|

Here are the links from this past week...

Gold Stocks Breakout, Gold to Follow

Penned Friday afternoon, our latest views.

Gold & Gold Stocks in Consolidation

Video update, published on Thursday.

Interview with Mike Swanson

We conducted this interview on Thursday.

Video: The Toughest Time to Buy?

We talk about why this point in time in the recovery is the toughest time to buy.

Market Anthropology: Dancing the Jig in Equities & Gold

Erik Swartz's latest on Equities, Currencies and Gold.

One of Paul Tudor Jones Favorite Indicators Suggests Gold Bear Market is Over

As posted by Jesse Felder

Premium Snippets

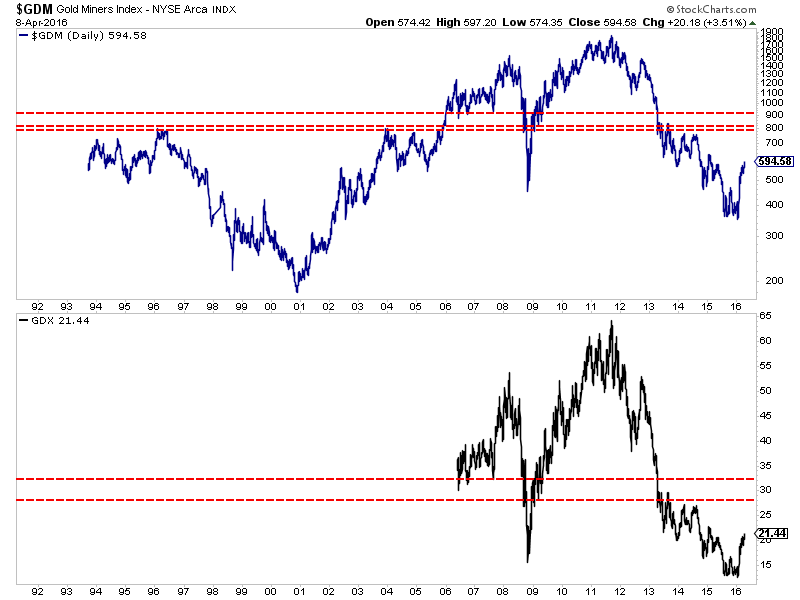

Chart 1: GDM Index (forerunner of GDX) & GDX

The image below contains the daily line charts of both GDM and GDX. Note the strong targets for GDM of 800 and 810 and roughly 900. The 62% retracement of the 2000 to 2011 move is near 810 while 900 is the 38% retracement of the 2011 to 2015 bear market.

In short, we see 800-810 as the strongest near term resistance. That corresponds to near $28.30 in GDX which also has strong resistance at $27 (the two 2014 peaks). Furthermore, if the recent consolidation was a bull flag, its upside target would be ~$27. Hence, we see $27-$28 as the upside target for this move.

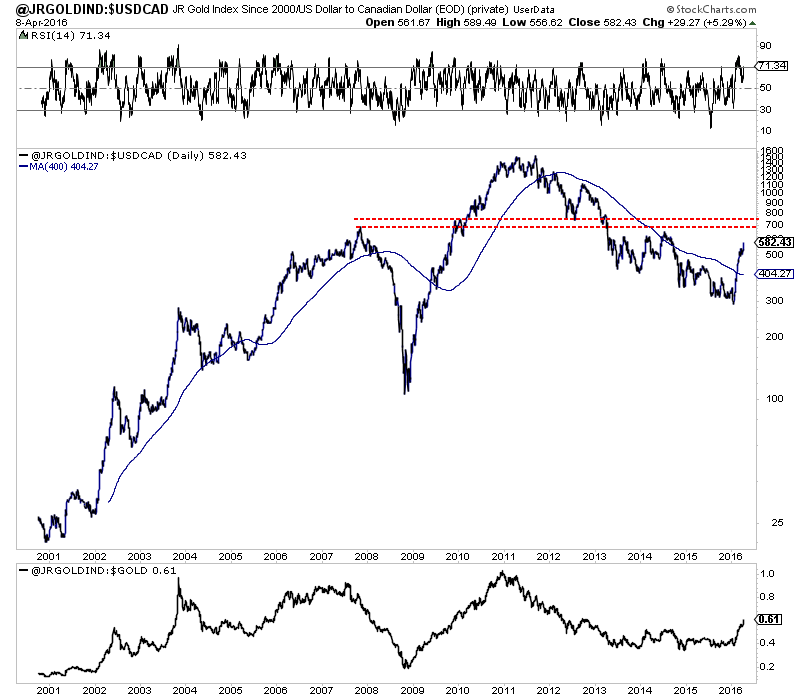

Chart 2: Junior Gold Index, Daily line chart

We have included our Top 15 chart many times. It had a major breakout and closed at 195, and has upside to 265-270. The chart below is our recently constructed Junior Gold Index that contains 18 stocks. (There is some overlap with the Top 15 index). The index has made a very strong move in recent weeks and closed at 582. It has a confluence of targets in the low 700s.

