|

Here are the links from this past week...

Gold Stocks: Extended More Upside Potential

Penned on Friday. Gold stocks are getting quite overbought but still have some near term upside potential.

Video: A 1942 Type Low in Gold Stocks

In this video I compare the epic 1942 low in the stock market to the recent low in gold stocks.

Fat Pitch Weekly Market Summary

Great info on the stock market with lots of charts and data.

This Indicator is Flashing a Bear Market Warning

Jesse Felder covers margin debt.

Calafia Beach Pundit: Chart Updates

A number of great charts of economic data and markets.

Checkout a few new gold related blogs. Simple Digressions and Fi Fighter.

Premium Snippets

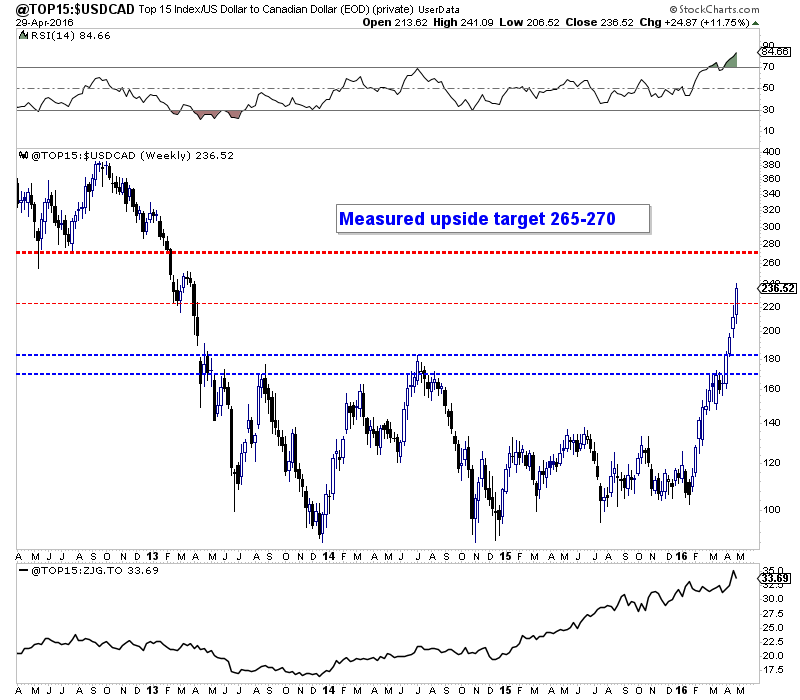

Chart 1: Top 15 Index Weekly Candlesticks

The Top 15 index has been on fire. It gained another 11.7% this past week and pushed above a little resistance around 220. It closed at 236. The breakout from 180 has a measured upside target of 270 and that happens to mark the double bottom support from 2012. That marks another 14% upside which is inline with GDX. GDXJ has more upside as it has more beta than the Top 15 index.

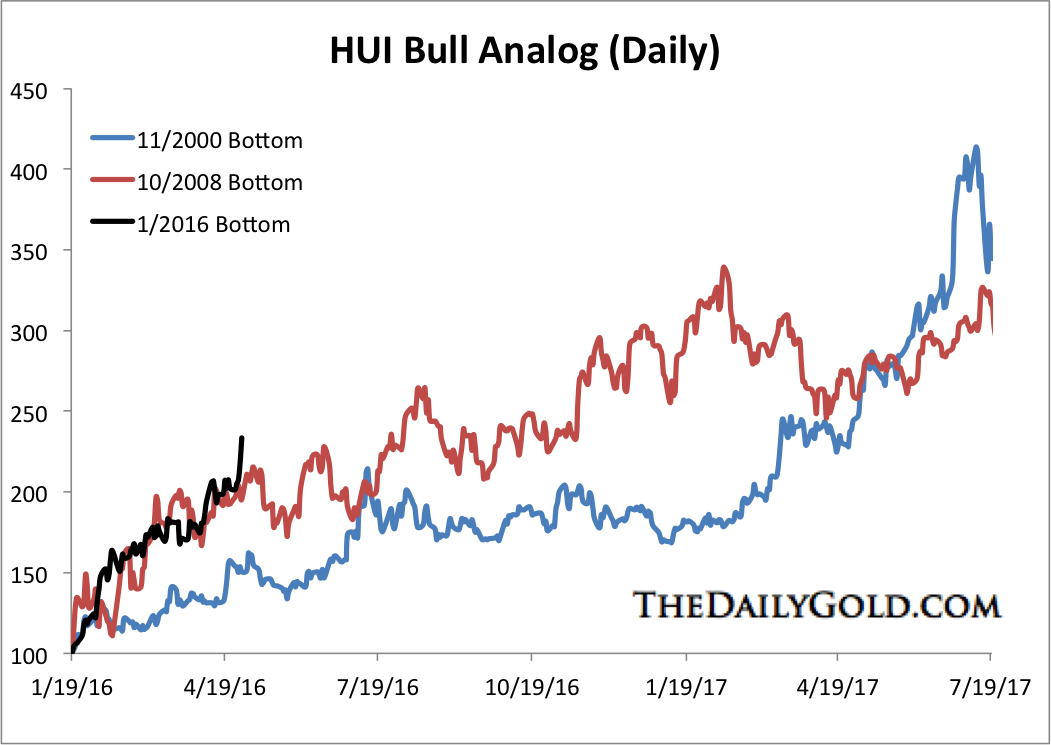

Chart 2: HUI Bull Analogs- Daily data

This rebound is now ahead of the pace of the 2008 rebound and well ahead of the 2000 rebound. There are many reasons to think the performance from this bull will exceed the other two. It may continue to over time but we cannot deny that things are extended right now.

