|

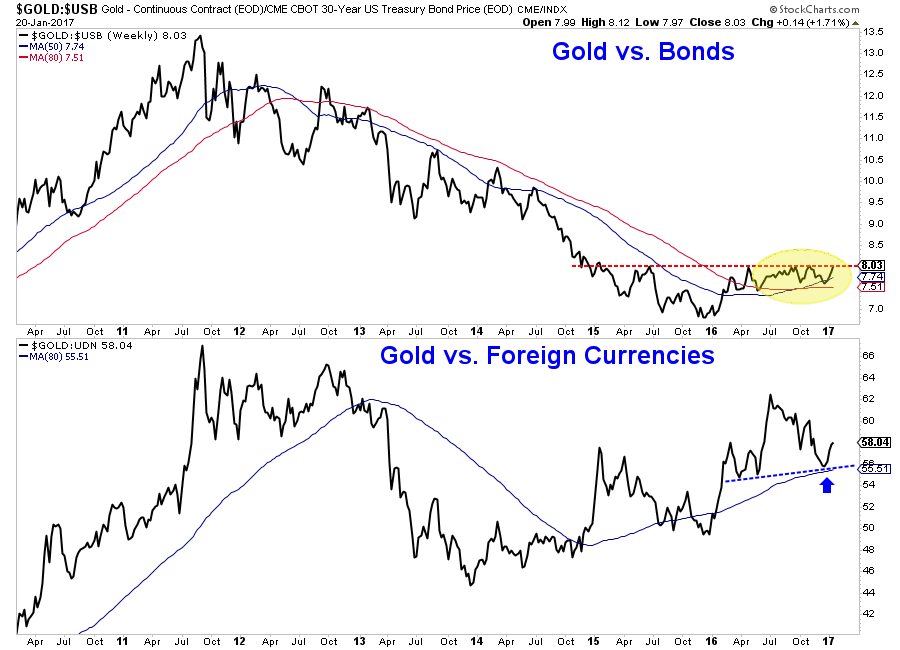

Picture 1: Gold vs. Bonds, Gold vs. Foreign Currencies

In this chart we plot Gold against Bonds and Gold against Foreign Currencies (the inverse of the US$ basket).

Gold and Bonds have been positively correlated recently and that hurt Gold when bond yields advanced aggressively. If this ratio can break to the upside now or soon then it will be a sign that rising rates would no longer hurt Gold or at least not hurt Gold as much. Meanwhile, we want to see Gold/FC extend its current rebound. It has only gone from ~55 to 58. We'd like to see it reach 60+. Otherwise it could peter out and threaten recent support.

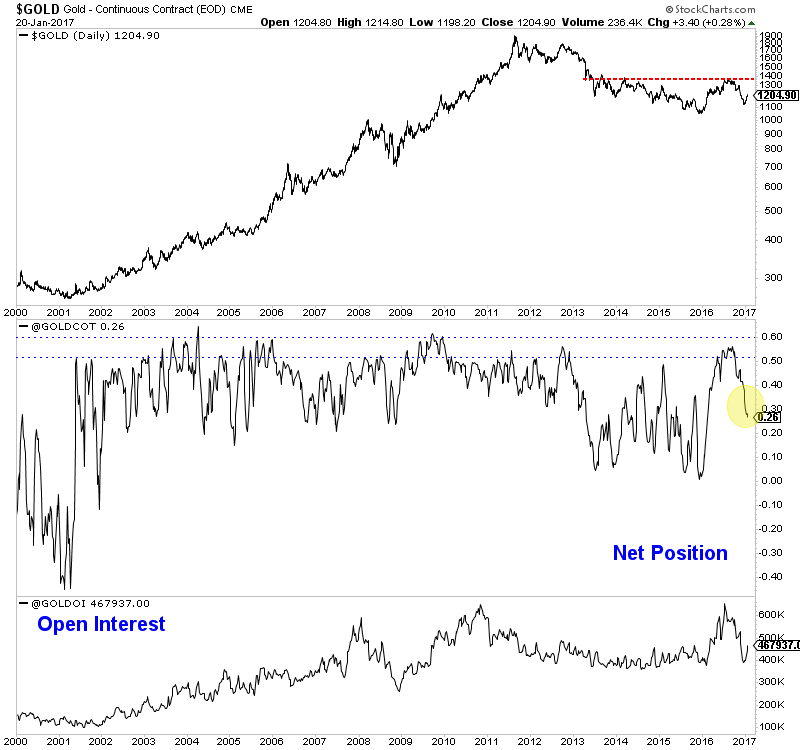

Picture 2: Gold CoT

Here we plot the daily chart of Gold along with the net speculative position and open interest.

Gold has rebounded as much as $100/oz but the net speculative position has increased by only 5K contracts (from 118K to 123K contracts) and as a percentage of open interest has decreased to 26%. I'm not sure what to make of this yet. Its certainly not bearish but it could be bullish. Is it signaling that commercial hedgers are more comfortable with $1200 Gold?

This email is going out a day late as we were busy the past few days at the Metals Investor Forum in Vancouver and we spent our limited time writing, editing and publishing TDG #501 for subscribers. It was a 25-page update that among other things included extensive comments on three companies.

One of the three we own and want to buy more of (hint- it's a company from the conference), one is on our watch list and the third is a nano-cap company that could have 3x-5x potential this year. It hasn't moved but has some catalysts coming that could push the stock higher.

The sector has had a good rally and we think it can make another push higher. We will see what happens if Gold and gold stocks test upcoming resistance. I expect the next few months to be quite interesting.

Consider subscribing to our premium service for less than $1/day.

Our service is tailored for precious metals investors who seek market timing and fundamental analysis of junior companies poised to outperform.

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential. We also want to cut our losses. A 20% stop loss on a 5% position limits the loss to 1% of the portfolio.

We are the only credentialed technical analyst (CMT, MFTA) with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is way more expensive than what we provide.

Consider a subscription today as you will receive all of our recent company reports and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and

be the best service in its category.

Click Here to Learn More

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Click Here to Learn More

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|