|

Here are the links of the week....

Are Junior Stocks Following the 2008-2009 Recovery?

Penned Friday, during that upside explosion.

Podcast: Interview with Sandspring Resources CEO Rich Munson

Sandspring boasts a 10M oz Au asset and financial backing from Silver Wheaton and Frank Giustra. It is one of the best gold optionality plays.

Podcast: Analyst Joe Mazumdar Talks Quality vs. Leverage

Joe is the co-editor of Exploration Insights, a highly respected publication. He talks about the strategy of buying companies with quality assets vs. companies with strong leverage to higher prices.

Asset Returns & the Global Economy

The latest post from Tiho Brkan @ SSOL Blog. Contains many econ and market related charts.

June Macro Update: Employment Data Weakens

Very informative post from the Fat-Pitch Blog. Lots of great charts and informed commentary.

Why the Fed is Trapped: 1% Rise in Rates = $1.4 Trillion in Losses?

From ZeroHedge.

Premium Snippets

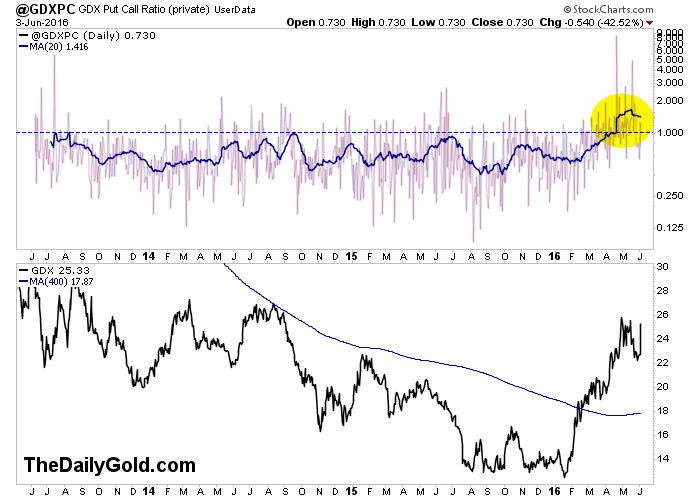

Chart 1: GDX Put-Call Ratio

Sometimes put-call ratios can give great contrary signals, sometimes not. Over the past few years the GDX put-call ratio has not given workable signals. However, one point I want to note is the recent large increase in the put-call ratio. (Note, we smooth the data with a 20-dma in blue). Note how the put-call ratio never went above 1.00 until this recent rally. It hit roughly 1.75.

This may not tell us anything about the short term but for me it is a general positive. As bulls we want to see this kind of skepticism in the market.

