|

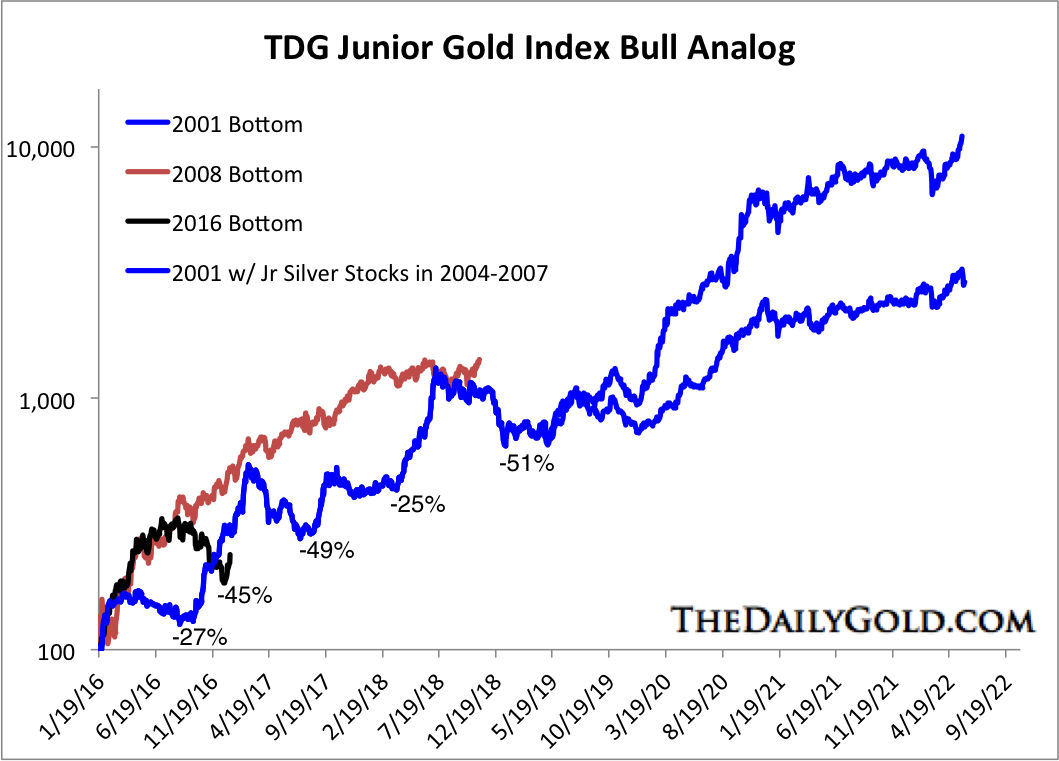

Picture 1: TDG Junior Gold Index Bull Analog

Our junior index corrected 45% while GDXJ corrected 42% and GDX 36%.

This logarithmic extends to show the full 2001 to 2007 run and we included a silver basket in 2004 to show how that would have pushed up the line to what amounts to a 100-fold gain! The real point however is to show that the 45% correction is inline with the corrections during the 2001-2007 period.

