|

Here are the links of the week....

Video: What Brexit Means for Gold..

Published Monday.

2014 Resistance Holding Gold Stocks After Brexit

Article published Friday. Gold Stocks remain below 2014 weekly resistance.

Interview with Dan Norcini

Dan and I discussed Brexit and Gold, Silver and interest rates. Find Dan at traderdan.com.

Precious Metals Video Update

Recorded before Brexit.

Greg Weldon Slides/Presentation

From three weeks ago but Greg Weldon's work is always top notch.

Premium Snippets

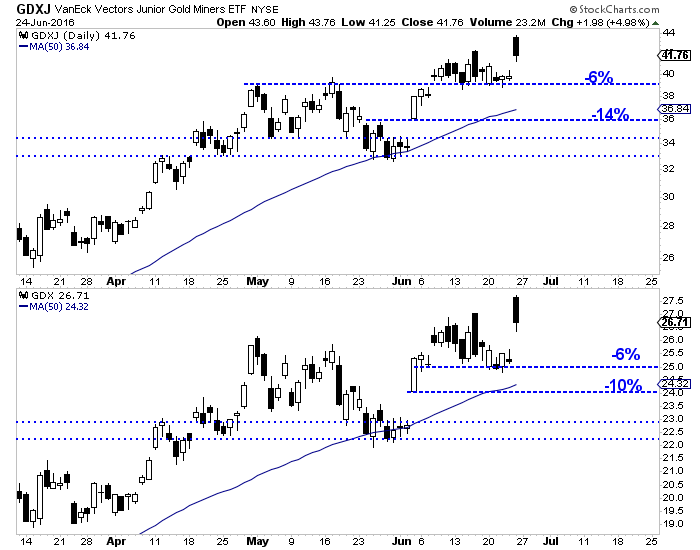

Chart 1: GDX & GDXJ Daily Candle

The weekly candle chart in our editorial shows the clear resistance facing the miners.

The daily chart below shows the bearish candle that formed on Friday, the clear gap from Friday and my support targets. The first two support targets mark a 6% and 14% decline for GDXJ and 6% and 10% decline for GDX. If that second support gives way then miners would fill the gap from the employment report. That is a pretty good decline yet miners would still be in good shape.

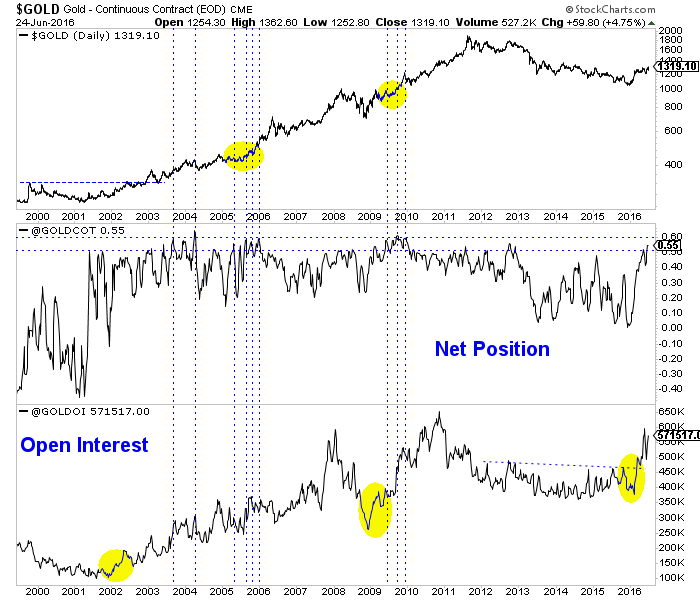

Chart 2: Gold CoT

The chart below shows Gold's CoT and specifically its net speculative position and open interest.

We've debunked conventional wisdom on the CoT in previous emails, editorials and in this video over 3 months ago. Yet Friday there was more fear mongering over the CoT and "record all time high speculation in Gold."

As most of you know we measure the net spec position against open interest as it allows a consistent comparison with the past. The net position is currently 54.6%. During the bull years the position often peaked at 50% to 60%.

However, note the vertical lines and specifically the yellow circles. Those were some of the highest points of speculation (by my own method) yet Gold surged in the months that followed. Those yellow circles coincided with major, major breakouts in Gold. Remember 2005 when it broke to multi-decade highs? Remember 2009 when it broke above $1000?

What do you think is more significant now...the CoT or breaking past $1300? For what its worth I bet Gold retests $1300 and perhaps $1280. But I bet three months and six months from now Gold is much higher. (One thing to note is when Gold has big breakouts, the commercials can be forced to cover).

In TDG #471, a 32 page update, we updated a report on one of our holdings, which is up roughly 200% since the sector bottomed. We are up 185% on it and while it is not a great buy right now we do see more upside potential over the next few years and think it will be acquired by a major. We also commented on a few stocks we own and a few stocks we don't own.

I've been saying it for weeks but judging from our analogs and the overbought conditions we think more consolidation and lower prices are coming before a sustained move higher. We could be wrong and the stocks could keep rising but I think the probabilities favor Gold retesting $1280-$1300 and miners also correcting and consolidating.

That being said, a lot of people are looking to get into the sector and a lot more need to get in for professional reasons. Hence, I doubt any big weakness will be sustained. Try to take advantage of 10% weakness in your favorite stocks (unless it is extremely overbought in which case you can afford to be more patient).

The big money will be made by buying holding. Thus, buy and hold and buy weakness if you can. Previous opportunities have been very hard to come by but I sense we may get a decent opportunity in the next few weeks.

If you think you could use some help in navigating the sector and picking quality juniors and optionality plays then consider our service.

Our methods are not perfect and we certainly make mistakes (which we admit because that is how we learn and grow), but over time we have strongly outperformed the benchmarks and competition since we started our model portfolio nearly 7 years ago. As of Friday our model portfolio was up roughly 340% over the past 7 years. That is a time period that includes the worst bear market in the sector in 90 years. Over that period

miners lost roughly 30%.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is a lot more expensive than what we provide. Some of these guys are touting juniors when a year ago they said don't buy juniors!

Consider a subscription today as you will receive all of our recent company reports (19 now) and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|