|

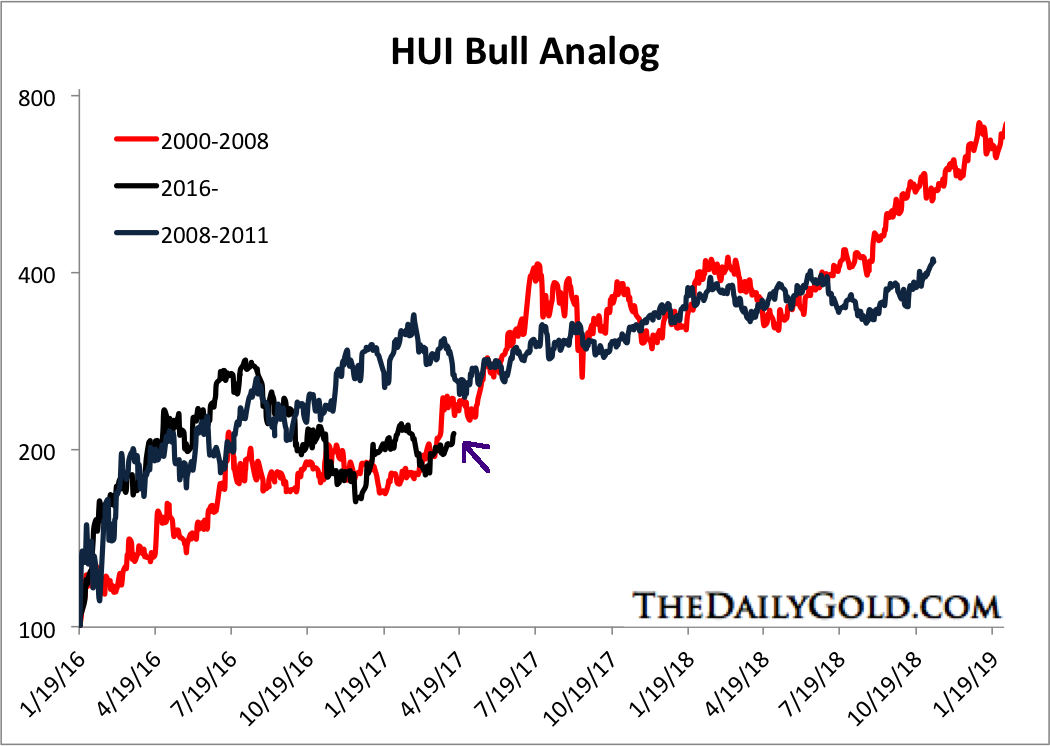

Picture 1: HUI Bull Analog Chart

At the December low the HUI was below the other two bull markets. The same was true at the March low and even now.

Simply put, relative to history this new bull was overbought in the summer of 2016 but it became oversold by the end of November. Based on history the HUI remains in oversold territory. Both bulls reached near 400, 10 months from now. That implies a 90% gain in 10 months and there is much more if the HUI follows the 2000-2008 run.

