|

Here are the links of the week.....

Gold Stocks Following Bull Analogs

The analogs are calling for a +20% correction now. Gold stocks were down 13% at last week's low. Will it continue?

Interview with CrushTheStreet

The interview was conducted on Thursday. We talk about Gold, Gold Stocks as well as the stock market.

Interview with WallStforMainSt

I enjoyed this interview as we discussed things beyond the technicals such as the recent acquisitions in the Gold sector, jurisdictional risk and why many companies need to acquire high margin deposits.

Fund Managers Survey for May

From the Fat Pitch Blog. Great data and charts from the survey.

Money Management & The Gold Mining Rally

Very good post from Steve Saville.

Premium Snippets

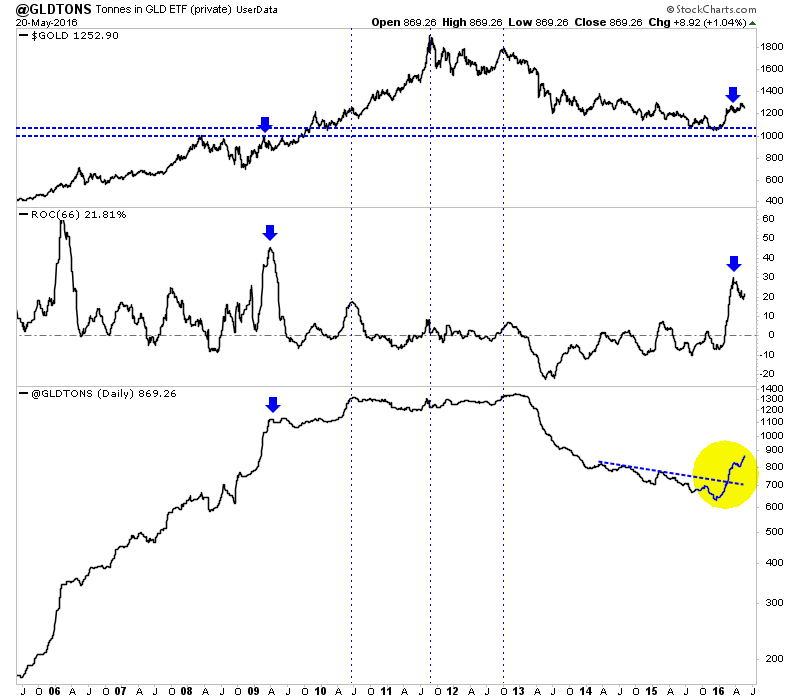

Chart 1: Tonnes in GLD

The chart below plots, Gold, the quarterly rate of change in Gold in the GLD and Gold in the GLD.

Note how GLD's inventory of Gold, currently 869 tonnes has been somewhat of a leading indicator. Demand for Gold as evidenced by GLD's inventory was very strong from 2005 into 2010. Note how it continued to increase even after Gold's 2006-2007 consolidation and 30% correction in 2008. Then demand was relatively flat from the middle of 2010 to 2012.

The point here is that if GLD keeps adding Gold, as has happened, it is generally bullish. Certainly Gold could correct or continue to be range bound. But if GLD's inventory remains firm or continues to increase, then its bullish. The recent surge in demand, when measured on a rolling 3-month basis has been the second strongest in the past 10 years.

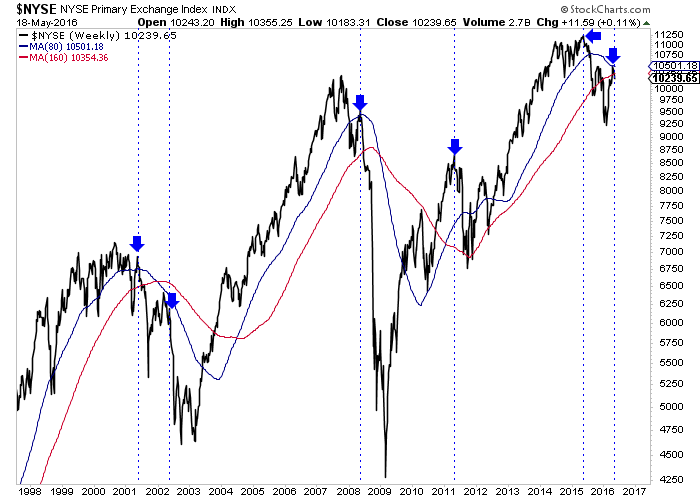

Chart 2: NYSE Composite w/ 80 & 160-week moving averages

The NYSE is a much broader index than the S&P 500 and it shows that the stock market is at a critical juncture. The market could be ripe for a decline. The NYSE recently failed at its 80-wma at the end of April. We highlight the times the NYSE peaked in April/May. In 2001, 2002 and 2008 the NYSE peaked in spring at its 80-wma.

Breadth right now is better than it was in those other periods. If we are going into a bear market then it likely will be closer to 2000 than 2008. Because of stronger breadth, it is possible the market will only have a slight decline and not break the February low. However, my point is clear. The stock market is very ripe for a decline in the months ahead. If the NYSE can move above 10,500 and stay there, it would be a good sign.

In a bull market you can buy or hold with a third option being selling or hedge. As Steve Saville wrote, it is always important to maintain a core position. If the miners push higher to those major resistance targets (2014 highs) then I would likely hedge. If not, I can ride out a routine correction (20%) and even some consolidation. In any case I expect a buying opportunity in June or July. Now is time to hold. Keep things simple.

We took full profits on Kaminak Gold, which was acquired by GoldCorp and we also trimmed our holdings in an underperforming company. So we have a bit more cash and we intend to put that to work when there is an opportunity.

In TDG #465, a 36-page update, we among other things answered a few subscriber questions, discussed some reasons why we may get the 20% correction this time and included an updated report on one of our favorite junior producers. This company has performed well but if it executes on its 2016-2017 objectives then it could be a huge winner.

We also will introduce you to a new sponsor company next week. This company is an optionality play that we bought a few months ago because it was very cheap. Even right now its enterprise value per oz Au in the ground is about $3.50/oz. Key resistance for Gold now is $1300, $1400 and then $1550. If Gold could break $1300 and then $1400, this stock would likely fly. Can you guess the company? Email me!

Our model portfolio (our own investments) focuses on quality and then some optionality plays. Quality deposits will be acquired (like the deposits owned by Lakeshore Gold, True Gold and Kaminak) and that provides some level of safety and a good exit strategy. The best optionality plays, if bought at lows and during corrections can produce tremendous gains. Just look at how well these performed in recent months.

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but over time we have strongly outperformed the benchmarks and competition since we started our model portfolio nearly 7 years ago. At its peak this past week the model portfolio was up over 300% since 7 years ago while gold stock indices are still in the red by a good amount.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling.

Consider a subscription today as you will receive all of our recent company reports (18 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|