|

Here are the links from this past week...

US Dollar Rebound Increases Near-Term Risk

Penned Friday afternoon. We point out the position of the US$, potential double top in the Yen and potential ramifications for Gold and gold stocks.

Precious Metals Video Update

Published Wednesday. We looked at the potential upside and resistance targets for Gold and gold stocks. If PMs did not peak last week then they may peak at these targets.

The Big Earnings Con

Great piece from Jesse Felder. Market is way overvalued when you look at non-earnings valuations or measure earnings by GAAP. Note that the WSJ shows the PE on the S&P 500 as 22.4. The same data shows that over the past 125 years, market peaks come around 22-26.

Changes in Gold Location Say Nothing About Gold Price

Great post from Steve Saville, who always does a good job debunking some gold bug views.

Inflation Tends to Rise into a Recession

Inflation is picking up but perma-bulls are drawing the wrong conclusion.

Major Inflows into Gold ETFs. See the updated chart here and Dan Norcini's analysis here.

Premium Snippets

Chart 1...

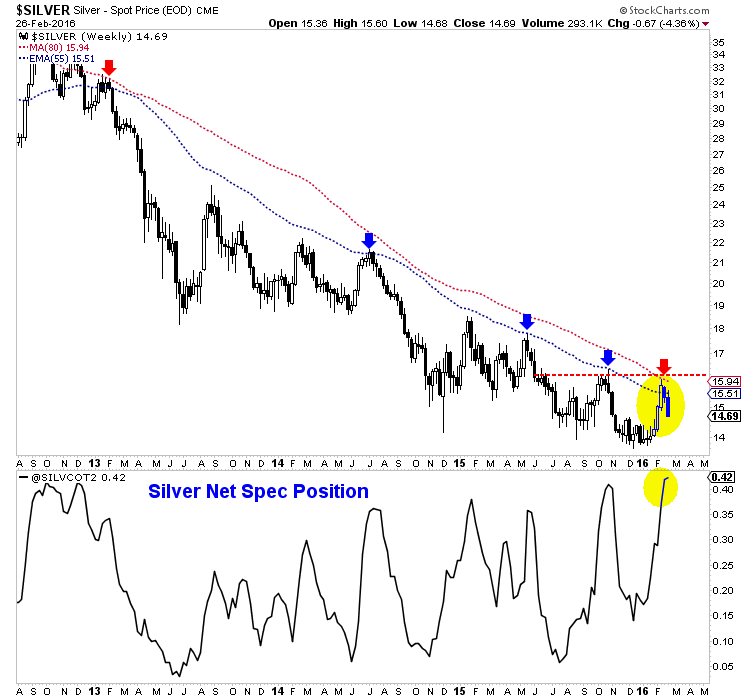

Here is the weekly candle chart of Silver with its net speculative position at the bottom.

Silver failed to make a new high even as Gold and gold stocks did. Also note that Silver's rally peaked at its 80-week moving average which was last tested in early 2013. Furthermore, Silver reversed back below its 55-week exponential moving average after closing above it two weeks ago.

Now combine the bearish price action with its net speculative position of 42.2% which is actually, barely, the highest since 2010!

Contrast that with the US Dollar, which has remained in a bullish consolidation and whose net spec position is at an 18-month low! It has the fuel to move much higher, while Silver has the fuel to push it much lower.

Chart 2....

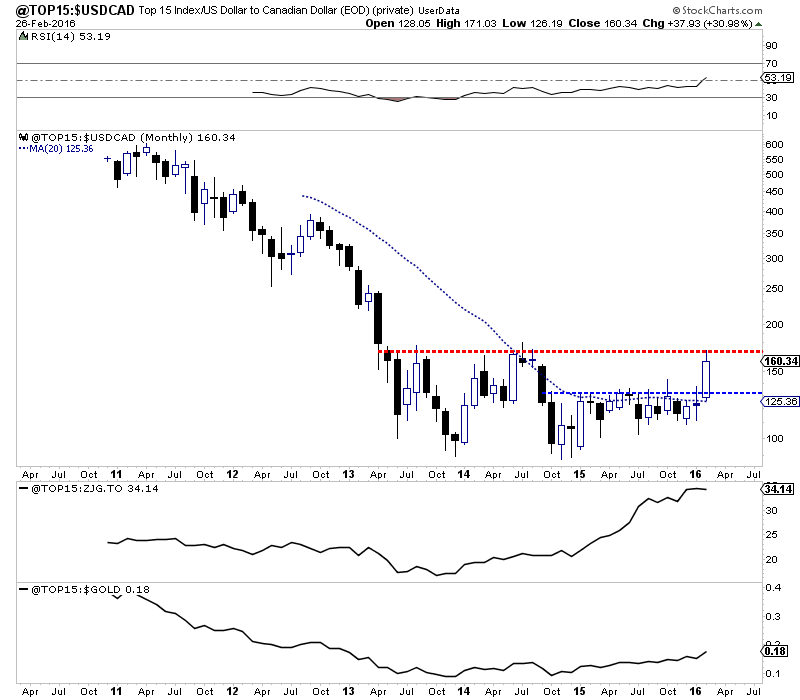

The monthly top 15 index.

Last week we wrote:

The index shows a potential ascending triangle pattern which projects to around 175. The next strong resistance is around 170-180 and that fits well with the upside potential in GDX and GDXJ.

The index peaked at 171 on Wednesday but ended the week at 160. Its certainly possible the index could touch 170 again or even 175 before a sustained correction.

However, the monthly chart below shows that area (170-180) as major resistance. Given that resistance, Silver's weakness and the US Dollar's rebound, it is unlikely that the index sustains a move above that resistance anytime soon. We could see a correction or consolidation for more than a few months.

The good news is that correction or consolidation would provide another chance to get into the sector before things really takeoff. When the Top 15 index breaks above 170-180 for good, it could run to 250 and then 290 within 4-5 months. If that move is in the cards my guess is it starts later in the year.

In TDG #454, a 31-page update we profiled one of the lowest cost producers in an emerging jurisdiction. Its a very well run company that will be developing its next mine soon. The company trades at a very low valuation. Considering the potential for production growth, valuation increase and a higher Gold price, we see huge upside over the next few years. If the stock corrects some 15%-20% then we could see the stock being a 5-bagger in

the next 2-3 years.

We also briefly discussed "optionality" plays. Rick Rule is a big fan of these. Essentially, these are the companies with big but uneconomic deposits. Those huge deposits can suddenly become a lot more valuable when metals prices rise. These stocks tend to be very depressed and that is why some of them have doubled from their recent lows.

The good news is we think there will be another chance to buy these cheap in the months ahead. We own a few in the portfolio already, although only one is a true optionality play. If the sector has a correction or multi-month consolidation that will be the time to buy these because they could explode and keep going higher into 2017 and beyond. We will be covering these companies more in the weeks ahead.

In addition to our exhaustive technical and sentiment research we provide one company report per week in each update. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Unlike many of our competitors we don't make ridiculous promises, we don't employ copy writers to give you the hard sell, we don't try to sell you additional products nor do we charge obscene prices. Also, we admit our mistakes and learn from them because thats how we grow and provide greater value in the future. Consider a subscription today as you will receive all of our recent reports and updates within hours of

your signup, as well as everything we produce for the next 6 months.

Click Here to Learn More

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +60 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|