|

Here are the links of the past week....

Gold Against Foreign Currencies Update

Penned Friday. Gold/FC has pulled back like Gold but has had a much bigger run which implies higher prices to come for Gold in US$.

Video: Next Upside Targets for Gold, Gold Stocks

Recorded on Tuesday but just as relevant today.

Portfolio Management Rules Regarding Selling

This was a subscriber report. I edited out company names in the public version.

Be on Alert for a Pop in Volatility

So says the Fat-Pitch Blog.

An Old Video for My Newer Readers: A 1942 Type Low in Gold Stocks

Why 2016 in gold stocks could be like 1942 for the stock market.

Premium Snippets

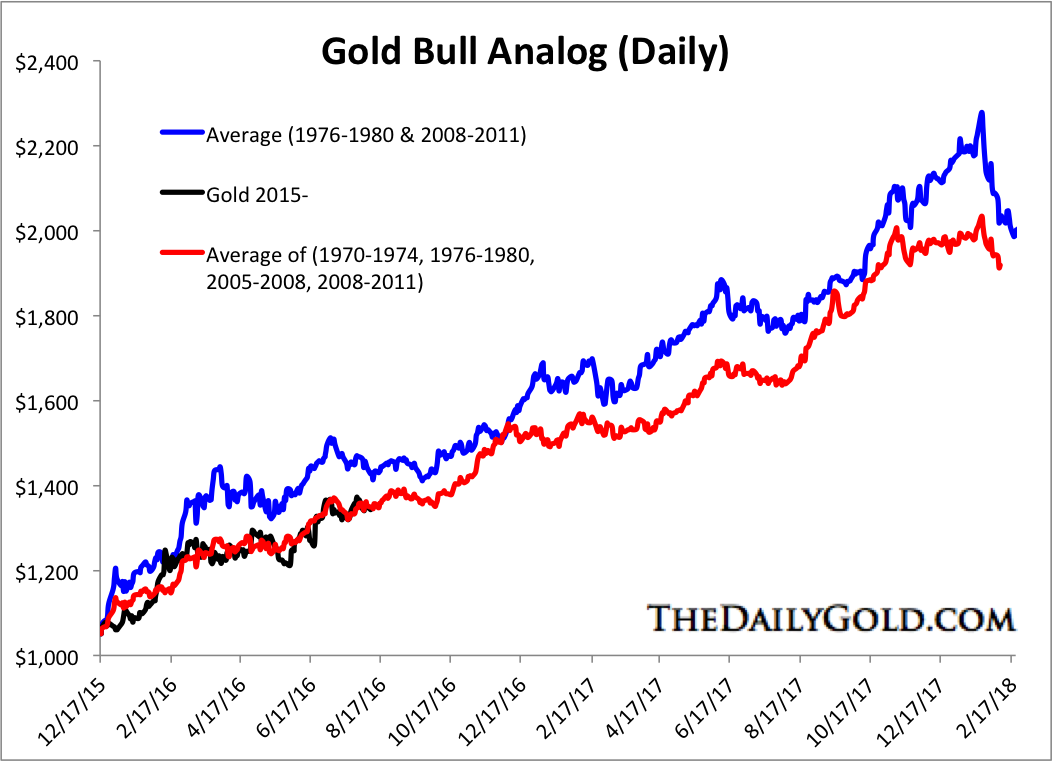

Chart 1: Gold Bull Analog (Daily)

This chart was part of a recent article I wrote but I wanted to call your attention to it in case you missed it. This is daily data. Look at how closely the current rebound is following the red line (the average of the 4 strongest rebounds in secular bull markets). It implies some very bullish things for Gold over the next 18 months!

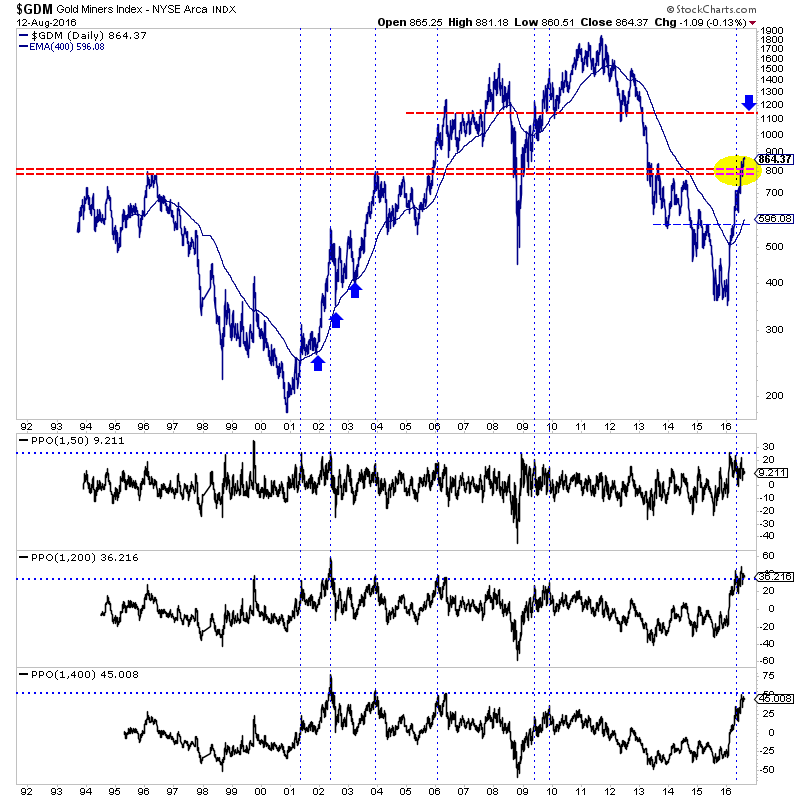

Chart 2: GDM (GDX parent) line chart

We've shown this before and this chart was the reason we were worried about a 25%-30% correction in May. Of course the sector barely corrected more than 15%.

We think the odds are at least 50-50 that the sector continues to trend higher. The blue arrow and red line is likely equivalent to ~38-40 GDX. If that happens then the oscillators at the bottom of the chart would get extremely overbought and as the sector nears big resistance. Or the sector could correct and consolidate for a month or two which would push out a larger correction.

That chart argues we should be concerned about a correction (especially if the sector breaks higher) while the Gold bull analog chart argues for $1800-$1900 at the end of next year. The junior gold bull analog chart is just as bullish.

Let's keep it simple. In a bull market you buy and hold. Ok, based on my rules (for this volatile sector) you take something off the table after a great run. Something, not all. But you buy again and hold. And make sure you have some cash to buy when the inevitable sustained correction comes. And you always have an exit plan. Mine is a 20% loss.

If you want to get my full analysis then consider subscribing to my premium service for what amounts to less than $1/day.

This is the 7-year anniversary of TheDailyGold Premium and that period of time has included the worst bear market in the sector in over 90 years. Nevertheless, the model portfolio is up roughly 440% while GDX and GDXJ are down 21% and 26% (est) in that time. (Our junior gold index above is up roughly 111%).

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential. We also want to cut our losses. A 20% stop loss on a 5% position limits the loss to 1% of the portfolio.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is way more expensive than what we provide.

Consider a subscription today as you will receive all of our recent company reports and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|