|

Here are the links from this past week...

Can Gold Climb to $1400, Gundlach's target?

We assess if Gold can reach Gundlach's target.

Video: Pierre Lassonde's $8000 Target

We analyze Pierre Lassonde's Gold target and comment if it is realistic or not.

Ned Davis Research Turns Bullish on Gold

Ned Davis Research is a highly respected research organization.

Trader Dan: Gold CoT Worrisome

My opinion is many analysts write about the CoT and come to knee-jerk reactions. Trader Dan is one of the few who knows what he's talking about.

Deflation/Recession Threat Recedes

So says Calafia Beach Pundit. Post includes many charts.

Weekly Market Summary

Always very insightful. From the Fat-Pitch Blog.

Premium Snippets

Before we get to the first chart, you can download the updated version of our book at the link below.

Updated Book, PDF File

Chart 1...

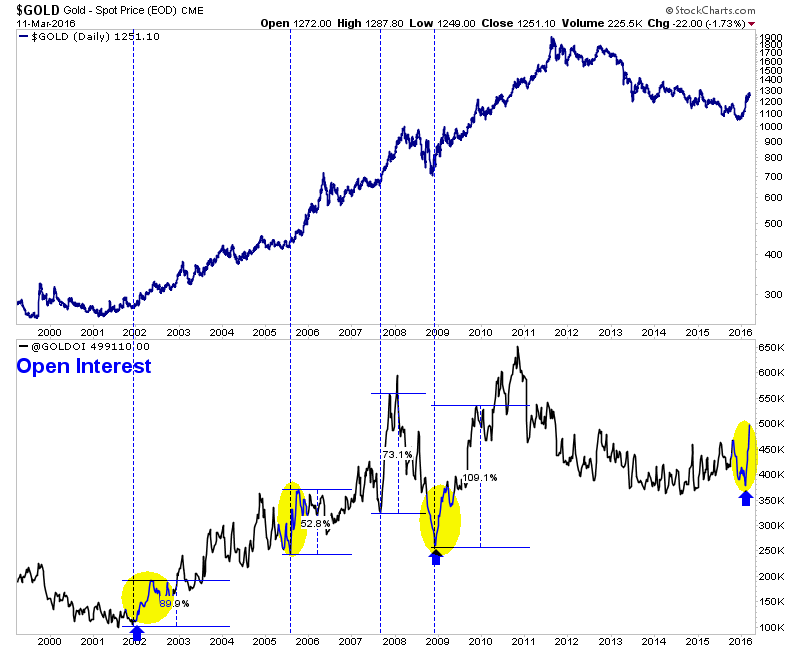

The chart plots Gold and the Open Interest in Gold.

Rising open interest confirms an uptrend. Thus, rising open interest is not a leading indicator but a confirmation tool. Last week in our premium update (and in a recent video) we mentioned that inflows into GLD have been the strongest since 2010. That is one piece of confirmation that Gold has made a major turn.

The other, is rising open interest which has reached a 4.5 year high! Note the other times open interest surged in a short time period. Gold had very strong moves. We do not know what open interest will do from here on out. But the fact that it has surged in recent weeks and reached a 4.5 year high is another indication of a major turn in Gold.

Chart 2....

