|

Here are the links of the week....

Jason Zweig- Still Wrong on Gold

Zweig was the guy who called Gold a pet rock. He's at it again. We respond, noting his complete ignorance of Gold's true fundamentals.

Video: Gold Investment Demand & Gold Price in Foreign Currencies

We talk about GLD as a proxy for real time investment demand. Gold is currently only 8% off its all time high against foreign currencies (inverse of US$ basket).

Tiho Brkan: Asset Prices are About to Correct

Tiho's latest.

Silver Linings

The latest from Erik Swartz at Market Anthropology. He can be verbose but he is one of the very few people who nailed the 2011 top in precious metals and turned bullish in 2015.

The Hyperinflation & Deflation Arguments are Both Wrong

From Steve Saville. I really enjoy his work.

Premium Snippets

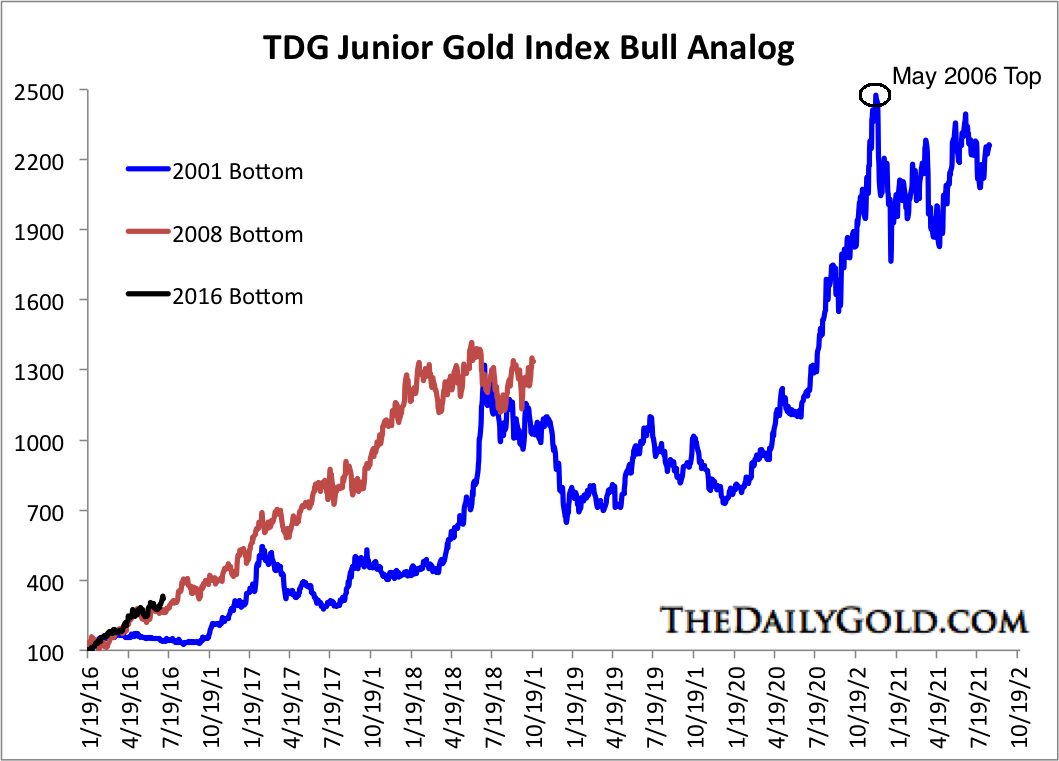

Chart 1: Junior Bull Analog

In this chart we have only shown the 2001 to 2004 move as it corresponds well in terms of time with the 2008 to 2011 move. Yet, if we show 2001 to 2006 it shows a major difference. The 2001 low was more significant than the 2008 low as far as long-term performance. The recent low obviously is more in tune with the 2001 than 2008 low.

From 2001 to 2006 the junior index was nearly a 25-bagger! Also, our junior silver index gained roughly 10-fold from 2004 to 2007. If we replaced the index with silver juniors at the 2004 low then the original index would have peaked near 6500!

