lows and the percentage of stocks trading above the 200-dma hit the highest level in 4+ years.

You can't tell on this line chart but if you refer to the chart in our editorial you'll see that the stock market formed a strong bullish hammer (reversal candle) and on strong volume. I expect the stock market to rally and it could last at least a few months.

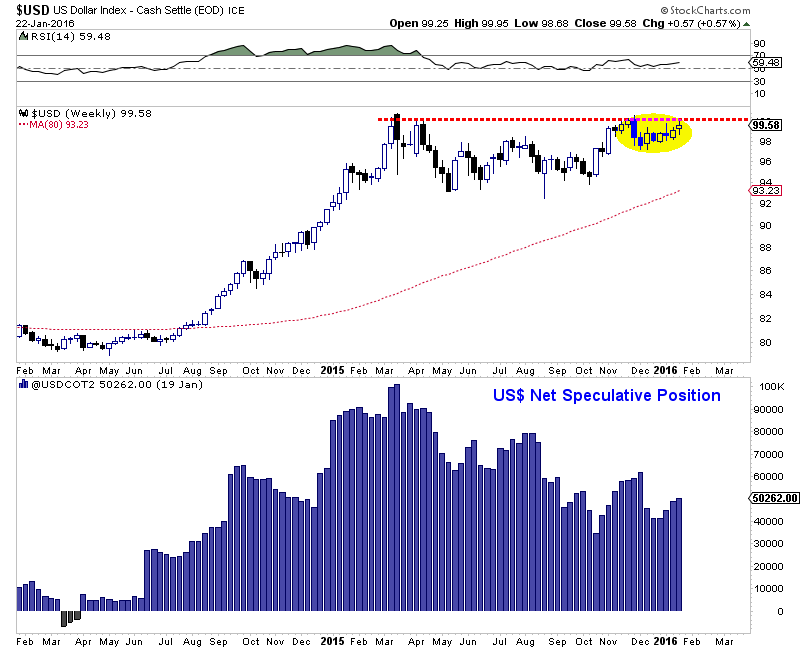

Chart 2 shows a weekly candle chart of the US$ index and the net speculative position in the US$ futures market. We like to measure the Gold & Silver positions as a percentage of open interest. The US$ open interest isn't as large so we focus on the nominal position.

Is the US$ getting ready for a breakout? It just made its second highest weekly close since the bull market began. Still, the US$ needs a strong weekly close above 100 to produce a breakout. Note that the speculative position is roughly half of what it was a year ago. Furthermore, another indicator (showed in our premium update) makes the same argument that sentiment has room to grow a lot more bullish.

A rising stock market coupled with a breakout in the US$ index could be the catalysts for the next round of weakness in precious metals. There is also a Fed meeting this coming Thursday and that can provide added volatility.

I looked at the past bear markets in equities, including 2011 and May is often an interim peak. Check what happened in 2001, 2002, 2008 and 2011. May was a significant peak in all of those years (which were in bear markets, though 2011 was really brief). In one of those years the market peaked before May. We often hear the phrase sell in May and go away. That may not matter in a bull market but it may really matter in a bear market. The market could be

setting up to rally for at least a few months and it may set up a spring peak that could come close to May.

An equity peak in the spring could coincide with a potential bottom in Gold. Three of the last four major bottoms in Gold came in the February to April time frame.

There are a lot of potential cross currents abound in the weeks ahead and we will cover them and all the best companies as best we can.

In TDG #449, a 32 page update sent Saturday evening we covered the equity market, the US$, US$ sentiment, Gold & Silver as well as their CoT's. We also commented on several companies including one exploration company which is suddenly becoming an intriguing value.

Whether you are accumulating Gold and Silver or want to speculate on promising juniors, our service can help you. We provide objective and actionable research on Gold, Silver and the companies. And we provide fundamental analysis reports of the companies. We also keep our eye on other markets. We are one of the only newsletters in the space that trades a real portfolio. That means our goals are aligned with yours. And we are one

of the only editors who is a professionally credentialed analyst.

Unlike many of our competitors we don't make ridiculous promises, we don't employ copy writers to give you the hard sell, we don't try to sell you additional products nor do we charge obscene prices. Also, we admit our mistakes and learn from them because thats how we grow and provide greater value in the future.

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +50 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|