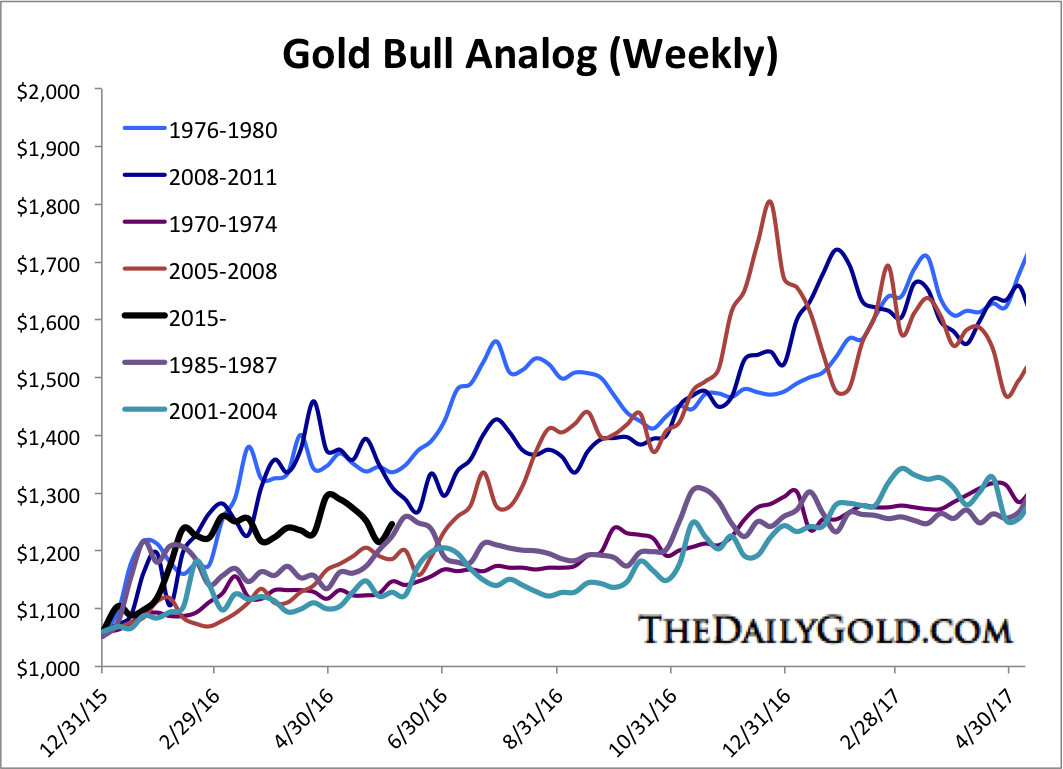

Chart 2: Gold Bull Analog-Weekly

We know that there is key resistance at $1300 and the next key resistance is $1375-$1400. If Gold can continue to hold $1200 then it has a chance to break $1300 and run to $1375.

The 3 strongest cyclical moves in Gold (based on this scale) hit $1500 before the end of the year. A technical move to $1375-$1400 makes sense and so does a move to $1550 if Gold breaks $1400. Time will tell if Gold picks up with the three strongest recoveries or if it continues at a gradual pace like the others. The miners should continue to lead.

What a difference one day can make.

We were worried about a longer and deeper correction and our work shows that, what is now a bullish consolidation could or should continue in the weeks ahead. We would like to see that as it would help correct the overbought condition in the miners and give more sustainability to another move higher. Even if the miners corrected 10% and filled their gaps they would not be at new corrective lows! So we'd bet on the low in price being in. It was about a 17%-18% correction. In any

case I think miners will spend some time digesting that one day wonder.

In TDG #468, a 30 page update we included an updated report on another junior producer (3rd one in 3 weeks) and provided updated comments on two stocks. I do not want to give too many hints on one but it is an exploration company that could have a real quality deposit. I happen to like what I see and I like the chart also. As Joe Mazumdar said there are not many of these assets out there.

The other company we commented on was Sandspring Resources, our new sponsor.

We also added to our holdings on Friday. From high to recent low the stock declined over 30%. Sure, that could turn into 35-40% but it is more unlikely than not. If Gold breaks $1300 and reaches $1375-$1400 then Sandspring should have some real legs here as $1300-$1400 could be considered the "strike price" on this optionality play.

Their PFS showed cash costs of $700/oz but that was with Oil at $100. Run the same study at current oil and the cash costs might be $625-$630/oz. The company is working on a feasibility study which is obviously more definitive than a PFS.

For being an optionality play, the project is not that far out of the money and the company is backed by Silver Wheaton and Frank Giustra. Furthermore, the company is valued at less than $5/oz in the ground and roughly $10/oz in the ground when considering only proven and probable reserves. Let me know if you find something with this much value, that has some legitimate financial backing and has a "strike price" of roughly $1400/oz.

What happens to Sandspring if Gold goes to $1500?

Anyway, Sandspring is an optionality play. As we said, we own a mix of quality and optionality with a greater emphasis on quality. Optionality plays are more risky. Much risk is priced out of Sandspring though and it should do really well if Gold goes materially higher in the next 6-12 months. If Gold does not pass $1300 this year then the stock will probably struggle.

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but over time we have strongly outperformed the benchmarks and competition since we started our model portfolio nearly 7 years ago. At its peak a few weeks ago the model portfolio was up roughly 317% with Gold up only 36% and GDX down 36%.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

Consider a subscription today as you will receive all of our recent company reports (18 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|