|

Here are the links from this past week...

What to Watch for in Gold & Gold Stocks

We penned this on Friday. Its simple, let's see if they hold the 400-dma's.

Video: Gold Stocks Correction Analysis

We published this on Thursday.

Weekly Market Summary

From the Fat Pitch Blog. Great coverage of the stock market.

The Markets Graduate to Commodities

The latest from Erik Swartz. The post includes numerous charts that are actionable.

Video: Hugh Hendry Talks Chinese Devaluation

From Real Vision via ZeroHedge.

Has the Reflation Trade Turned the Corner?

Informative piece from Chris Ciovacco.

Premium Snippets

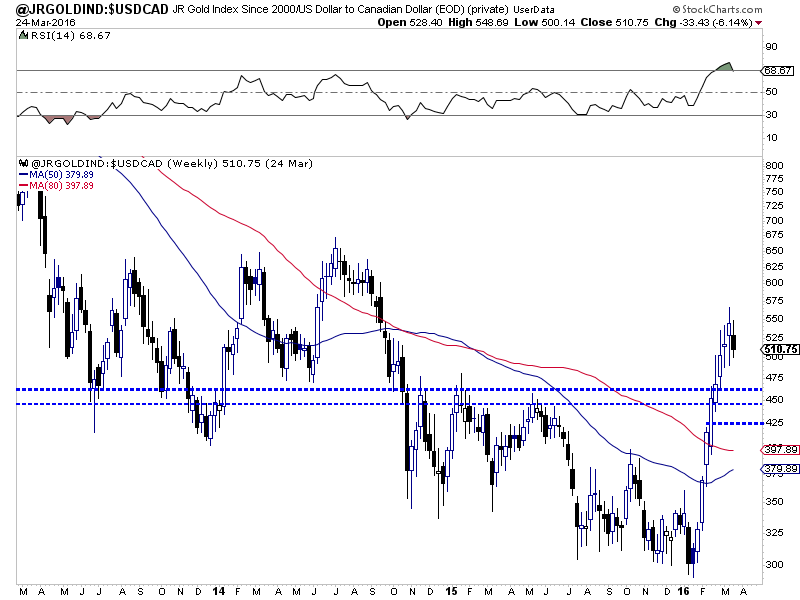

Chart 1: Junior Gold Index, Weekly Chart.

This index contains 18 companies and the median market cap is roughly $200 Million in US$.

A week after we highlighted the lack of a correction and the sector refusing to correct, it starts to correct. Does this index look like something you want to buy right now?

It recently peaked at 570 and closed just below 511. So it has corrected about 10%. The strongest support looks to be around 445 to 460. The upper end of that is the 38% retracement of the recent decline. A move down to 425, the 50% retracement would be a 17% decline and a total correction of nearly 25%.

There have been chances to buy some stocks off 15%. The odds now favor many juniors correcting 20% to 25%. Better buying opportunities should be ahead.

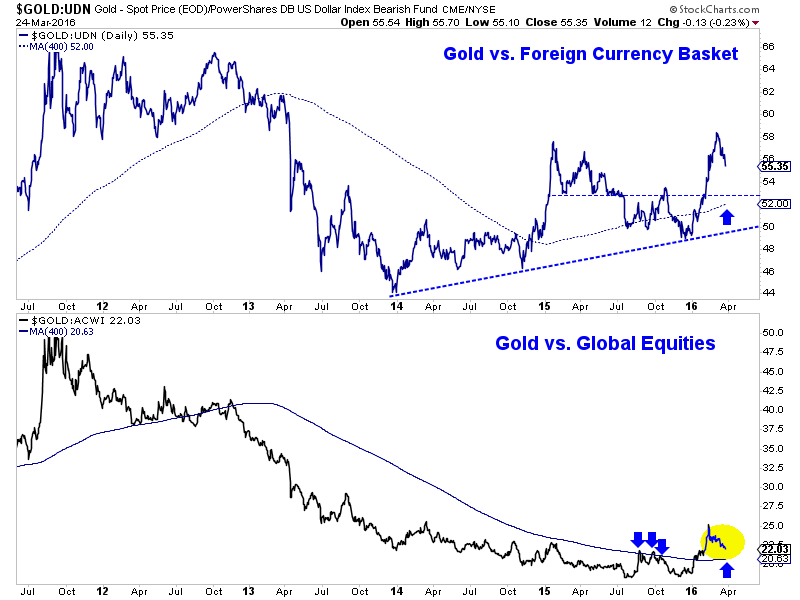

Chart 2: Gold vs. FC & Gold vs. Global Equities

Gold's relative strength against foreign currencies and global equities preceded the strong sector rebound by a few weeks. Gold has already corrected some in real terms and now Gold in US$ is following suit as the US$ index bounces.

Gold/FC closed at 55. There should be very strong support at 52-53. Gold/global equities could also decline a bit more before testing strong support. For this rebound to develop into a real bull market these ratios must show strength in the next few months.

The past few weeks we've made the case of buy weakness and buy and hold. Buy that 10% to 15% weakness. Well now that could become 20% to 25%. Some of the best juniors could correct that much and not just the smaller exploration companies that doubled recently.

In TDG #458 sent Saturday I noted two quality companies that I missed during the recent rebound. They took off before I could buy them. One is my favorite Silver company and I was not real bullish on Silver at the time (doh!). I hope it corrects so I can buy it. The other is a company that is cashed up and is thought very highly of by a very respected and discerning newsletter writer.

What do you do if you are worried about a big correction? If you are 75% invested, you can use a 3x hedge and basically be neutral in your portfolio. If you have a lot of cash then look to buy quality that is off more than 20%. You can also reevaluate that 75%. Is there something you missed? Are there a few stocks in your portfolio that could be replaced with something better? (Like the one's you missed).

In addition to our exhaustive technical and sentiment research we usually provide one company report per week in each update. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Consider a subscription today as you will receive all of our recent company reports (over 15) and updates within hours of your signup, as well as everything we produce for the next 6 months.

Click Here to Learn More

I have subscribed to many investment services over my lifetime. I can honestly say Jordan Roy-Byrne has developed not only one of the most analytically accurate, but also has hit the high water mark by making his analysis feel personalized. In addition to a detailed weekly report, he often sends additional emails with daily observations of not only the physical metals and miners, but also related metrics such as the

market and currencies. His service is a great integration of history and future probability that has not only helped me make money, but also avoid losing. In fact, the only time I do lose is when I take more aggressive positions than he has recommended, or follow my gut instead of his objective reasoning. It truly is a 5 Star Service at a great price.

-Andy P. CPA & Attorney

Consider a subscription to our premium service as you will immediately receive all recent updates as well as recent company reports (a +70 page file) and our book, "The Coming Renewal of Gold's Secular Bull

Market". You pay up front but you get significant value up front (in a welcome email), plus everything we send over the next six months.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|