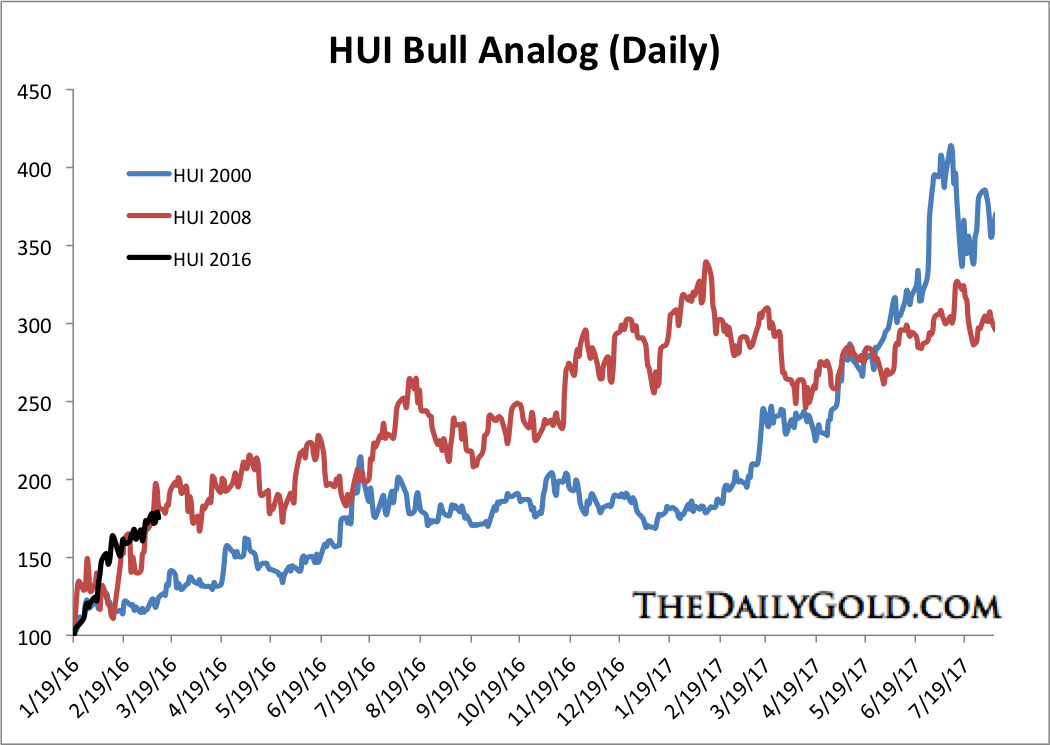

HUI Bull Analog using daily data.

The current HUI is in black. The other lines are the recoveries from 2000 and 2008. The HUI is following 2008 thus far although it has not had that 20% correction yet.

If the HUI continues to follow the 2008 analog, then it could rise 55% in the next 5 months! If the HUI follows the 2000 analog then it could rise nearly 140% in the next 16 months. All the more reason not to trade in and out. Buy quality, buy weakness and hold!

In TDG #456, a 31 page update sent Saturday evening, we included a report on an optionality play we bought last week. We projected the company's stock price if Gold goes to $1400 and what the company could be worth (given the NPV of its project at higher metals prices). As far as optionality plays we are looking for company's that have big deposits that could have some value at $1200-$1300 but accelerated upside at $1400-$1500. We

aren't looking at the stuff that needs $1600 Gold and higher to be economic.

In our update we provided updated comments on Silver, knee-jerk reactions to the CoT and we also mentioned an old junior gold index we created but haven't looked at for a year. We built it going back to 2000. From the 2001 low this index gained 436% in one year. From the 2008 low the index gained 463% in 14 months! These gains were helped by a weakening US$ but nevertheless that is huge. We mentioned some of the companies that could repeat that performance, assuming this recovery

holds. Think about it. If something has gone from 50c to $1. Then it has another 10-11 months to double for it to be up 300%. That is how those huge gains occur after lows.

This is why you buy and hold. Buy quality and hold. Buy weakness and hold. A few days ago I bought a producer that was down 20%. Its had a strong run but is very cheap based on its cash flow. Maybe it goes down 30% but in any case buying something of quality, down 20% in a bull market is generally a good idea. The week before we bought an optionality play that was down 20%. Its up slightly so far.

Gold could test $1200 and miners could correct 15%-20% but it would likely be a buying opportunity. Correction or not, I agree with Gundlach and think we are headed to $1400!

In addition to our exhaustive technical and sentiment research we provide one company report per week in each update. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Unlike many of our competitors we don't make ridiculous promises, we don't employ copy writers to give you the hard sell, we don't try to sell you additional products nor do we charge obscene prices. Also, we admit our mistakes and learn from them because thats how we grow and provide greater value in the future. Consider a subscription today as you will receive all of our recent reports and updates within hours of

your signup, as well as everything we produce for the next 6 months.

Click Here to Learn More

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +60 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|