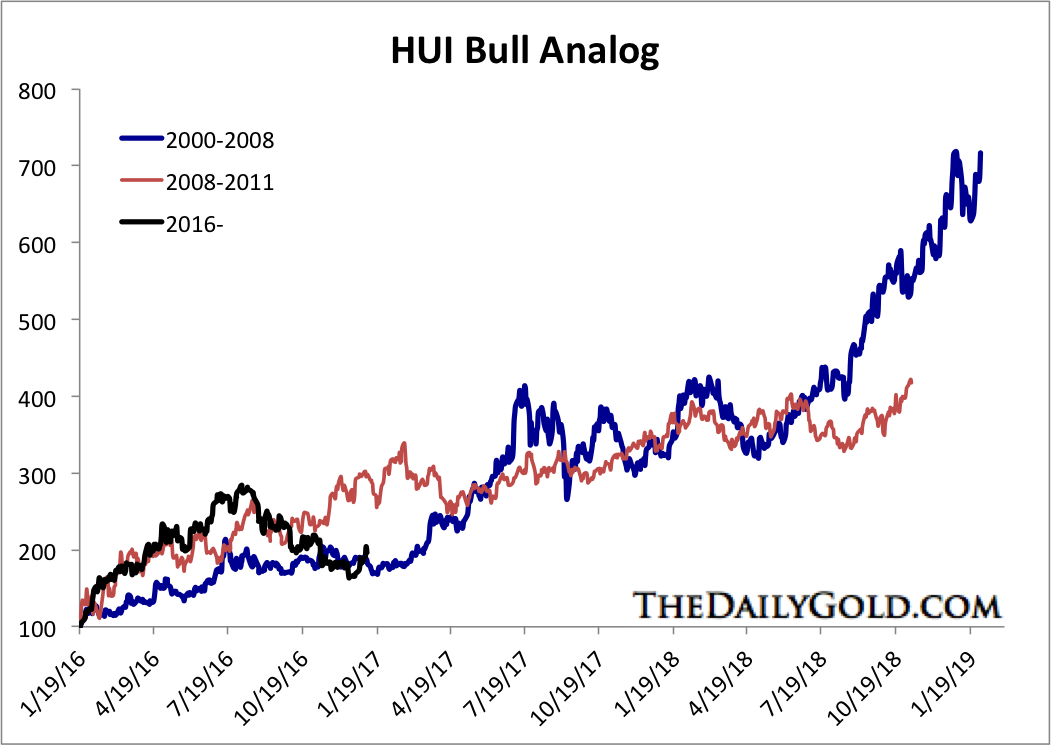

Picture 2: HUI Bull Analog

Two months ago we pointed out how Gold and gold stocks went off course. Sure, that was true and there was another two and a half months of losses. But going off course may have led to a great buying opportunity.

In TDG #499, a 27-page update sent yesterday we updated a report on one of our favorite producers. We missed a buying opportunity in this company but may get another chance this year. We believe its real outperformance will come in 2018. In TDG #498, sent last week, we provided our top 4 takeover targets for 2017 and the criteria one should look at in order to spot an immediate takeover target (versus something that could be acquired in 2-3 years).

It looks like the sector is going to rally a bit more from here. Gold could even reach $1220 instead of $1200. GDX and GDXJ look like they will test strong resistance at $25 and $40. There should be some kind of a pullback from there and then things get really interesting. Will gold stocks keep going higher or hold up if Gold breaks lower again? Could gold stocks go even higher before Gold breaks lower?

One of my failings is trying to wait for a perfect buying opportunity instead of taking advantage of "good" buying opportunities. When I look at the analog charts above and consider we are only one year removed from possibly the greatest buying opportunity ever in gold stocks, I don't want to wait for a perfect opportunity that may never come.

Anyway, I've recently bought four new "half" positions including one of those four immediate takeover targets. The other three are exploration companies that are reasonably valued and trading off their highs. These three are exploration companies that have deposits in a top jurisdiction with good grade. This is the type of quality and value I'm looking for. If Gold tests $1050/oz again and these stocks go lower, I will make these full positions, and lower my cost basis by

doing so.

Consider subscribing to our premium service for less than $1/day.

Our service is tailored for precious metals investors who seek market timing and fundamental analysis of junior companies poised to outperform.

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential. We also want to cut our losses. A 20% stop loss on a 5% position limits the loss to 1% of the portfolio.

We are the only credentialed technical analyst (CMT, MFTA) with a gold-stock focused service that utilizes a real model portfolio. We tell you what we are buying and selling. Hence, we are completely transparent.

And when you see the volume of our work and significant weekly updates you will realize that no one works harder than we do.

Our subscription cost amounts to less than $1/day!

There is so much fluff out there in this sector and much of it is way more expensive than what we provide.

Consider a subscription today as you will receive all of our recent company reports and updates within hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make money and

be the best service in its category.

Click Here to Learn More

Jordan focuses nearly exclusively on the gold sector and in my opinion does a good job either being right, or getting right when adjustment is needed. He moves forward without hype, bias or ego.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Click Here to Learn More

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|