|

Here are the links of the past week....we've been out of town for most of the past two weeks and will have more podcasts & videos soon....

Correction Over, Gold & Gold Stocks Eyeing New Highs

Penned Friday Morning. Gold and gold stocks retested the recent breakout and could be up, up and away.

Video Interview with Brent Cook from Sprott Symposium

Time to Focus on Juniors?

Weekly Market Summary

Great post from the Fat Pitch Blog.

Helicopter Money

From Steve Saville.

Gold Passes Major Milestone

Gold has rebounded enough to pass a major milestone.

US Gov Entitlements- The 6th Biggest Economy on Earth

Just one of many reasons inflation is somewhere in our future.

Premium Snippets

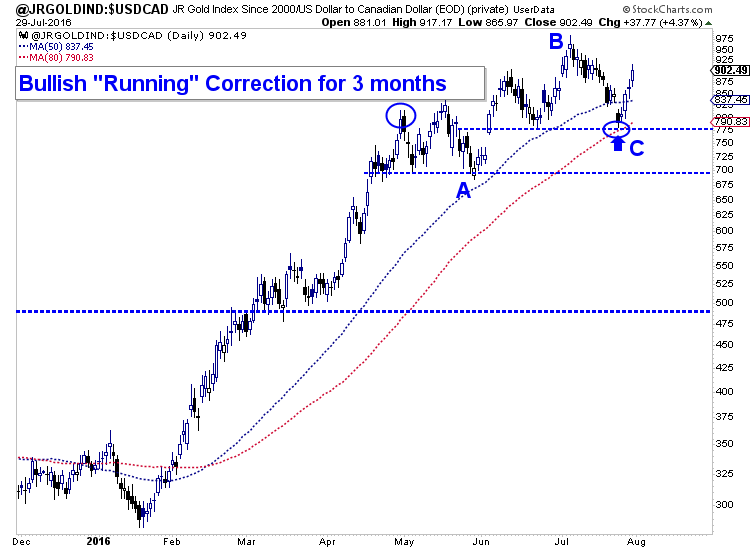

Chart 1: Junior Gold Index Daily Candle Chart

The index bottomed Monday of the past week and quite close to the confluence of support around 775. It was a 20% correction from B to C. The low also came at the 80-day moving average which was support during the strong performance in 2009 and 2010.

The important point here is that the index completed a bullish running correction. Corrections typically have three legs. Down, up down. A-B-C. Typically, the A and C legs are the strongest and C finishes well below the start of the correction. In a running correction, B goes to a new high while C finishes where A starts. It happens in very strong trends.

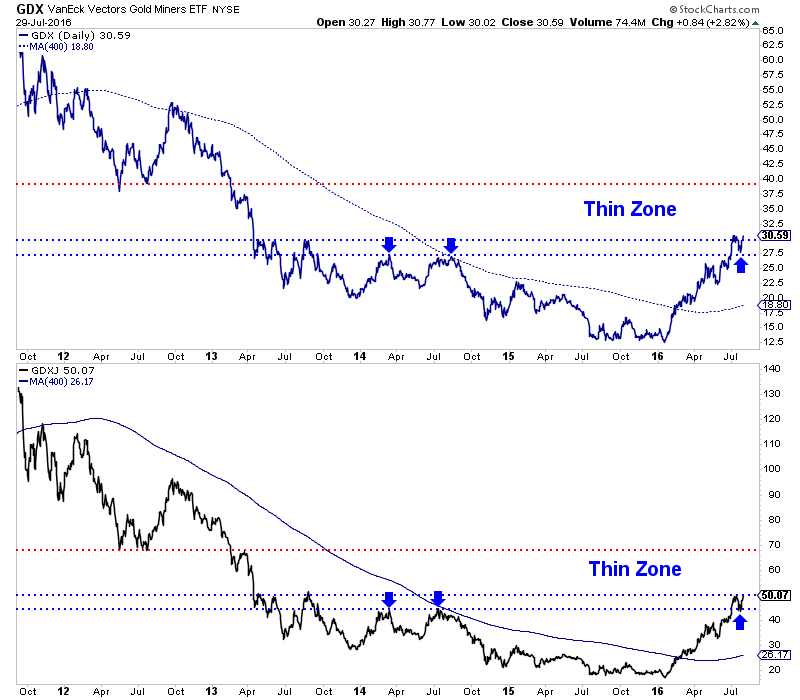

Chart 2: GDX & GDXJ Daily Line Charts

The recent correction was a retest of the recent breakout which also retested the 2014 highs. Miners are already overbought but they just corrected and with some more gains would have a very thin zone of resistance and lots of room to run.

In TDG #476, a 32 page update, we noted how bullish the technicals look for both Gold and gold stocks (which we shared above). Gold's corrective low came at $1310. It marked only a 38% retracement (the minimum) of the recent move from $1200 to $1377. Gold closed at $1357 and only $1375-$1400 stands in its way to $1500. Don't be surprised if the move to Gold $1500-$1550, GDX $40, GDXJ $70 and Silver $26 started a few days ago.

The update included comments on a handful of stocks we own as well as notes on two exploration companies on our watch list. We've covered some exploration companies in recent weeks and even bought one. The current value, relatively speaking is in the exploration companies and specifically sub $40 Million capitalization companies.

If the sector follows the path I anticipate and hits those aforementioned resistance targets then we are likely to see a real correction. It could happen during Q4 or start in Q4 and last into Q1 2017. If this happens it would give us a broad-based buying opportunity. I'm working on a report detailing how to sell and de-risk the portfolio while remaining invested. The key is to take some profits and then redeploy that cash back into the new and best opportunities that result from

the correction. Plenty of upside potential remains before we could hit those resistance targets..

If you want to get my full analysis then consider subscribing to my premium service for what amounts to less than $1/day.

This is the 7-year anniversary of TheDailyGold Premium and that period of time has included the worst bear market in the sector in over 90 years. Nevertheless, the model portfolio is up roughly 440% while GDX and GDXJ are down 21% and 26% (est) in that time. (Our junior gold index above is up roughly 111%).

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential. We also want to cut our losses. A 20% stop loss on a 5% position limits the loss to 1% of the portfolio.

We are the only credentialed technical analyst with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is way more expensive than what we provide.

Consider a subscription today as you will receive all of our recent company reports and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and be the best service in its category.

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber

questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious

metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|