|

Here are the links from this past week...

Gold Stocks Correcting Through Time not Price

The gold stocks have held firm above initial support and 50-dma's. They appear to be correcting through time, not price.

Commodities & Inflation Expectations

Excellent post from Tiho Brkan at ShortSideofLong.

April Update: Still No Sign of Recession

Update from the Fat-Pitch Blog. He does an excellent job using data and charts to support his views.

Signs of Reversal in the Wealth Effect?

Jesse Felder thinks so. Great piece.

Market Anthropology: Connecting the Dots

Erik Swartz's latest on the Fed and Currencies.

TraderDan on the Gold CoT

Dan Norcini is one of the top Gold analysts in my opinion.

Premium Snippets

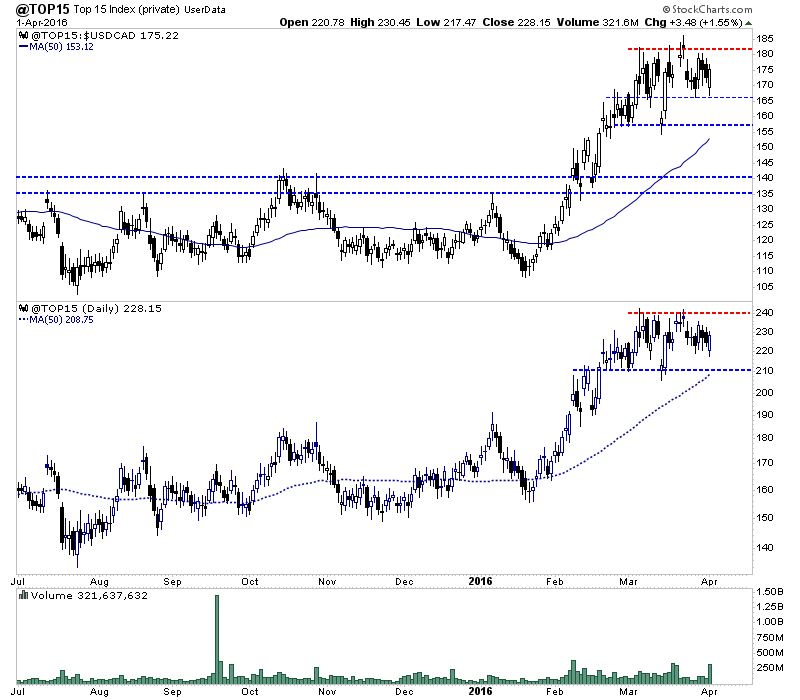

Chart 1: Top 15 Index Daily

This chart was only updated in time for this email and not the premium update sent earlier.

The index at the top is in US$, the one at the bottom is in CAD$.

Anyway, the index managed to hold above initial resistance around 165. Last week I thought it was headed for 155 and perhaps even 145. That remains possible but the index reversed early losses on Friday on huge volume.

The index is digesting its gains but needs more of that before it can breakout. The 50-day moving average is at 153 while the index closed at 175. So the index remains some distance above even a short-term moving average. Its still overbought.

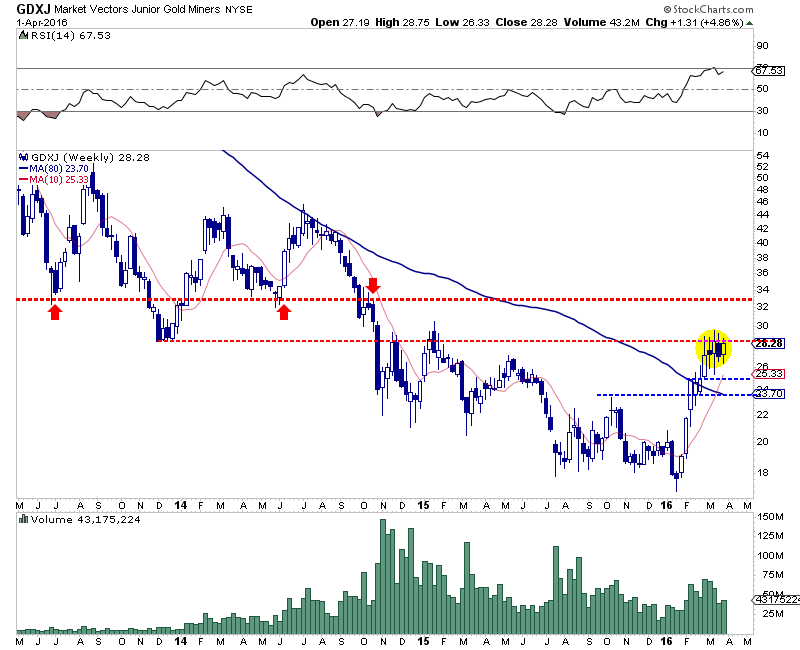

Chart 2: GDXJ Weekly

GDXJ has weekly resistance near $29 with weekly support at $26 and $25. A clean break above resistance and the next target becomes $33.

During the week we noted, in a flash update that most the juniors we own and follow have or were correcting a maximum of 15% to 20%. If this initial support continues to hold then we don't see our stocks correcting more than 20%. Sure, a few have. But most have corrected around 15%-20%.

We now think the odds favor precious metals continuing to consolidate for at least a few more weeks. Gold is definitely range bound and its high net speculative position needs to be worked off. That doesn't mean Gold is going to plunge but it does mean it will have a hard time rising when viewed in the context of its technical outlook.

I'm holding what I own and also looking to prune my portfolio. I will keep an eye on it in the short-term to see if anything is lagging and not meeting my expectations. I'm also taking advantage of weakness. I bought a cash rich exploration company that is very highly regarded by some esteemed analysts. I missed it earlier but it was off nearly 20%. Odds are the bottom is in and these stocks aren't correcting 30% or 40% anytime soon. Hence, take advantage of the 15%-20% dips

if you can.

Moreover, if the miners are building a bullish flag consolidation, then we have another few weeks to get fully invested for another big move higher. If the bull flag plays out, we could see some very strong gains into May and June. If you are unsure of which companies are the best buys here or which companies have the best risk reward, then consider a subscription to our premium service.

In addition to our exhaustive technical and sentiment research we usually provide one company report per week in each update. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Consider a subscription today as you will receive all of our recent company reports (over 15) and updates within hours of your signup, as well as everything we produce for the next 6 months.

Click Here to Learn More

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +70 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|