The bottom line is there is still huge long-term upside potential in the junior gold sector. You just have to know where to look, pick the right companies and accumulate on weakness. That will lead to outperformance.

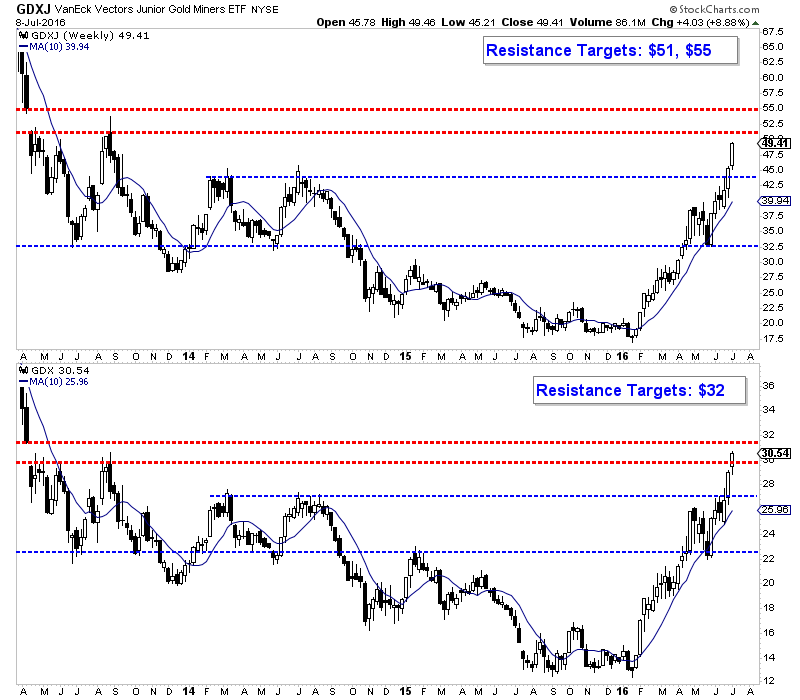

Chart 2: GDX and GDXJ Weekly Candles

The gold stocks have made huge gains over the past three weeks and are nearing key resistance targets. GDXJ, which closed at $49.41 is very close to $51 and even $55 while GDX, which closed at $30.54, is a hair from $32.

The miners are ripe for a 10-15% correction. I would not be surprised to see them hit the upside targets then correct.

These two charts are a decent sized snippet of TDG 473, a 31 page update sent to subscribers. The update included an updated report on one of our favorite holdings (which we are hoping corrects so we can buy more) as well as our thoughts on the short-term outlook and the one stock we would buy (for new portfolios).

For those on the sideline we sense a buying opportunity sometime this month. The sector has been on fire and we do think it is ripe for a correction soon. That being said, because we think this rebound continues to $1550 Gold, we don't feel the need to hedge or sell. The reason to sell if fundamentals change (for that company) or if you want to replace a holding with something better.

For new readers we will reiterate what we wrote last week:

With respect to putting money to work now, and this goes for those who are not invested enough, we would look for a combination of things. First, look for things that have not gone straight up. One could look for things which have consolidated since early May. Fundamentally, look for companies that are undervalued or can add more value in the next 6-9 months. Examples include but are not limited too: production growth, a growing resource, a big drill program with potential. Look for

things that are not really priced into the market. With respect to optionality plays we want to look for companies that have not surged in recent weeks and have an asset that would gain much value at $1400 Gold and $1500 Gold.

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but over time we have strongly outperformed the benchmarks and competition since we started our model portfolio almost exactly 7 years ago. As of Friday's close our model portfolio was up 396% in that period. Our junior index gained 115% while Gold gained 43% and GDX lost 20%.

Past performance is no guarantee of future performance but we are confident we will outperform over the long-term.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is a lot more expensive than what we provide.

Consider a subscription today as you will receive all of our recent company reports and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|