|

Here are the best links from the past week...

Misreading the CoTs, Again

Penned on Friday. We discuss some mistakes people are making with the CoTs.

Metals Investor Forum Information

For those in the Vancouver, BC area we will be speaking at this conference next weekend. It's a two-day conference and free to attend if you register. The conference includes roughly 25 companies and a handful of speakers including Brent Cook.

S&P Seasonal Change, Value in China & Vietnam

A lengthy post from Tiho Brkan at ShortSideofLong covering many markets.

May Macro Update

From the Fat Pitch Blog. He says there are some signs of slowing growth. Great charts and data in this post.

Macro & Credit: When Doves Cry

A lengthy post on the credit markets from the Macronomy Blog. Take a look at the last chart and the text above and below it.

Stan Druckenmiller says Get Out of Stocks, Buy Gold

He backed up the truck on Gold last year. He has a huge position in Gold. Remember, he made 30%/yr over a 25 year period!

Premium Snippets

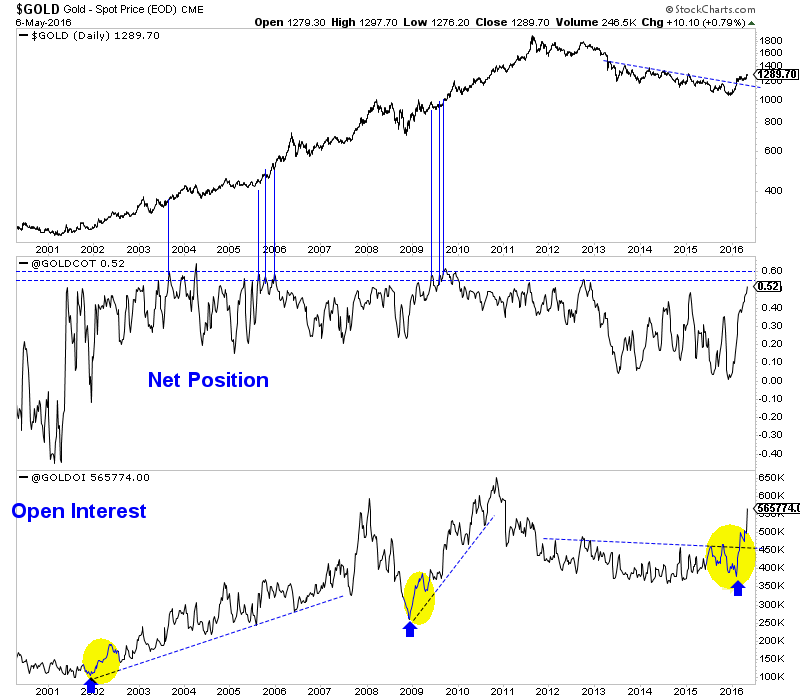

Chart 1: Gold CoT w/ Net Position & Open Interest

The net speculative position in Gold is up to 52.1%. Note that previous peaks were at 55% to 60%. Furthermore, note the peaks we highlighted in 2003, 2005 and 2009. The CoT was flashing danger but Gold continued to trend higher in the weeks and months ahead.

We have to be careful in assuming the CoT will mark a significant top. Its certainly possible but I don't think its probable. If Gold powers through $1300/oz in the weeks ahead then it could continue all the way to $1400 or even $1550 potentially, before there is a pullback beyond that lasts beyond a month. People were worried about the CoT two months ago! It makes more sense to worry now but one must also realize the CoT won't derail the primary

uptrend.