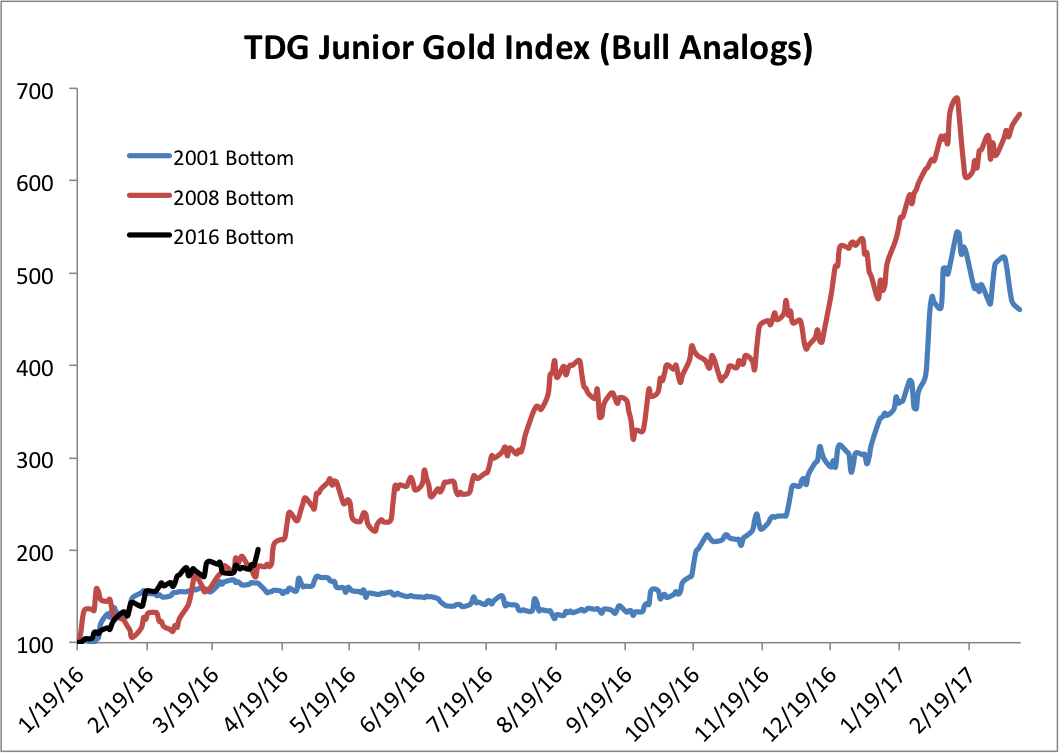

Chart 3: Junior Gold Index Bull Analog

In the chart below we plot the rebounds from major bottoms (2001, 2008 and 2016) all on the same scale which starts at 100 and on January 19, 2016, the bottom for this cycle. The current rebound is following the 2008 rebound fairly close (we also see the same with the HUI analogs). Juniors bottomed in 2001 then had a lengthy consolidation before exploding higher from the end of 2001 into 2002.

Note that the index is currently at 201 (on this scale) and would reach the next red peak at 277. (Then the 2008 rebound corrected 27% in absolute terms).

While miners are a little bit overbought now, take note that in a very strong trend overbought can become very overbought and extremely overbought. There will be corrections along the way but the analog chart shows the potential for quality juniors in the months and quarters ahead.

Our work shows that miners both large and small have additional upside following Friday's breakout. GDX could rally roughly 30% to its upside target, while the Top15 index could rally 38% and GDXJ could rally 40% to its 2014 resistance. The sector could move quite a bit higher before it gets its first "big" correction.

In TDG #460, a 34 page update sent Saturday afternoon, we provided long comments on 3 stocks as well as, among other things, notes on what stocks we would buy if we were starting a portfolio today as well as what stocks we are considering overweighting in our portfolio. We noted the current low valuation of one of our favorite producers which has production growth potential, valuation expansion potential and factor in a higher Gold price and it can move a lot higher. That is why we

are considering overweighting the position. We are also carefully watching everything we own in order to ensure performance is as expected. One stock was lagging so we sold it and replaced it.

If you are unsure of which companies are the best buys here or which companies have the best risk reward, our research and guidance can help. In addition to our exhaustive technical and sentiment research we usually provide on average nearly one company report per week in each update. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Since the summer of 2009 our model portfolio is up 200% while GDX has lost 43% and GDXJ an estimated 55%. Gold is up 31% over that period.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling.

Consider a subscription today as you will receive all of our recent company reports (over 15) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|