|

Here are the links of the week....

Gold Stocks Retreat at Resistance

Penned Friday as miners reversed at resistance.

Podcast: Dan Norcini Analyzes Gold, Silver & Commodities

Professional trader Dan Norcini covers quite a bit in this interview. You can follow him at traderdan.com.

Video: Quality vs. Optionality Strategies

In this video we comment on each strategy/theme and what to look for with respect to finding investments in both themes.

Macro & Credit: Road to Nowhere

Excellent post from the Macronomy Blog. A few comments on Gold are included but it covers mostly macro and credit. It's a long post, you won't be able to skim through it.

SoberLook: US Labor Markets Take a Turn for the Worst

Great post which includes a number of charts on the labor market.

Gold & Keynesian Death Spiral

Another good post from Steve Saville.

Premium Snippets

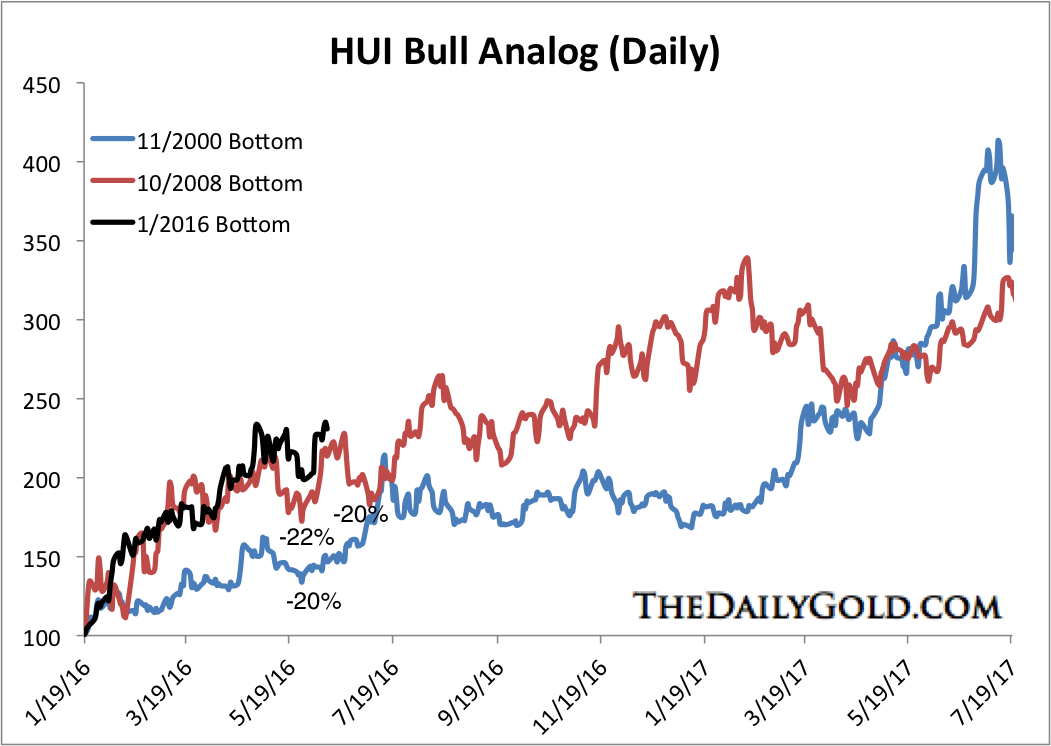

Chart 1: HUI Bull Analog (Daily)

The HUI corrected 18% at exactly the same time as the 22% and 20% corrections in the other series. The 2008-2009 analog had a 20% decline at this point in time. The price action tells me that miners are likely to correct in the days ahead and perhaps consolidate for several weeks. That fits with the 2008-2009 analog.

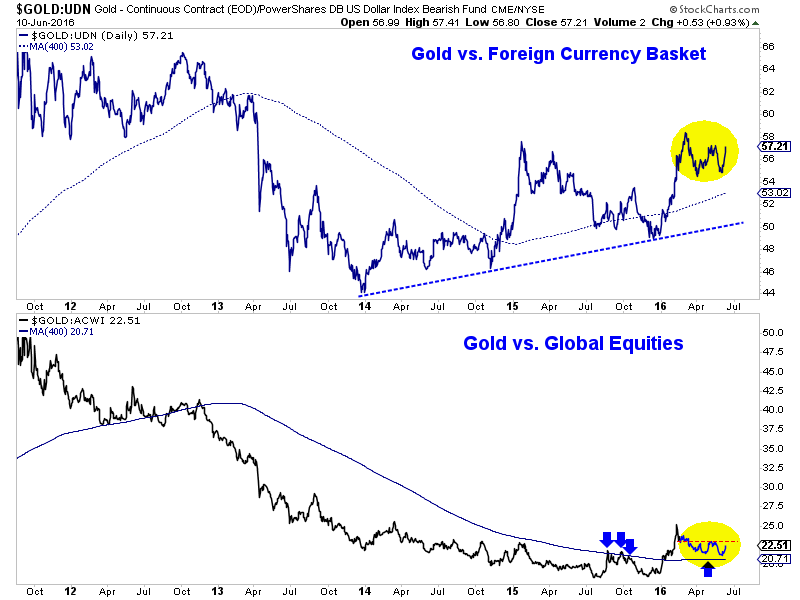

Chart 2: Gold vs. Foreign Currencies & Gold vs. Global Equities

In recent months Gold has been weak in real terms but is showing signs of promise again. The first chart plots Gold against the US$ index basket. The chart has formed somewhat of a W bottom. We will see if that holds up but it is a good sign to see the huge surge digested well. Last year the chart surged but by July it had fallen apart.

Meanwhile, Gold/Global equities bounced near support. If it can takeout its April and May high then that is a very bullish sign.

If we are correct and miners correct then those with cash should take advantage. If GDXJ tests the open after the employment report it would correct 12%-13%. I see the risk of a consolidation as more likely than a big correction here. In any event, buying weakness makes sense.

In TDG #469, a 30 page update we updated a report on a junior producer that will become a mid-tier in a few years and provided extended commentary on 3 other stocks we own including one of our other favorite optionality plays (next to Sandspring). We also commented on a stock we own that has been on fire because it has made what could become a major, major discovery. We are hoping that stock corrects so we can buy more.

In the update we also discussed major resistance targets for GDX, HUI and Gold that could mark the start of the first real counter-trend move in this new bull.

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but over time we have strongly outperformed the benchmarks and competition since we started our model portfolio nearly 7 years ago. At its peak a few weeks ago the model portfolio was up roughly 317% with Gold up only 36% and GDX down 36%. I don't have the numbers in front of me but Friday the portfolio

closed at a new all time high, surpassing the one from several weeks ago.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

When you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Consider a subscription today as you will receive all of our recent company reports (18 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|