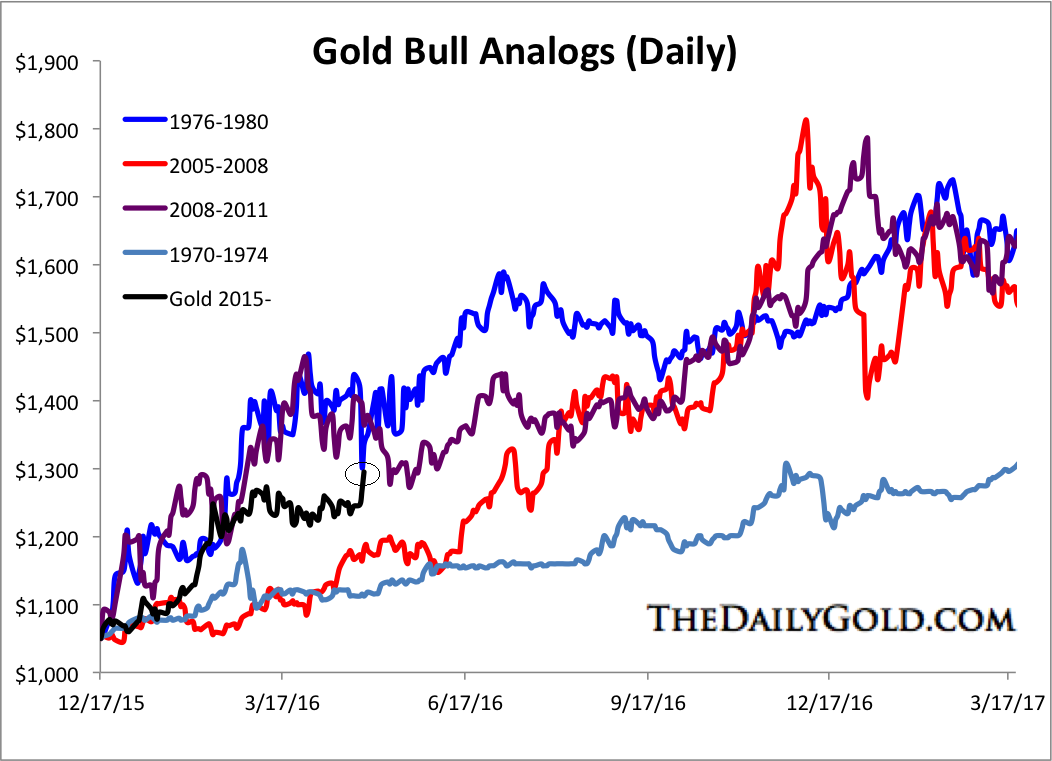

Chart 3: Gold Bull Analogs- Daily data

In this chart we plot Gold's rebounds from the 1976, 2005, 2008 and 1970 lows and put them on the scale of the December 2015 low. Note that Gold's recent rebound is in black and the circle shows its current position.

If Gold can reach $1400, my medium term target within the next two months then it will be fairly close to the two largest rebounds, 1976 and 2008. And if Gold can reach $1400 in the next few months then it probably has a chance to reach $1500-$1550 before 2017.

After the action of the past two days the gold stocks are very overbought and if they continue higher unabated to the upside targets then they would become dangerously overbought. There is a risk of a blowoff move in the next week or two. I'd prefer to see a little correction now as it would raise the upside potential to resistance and help those who would buy in on that weakness. However, if the gold stocks push higher this week then the odds of a 25%-30% correction into

June will increase.

Regardless, I will continue to hold my stocks. I may sell one or two and buy a hedge to cushion the blow of big correction. Even in that scenario I am holding the vast majority of my positions. Instead of being 95% net long I might be 50% net long.

If we were heavy in cash, we would buy a few things which we noted in TDG #463, a 34-page update sent Saturday. Otherwise its best not to chase strength and wait for a correction. The update included a report on a company that recently corrected 21% after a huge move. This company has huge insider ownership and the founder of the company sold two companies in the last decade. We took advantage of the correction.

If you missed this rebound do not worry or panic into stocks that have gone vertical. Have patience and realize that there will be a buying opportunity in the next few months. Just wait for the companies to correct 20% because they will and likely fairly soon.

If you are unsure of which companies are the best buys or which companies have the best risk reward, our research and guidance can help. In addition to our exhaustive technical and sentiment research we usually provide on two or three company reports per month. These are not fluff reports. These are around 1500 words and we project potential price targets based on valuations and various Gold prices.

Since the summer of 2009 our model portfolio is up nearly 290% while GDX has lost 31% and GDXJ has lost an estimated 45% and Gold has gained 37% over that period.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling.

Consider a subscription today as you will receive all of our recent company reports (18 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|