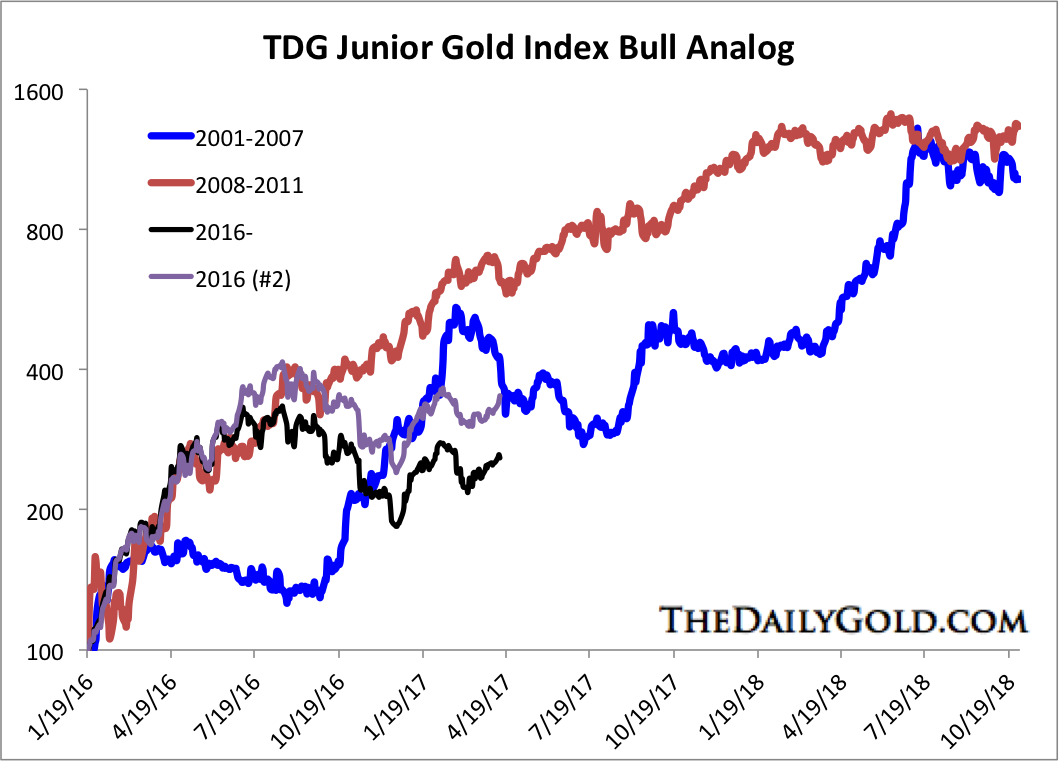

Picture 2: Junior Gold Bull Analogs

The main junior index we have is in black while our new smaller index is in lavender.

This chart illustrates the same point in picture 1 but it is more clear. In summer, the juniors were very overbought relative to history. In recent months they have been very oversold relative to history. That may not last for long.

Saturday evening we emailed subscribers a 33 page update in which we covered sector trends as well as 4 companies in detail. We shared our short and medium term expectations as well as the companies we think are the lowest risk buys at present. Although we were bearish in recent weeks we did not sell any positions and last week we mentioned a few companies that could be bought. One of those stocks surged this past week.

There are a handful of stocks that look like good buys and we are planning on putting a bit of our cash to work soon and more to work later. When you study the historical analogs above and combine that with the reduced risk of a test of the December 2016 lows, you should conclude that we are still in a window of opportunity as far as buyers. That window opened up last December and it may close later this year if the breakout move begins in Q3, rather than Q4 or Q1 2018.

Consider a subscription today as we can help you get positioned in the junior companies with significant upside potential at reasonable entry points.

Dr. Jeffrey Kern, who we recently interviewed, had this to say regarding our stock-picking abilities:

I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his

integrity.

Click Here to Learn More

And these are just a few examples of subscribers' praise......

Your doing an excellent job with your research and your reports! Timely, precise and damn accurate.

Your work is just too good to be missed. I'd like to have your ongoing assessments and views...

I appreciate your service and have some concept of the work that goes into it. Your stock picking is excellent.

I have subscribed to many investment research services over the years, both TA and FA, both within the gold sector and also from different sectors. Your report is right up there amongst the best.

I have been a subscriber for nearly 2 years now, and just wanted to let you know how much I appreciate the work you do. I always look forward to your weekly reports and find the analysis you present to be outstanding.

In my experience (over 30 years in PM’s), your service is one of great value and high integrity.

Thanks for all your great work - charts and analysis is the best there is.

Your service is truly a gem among this industry. I've subscribed to several services over the past year and a half, and I wish I had landed on your site first.

I'm a new member - just want to say how much I appreciate your expert advice but mostly, your direct, honest and zero bullshit approach.

Click Here to Learn More

We seek to own the companies with the best fundamentals that have the best risk/reward potential. We want to own the leaders while avoiding laggards with limited potential.

We tell you what we are buying and selling. Hence, we are completely transparent.

Consider a subscription today as you will receive all of our recent company reports and updates within several hours of your signup, as well as everything we produce for the next 6 months. You pay up front but get significant value up front (in a welcome email). Our goal is to help subscribers make

money and be the best service in its category.

Click Here to Learn More

Weekly updates are sent on Saturdays while flash updates are sent when we make a trade. Reports are sent sporadically. Upon signup you receive all recent reports and updates. Unlike most other editors, we answer subscriber questions.

Thanks for reading. I wish you all great health and prosperity.

-Jordan

Disclaimer: This newsletter is intended for informational and educational purposes only and should not be considered

personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and do your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|