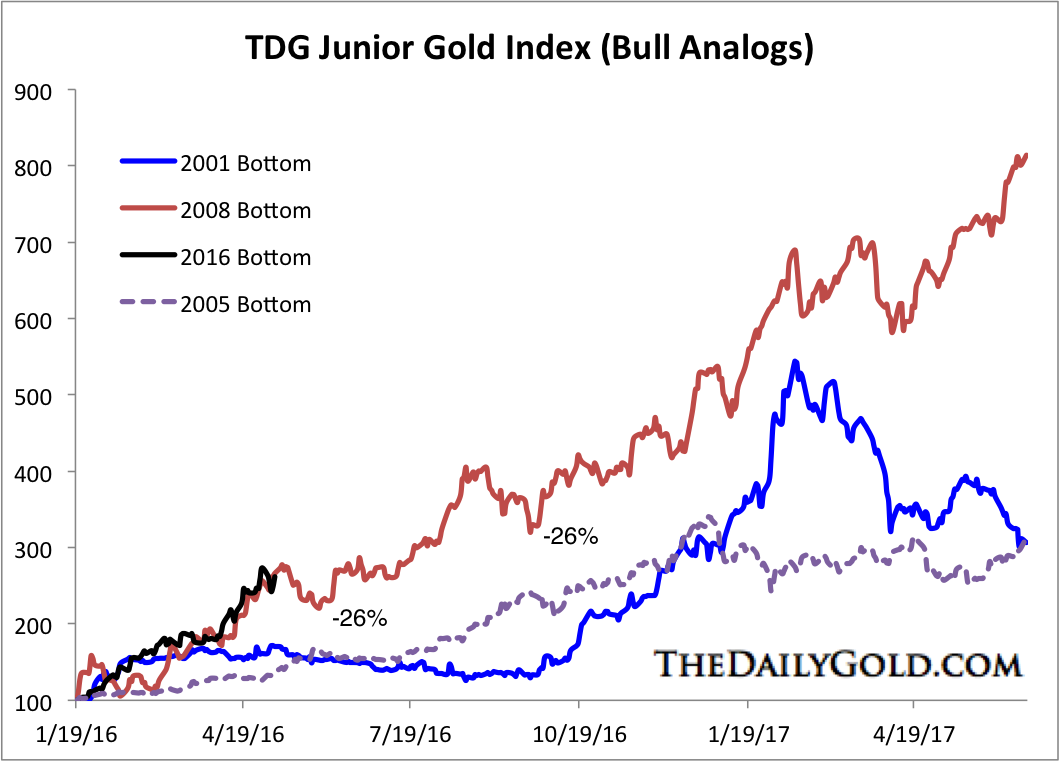

Chart 2: TDG Junior Gold Stocks Bull Analogs

Last week we showed the HUI bull analog. Here is the one of our junior gold index. The index has been reconstructed a handful of times as some companies are acquired or flame out. Interestingly, note how the current rebound has followed the 2008-2009 rebound very closely.

If the juniors continue to follow the 2008-2009 rebound then the months ahead will offer a few buying opportunities amid continued strength. Both the HUI bull analog (shown last week) and the above analog are arguing for a +20% correction quite soon. I should note that as of Wednesday the miners corrected 11% and our junior index 15%. So to get that correction the sector only needs to move beyond last weeks lows and it will come close to 20% in the indices.

I think the gold stocks will correct more at least in terms of time. At best they consolidate here for a few weeks while at worst they probably break Wednesday's lows and perhaps test their 50-day moving averages. I would welcome that because we are overdue for a correction and that would eliminate the need for a huge summer correction (30-35%). The third scenario would entail a blowoff type move which would bring that huge correction into play.

If you missed the huge rebound of the past few months do not worry or panic into stocks that have gone vertical. Have patience and realize that there will be a buying opportunity either in the next week or two or in the next month or two. Unless the sector goes vertical for another month then we don't have to worry about most stocks correcting 30%-40%. Accumulate on dips and weakness (10%-15%) and buy during the correction (20%-25%). That is how you can build

positions.

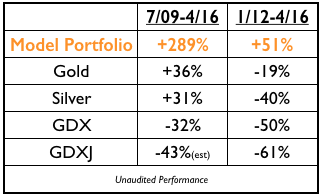

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but we have crushed the benchmarks and competition since we started our model portfolio nearly 7 years ago.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling.

Consider a subscription today as you will receive all of our recent company reports (18 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|