|

Here are the links of the week....

Gold Looking Vulnerable While Gold Stocks Correct

My article penned Thursday. A few things with Gold concern us. The miners are of course correcting and it could be a significant correction.

My Favorite Microcap Silver Company

Click the link to read my report on this company.

Video: Stock Market & Impact on Gold

Links directly to YouTube video. The Gold/Stocks ratio looks bad and part of the reason is because the stock market is moving higher after digesting recent gains. Video was recorded several days ago.

Checking in on the China Gold Fix

From Steve Saville. Always a go-to analyst for analysis on these types of gold topics.

Risk Aversion Still Order of the Day

Excellent blog post from an economic blog which includes more than a handful of informative charts. Note how closely Gold follows Real Yields (inverted).

Premium Snippets

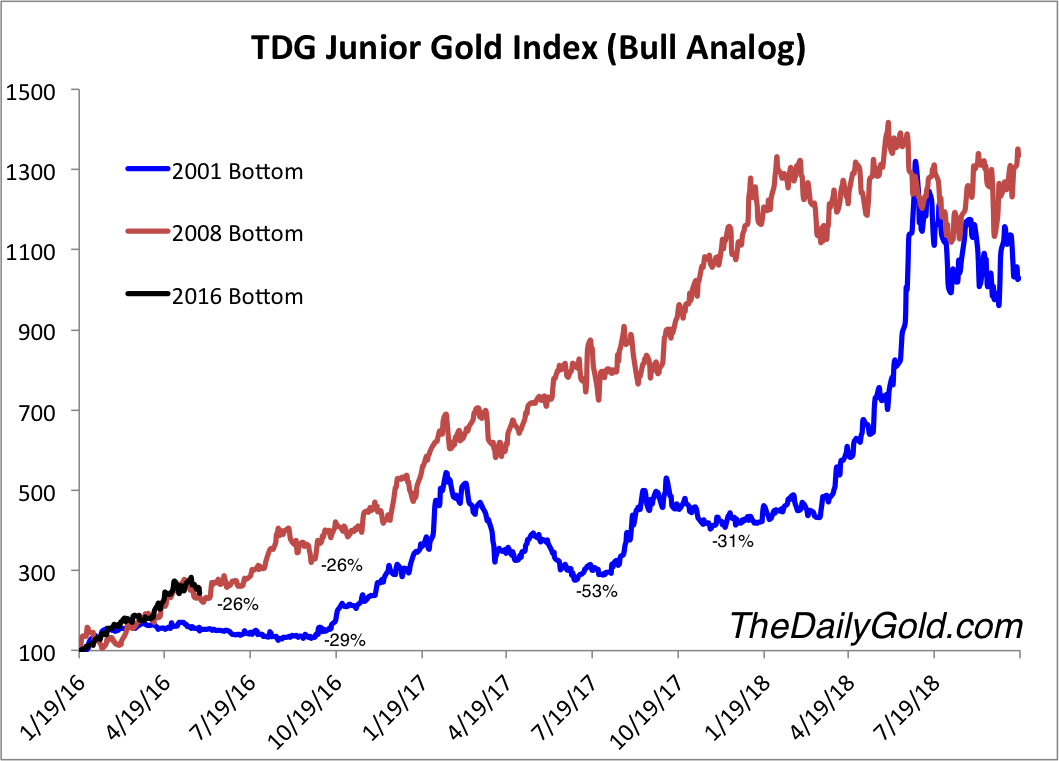

Chart 1: TDG Junior Gold Index Bull Analog

Note the percentage decline of each correction. My guess is that the 29% and 53% corrections, each about 5-months long could instruct as to what we can expect from the current correction. It was off 16% at the low of the week.

Given the weakness I see in Gold and how overbought the miners became, I doubt this is a quick correction followed immediately by a move to new highs like in 2008. Its possible but I see a multi-month 30% correction as more likely. A 50% retracement of the gains equates to a 33% correction. The 29% correction in 2001 retraced 50% of the previous gains.

Although we have a bearish outlook in the near term, we noted in TDG #467 the risk of being out of the market. Because of a hedge we are only slightly net long. That hedge can be sold or sold and bought back at any time. However, if one sells what should be core holdings then they have to buy them back at somepoint. Trading in and out of a bull market is risky because you can easily miss the big moves. The 2001-2004 move was over

7-fold in the HUI and 13-fold in our Junior index.

For those on the sideline, buying 20%-25% declines in quality companies will work quite well. Even if a stock corrects 30% and you buy it down 20% that remains a very good entry point. If you buy that kind of weakness then you will be able to ride out these types of corrections while being well positioned for the next leg higher whether it comes in a few months or 5-6 months. We have to keep things as simple as possible because it is extremely difficult to buy, sell and hedge at exact

highs and lows.

TDG #467 also included an updated report on a junior gold producer that has performed quite well. The company has one of the best operating projects (in our opinion) and figures to be a takeover target over the next year or two. It fits into the quality category.

Last week we wrote about quality vs optionality:

Our model portfolio (our own investments) focuses on quality and then some optionality plays. Quality deposits will be acquired (like the deposits owned by Lakeshore Gold, True Gold and Kaminak) and that provides some level of safety and a good exit strategy. The best optionality plays, if bought at lows and during corrections can produce tremendous gains. Just look at how well these performed in recent months.

The optionality play we teased last week, who is a new sponsor is Sandspring Resources who owns the 10M oz Au Toroparu project in Guyana. The company's 2013 pre-feasibility study showed an after tax internal rate of return of 23.1% at $1400 Gold. (Generally we want to see +20%).

When we bought the stock in February its enterprise value was only $18 Million. It is pretty simple. At $1100-$1200 Gold the company is not worth much. But at $1500 Gold it is worth a lot more. I really like the optionality in this company and the company has the backing of Silver Wheaton and Frank Giustra. An interview with the company and my premium report will be coming in the near future.

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but over time we have strongly outperformed the benchmarks and competition since we started our model portfolio nearly 7 years ago. At its peak a few weeks ago the model portfolio was up over 300% since 7 years ago while gold stock indices are still in the red by a good amount.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling.

Consider a subscription today as you will receive all of our recent company reports (18 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|