|

Here are the links from this past week...

Gold Stocks Reverse at Resistance Targets.

Penned Friday afternoon. Gold Stocks hit our resistance targets and reversed course. History and the reversal at resistance argues for a correction. But did Monday's strength change that?

Video: Gold & Gold Stocks Breakout

Published on Thursday.

Video: Negative Real Rates, Investment Demand & GLD

We discuss how these drivers of Gold are connected and the huge inflows into GLD.

Interview with CrushTheStreet

This was on Tuesday. The link includes a list of topics discussed at precise times.

Podcast: Dan Norcini Analyzes Gold Market

We interviewed Dan on Friday to discuss all things Gold. Find him at traderdan.com.

Weekly Market Summary

Update from Fat-Pitch Blog. Focuses on stocks.

Gold & Confidence

Post from Steve Saville.

Premium Snippets

Chart 1...

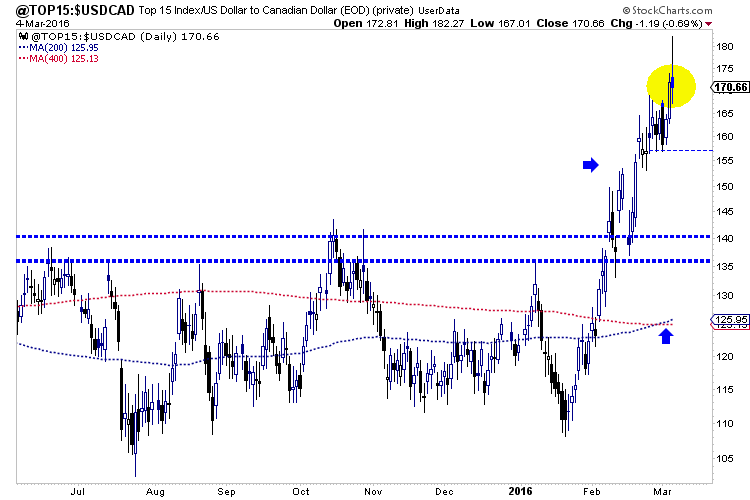

Here is the daily chart of our Top 15 index.

The top 15 index has strong resistance at 170-180 dating back several years. The index tested 170 last week and closed lower. It touched 182 on Friday but closed below 171. The two support areas are 154-157 and 135-140. A retest of 140 would be a retest of that key breakout.

Chart 2....

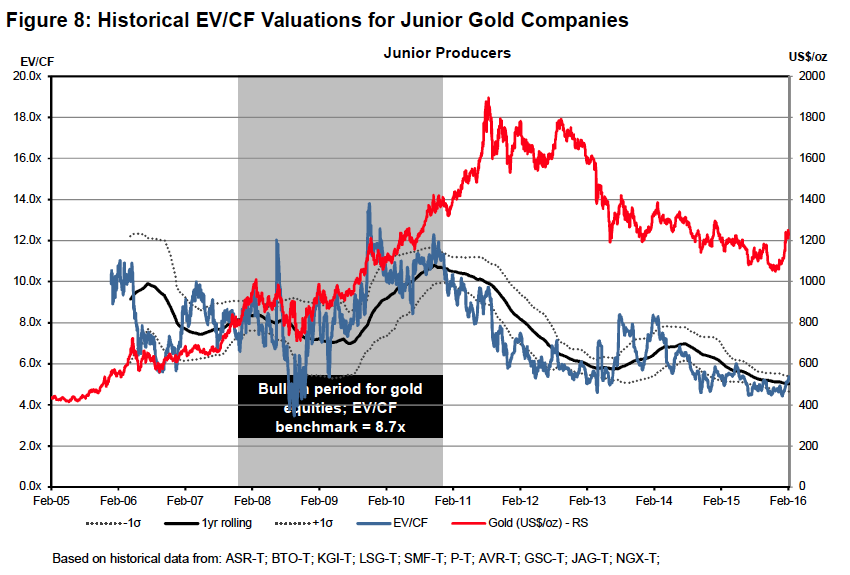

Historical valuations for junior gold producers.

The chart plots enterprise value to cash flow from an index of 10 juniors. The low during the bear years was 4x-5x cash flow. During the bull years the valuation spent most of its time from 7x to 12x cash flow. Currently its about 5.5x cash flow. That means the recent rise can be mostly attributed to the Gold price and not from a valuation increase.

In TDG #455, a 34 page update we noted correction targets for the Top 15 index, the ETFs as well as our favorite individual stocks. Like the index, many stocks have two potential areas of support. We'll see if the stocks correct 10% or 15-20%.

As we noted last week the top 15 index has major resistance at 180 but the long-term prognosis has turned bullish. Whenever the index breaks above 180 (assuming later and not immediately) it figures to be an explosive move. Hence, it will be important to put cash to work during this period of weakness. One should be a bit patient also because maybe the sector takes a few months to consolidate the gains.

Last we mentioned optionality plays. In TDG #455 we included a report on a company that we own that is an optionality play. The stock corrected 20% so we took advantage of it. The stock is a speculation but it has an extremely low market cap and based on the economics of its project, the move above $1300 (and resistance at $1325) and then $1400 would be very significant. We projected if the stock trades at 0.25 NAV at $1750 (and we reduced the project's NPV by another 33%) the

market cap of the stock could rise nearly 10-fold. That will take time though. With optionality plays one has to be very patient and hold the position.

We reiterate what we said last week:

The good news is we think there will be another chance to buy these cheap in the months ahead. We own a few in the portfolio already, although only one is a true optionality play. If the sector has a correction or multi-month consolidation that will be the time to buy these because they could explode and keep going higher into 2017 and beyond. We will be covering these companies more in the weeks ahead.

Its a bull market and its best to buy and hold. Don't let the perfect be the enemy of the good. Don't wait for 30% weakness if you can buy something down 20%.

In addition to our exhaustive technical and sentiment research we provide one company report per week in each update. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Unlike many of our competitors we don't make ridiculous promises, we don't employ copy writers to give you the hard sell, we don't try to sell you additional products nor do we charge obscene prices. Also, we admit our mistakes and learn from them because thats how we grow and provide greater value in the future. Consider a subscription today as you will receive all of our recent reports and updates within hours of

your signup, as well as everything we produce for the next 6 months.

Click Here to Learn More

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +60 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|