|

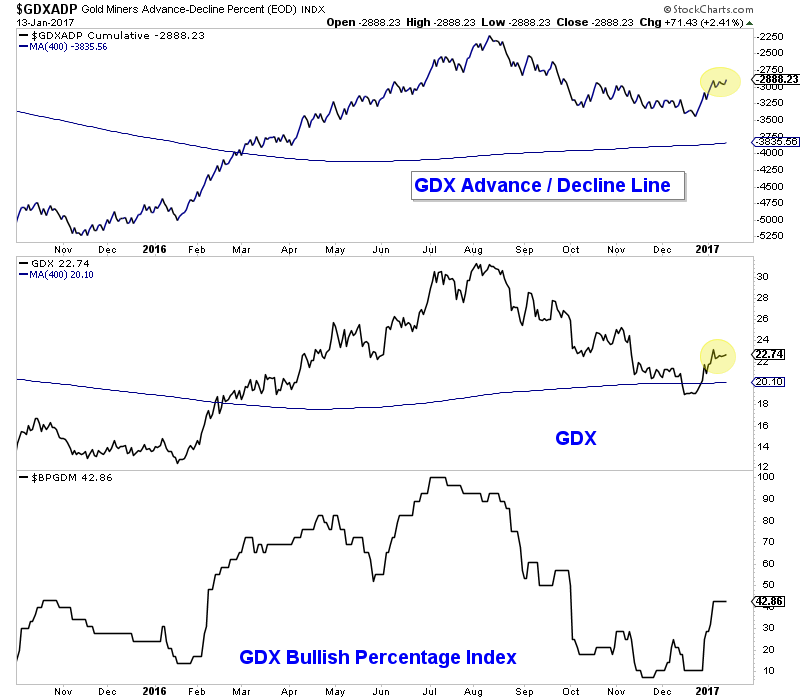

Picture 1: GDX Breadth Indicators

In this chart we plot the advance/decline line (for GDX) as well as the bullish percentage index (BPI). The A/D line is typically one of the best leading indicators. The BPI, while also a breadth indicator tends not to be a leading indicator like the A/D line.

Anyway, the A/D line is quite strong. It is at a 3.5 month high and it didn't even come close to testing its 400-dma. Also, GDX retraced 62% of its advance while the A/D line retraced only 38% of its advance.

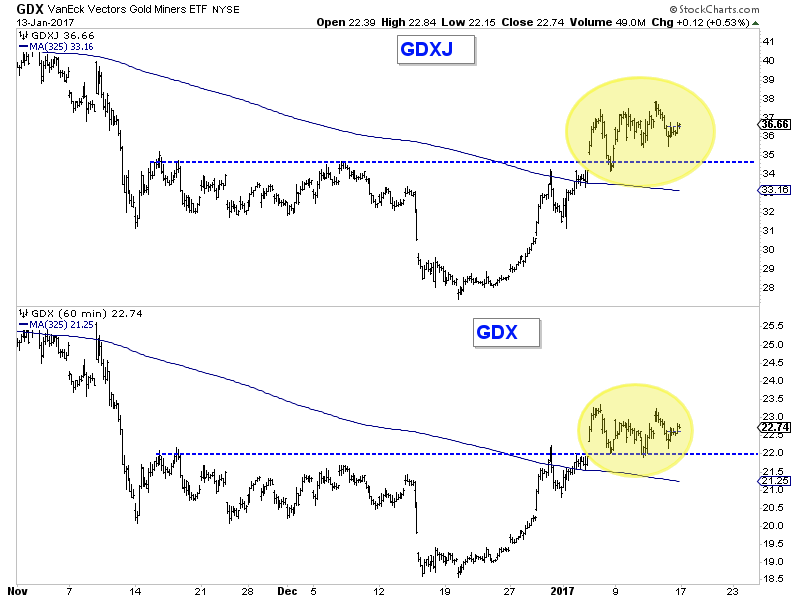

Picture 2: GDX & GDXJ Hourly Charts

These are the hourly bar charts. GDXJ is on top, GDX below.

Note the strength in GDXJ. It has grinded higher even as it has consolidated. GDX has consolidated in textbook fashion. It has held above $22 three times. Measure the consolidations and project from the start of the consolidations and we get upside targets of GDXJ $40 and GDX $25. Those targets are inline with our general targets.

In TDG #500, a 26 page update sent Sunday morning, we provided a report on one of our recent buys. It is a takeover candidate which we are up 30% on (should have bought more!) and we projected some upside targets based on some ranges of Gold prices and their project being fully permitted.

We also added a new company to our nano-cap watch list. It has an enterprise value of less than $10M and a major company owns a chunk of it.

We would like to buy another position or two as we do see some more upside for the sector. As we noted last week we are trying to buy based on fundamental quality and value. My best buys have been according to this method and not trying to time my buys perfectly. This being said, if and when miners reach $40 and $25 then we will want to be patient.

Consider subscribing to our premium service for less than $1/day.

Our service is tailored for precious metals investors who seek market timing and fundamental analysis of junior companies poised to outperform.

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential. We also want to cut our losses. A 20% stop loss on a 5% position limits the loss to 1% of the portfolio.

We are the only credentialed technical analyst (CMT, MFTA) with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is way more expensive than what we provide.

Consider a subscription today as you will receive all of our recent company reports and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and

be the best service in its category.

Click Here to Learn More

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Click Here to Learn More

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|